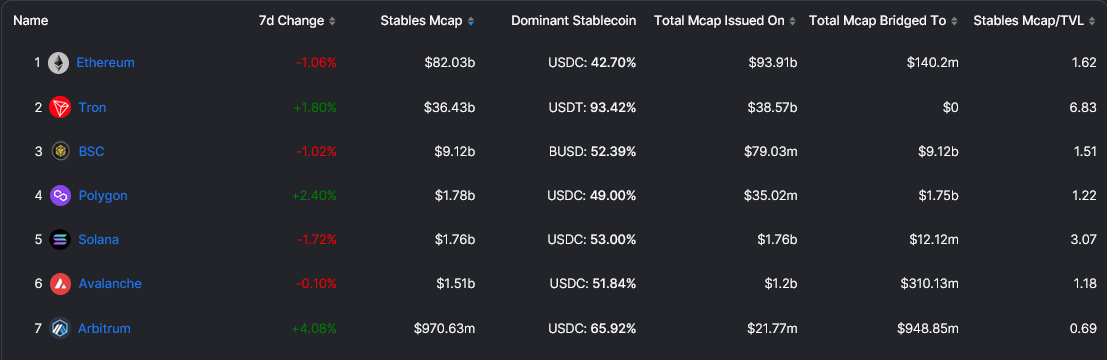

USDC, the stablecoin pegged to the USD issued by Center, a consortium comprising Coinbase and Bitmain, is the most dominant in Ethereum, flipping USDT.

According to DeFiLlama stats on February 2, USDC has a 42% share in Ethereum, with $93.91 billion issued in the popular smart contracting platform. The flipping of USDT, a stablecoin issued by Tether Holding, which is also the most liquid per market cap, is a curious development.

A while back, USDT used to dominate Ethereum as most protocols opted for the stablecoin primarily because of its high liquidity. However, this is beginning to change as more protocols opt for USDC.

As of February 2, Coinlore stats reveal that USDC has a market cap of $53.8 billion versus USDT, which leads the pack at $66.9 billion. BUSD has risen to be the second most popular stablecoin with a market cap of $55 billion.

It is not immediately clear why users increasingly opt for USDC in Ethereum.What’s clear is that USDT leads in the number of settlement volume.

Reality check pic.twitter.com/41F2QVEvj2

— Paolo Ardoino 🍐 (@paoloardoino) January 12, 2023

USDC and USDT are ERC-20 tokens and should incur the same network fees when transferring between addresses. The only variance in fee may stem from how the coin is used in DeFi, metaverse, gaming, or NFTs. Operations such as swapping, staking, yield farming, and other interactions could demand more Gas.

What’s known is that USDT issuers have not publicly issued audited statements of its financials. Therefore, while it claims that all its coins are backed 1:1 to the greenback, there are no official reports endorsing its position.

By the close of 2022, it was their eighth year of operation without a fully audited report from any top-four auditor like KPMG or Deloitte.

On August 19, Tether contracted BDO, a top-5 auditor, to audit their Consolidated Reserves. The report revealed that Tether had increased its cash and bank deposits to 32% by the close of the first half of 2022. They also reduced their commercial paper, saying it would phase out.

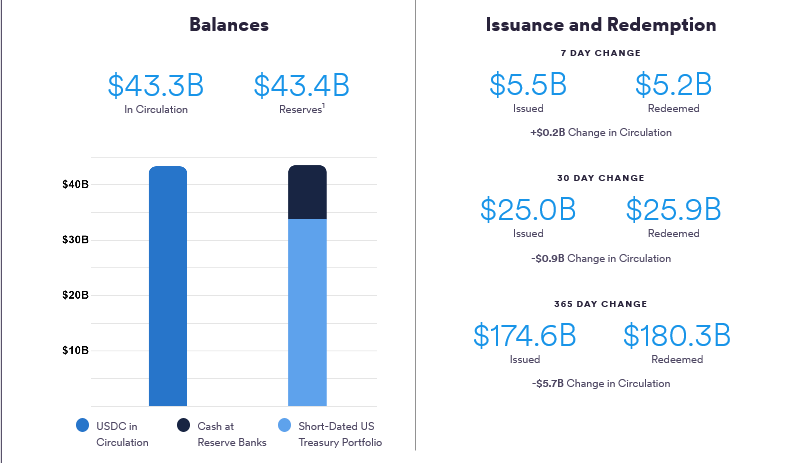

There are monthly attestations done to check USDC reserves done by Grant Thornton, LLP.

Besides, USDC reserves are audited annually.