At the moment, over 10 million ETH have been staked to foster the development of ETH 2.0. Crypto investors have various expectations on the effect of the merger on the coin’s price. While Ethereum maximalists strongly believe the migration from proof-of-work to proof-of-stake will positively impact ETH’s value, some crypto investors believe otherwise.

In truth, the millions of Ether staked will be unlocked after the merge. This has raised concerns for some as they believe stakers will likely sell off, leading to a massive dump. But here’s why ETH would rather increase its value after the launch of ETH 2.0.

More Reasons to be Bullish than Bearish

Firstly, staked ETH will not be unlocked immediately after the merge. Thus, the amount of Ethereum tokens staked and the rewards that follow will be a part of Ethereum’s total supply, but not the circulating supply. Another network upgrade will follow the merge 6-12 months later. Only after that will the staked tokens be unlocked.

Secondly, after the next upgrade, withdrawals will be enabled. However, all the ETH tokens staked will not be released at once. The network has plans to release rewards to investors in batches. This will prevent a massive sell-off of the crypto asset.

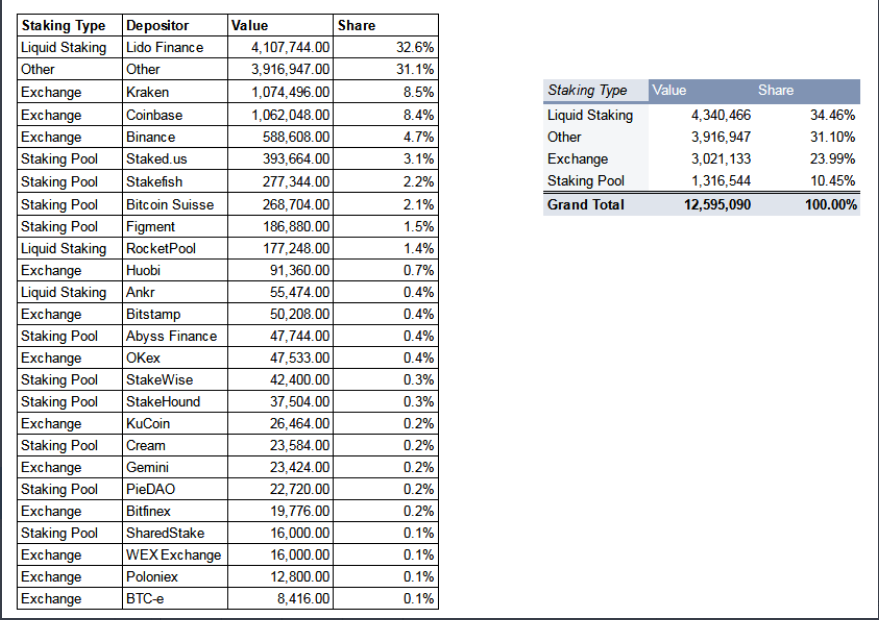

Thirdly, ETH stakers are long-term holders. The amount of ETH locked in the staking pools for the release of ETH 2.0 has been locked for years. Only Ethereum maximalists will lock their valued asset for so long. Investors who had the intention of selling off sooner would have staked in liquid staking pools to enable them to sell at any time. In fact, data from Etherscan reveals that most stakers avoided liquid staking pools.

Thus, even when staked tokens are revealed, it is unlikely that most of the investors will sell off their highly-priced tokens at a go.

Finally, the benefits of ETH 2.0 will be too hard to ignore. Despite the relatively high gas fees on the network and its energy consumption rate, the network’s token has still soared. ETH 2.0 will reduce the energy consumption rate on the blockchain by 95%. ETH burning will reduce supply, and the network’s speed will be more than 3000 times faster. Also, stakers will earn up to 8% in rewards. All these benefits will definitely attract more investors to the network, making ETH a more valuable asset.