On the 7th of July, the Aave team announced that its DAO had voted in favor of launching a new stablecoin. Aave’s controlled collaterals will support the stablecoin named GHO.

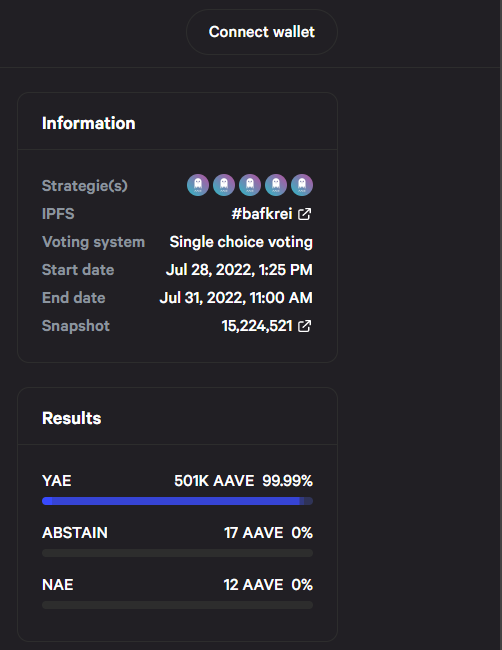

Earlier on, Aave DAO members had submitted the proposed development. Interestingly, the proposal was backed by a large percentage of voters, pledging about 500,000 AAVE to stamp measures to create GHO.

In total, 99.99% of users voted to support the creation of GHO. A stake for 17 AAVE tokens remained neutral, while a stake for 12 AAVE, which ended up being insignificant, was against the proposition.

The GHO will be pegged to the US dollar. In line with information from Aave’s official website, the imminent value of stipulated coins would be determined largely by its DAO.

The Aave protocol was first built on the Ethereum blockchain, and the bulk of traders utilize ETH on the protocol. The protocol supports borrowing and lending, although users need to over-collateralize their loans for long-term loans.

Since its inception in 2017, the DeFi platform has gradually gained ground in the crypto ecosystem. Further, data from DeFi Lamar indicates that AAVE is the second-largest decentralized protocol in terms of total value locked (TVL). With the Aave community set to launch a decentralized token, Aave protagonists will look forward to seeing how the token gains traction in the coming months.

Admittedly, the crypto ecosystem already has a host of stablecoins like USDT and USDC that have grabbed a massive chunk of the crypto market. However, these leading stable assets are linked to centralized platforms, limiting holders’ freedom. GHO will be overcollateralized with crypto assets and, most importantly, decentralized.

Although the failure of UST, the leading decentralized stablecoin at the time, shook the crypto ecosystem, the Aave community will be on guard to avoid a similar scenario. Perhaps, existing algorithmic stablecoins like DAI have proved that decentralized stablecoins can be a reality.