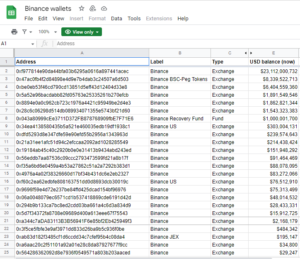

On December 13th, 2022, the Vice President of BlockResearch posted a spreadsheet containing Binance’s Proof of Reserves on Twitter.

Following the FTX debacle, centralized exchanges have been forced to publicly declare their Proof of Reserves to show how solvent they are. This move is highly significant as it helps to ensure the safety of customers’ assets held on these exchanges.

Centralized exchanges are required to hold their customers’ assets at a ratio of 1:1 apart from their corporate holdings and ensure zero debt in their capital structure and operations. With a zero debt proof of reserve, a centralized exchange like Binance will not become insolvent if all its customers decide to withdraw their assets.

On the 13th of December, 2022, Larry Cermack, Vice President of Research at The Block Institute, a crypto research firm, released a spreadsheet showing the net reserves of Binance stored in cold wallets. Regardless of the FUD generated by some Binance users on crypto Twitter, which resulted in a blown-out argument between CZ and major crypto influencers, Binance inarguably has more than enough proof of reserves and can cover its customers’ assets 1:1. Compared to FTX, Binance is safer and more secure.

Samuel Bankman Fried, founder and CEO of FTX, popularly known as SBF, showed inadequacies while managing users’ funds. He used customers’ collateral to invest in other organizations instead of their reserves, thus leading to the exchange’s collapse in late November. But the FUD being circulated concerning Binance is a different case entirely and should not make users lose trust in the exchange.

According to the tweet by Larry Cermark, Binance has more than $36 billion stored in cold wallets, and this is solid proof of its solvency. This is completely unlike FTX, which had close-to-zero Proof of Reserves after using customers’ assets as seed funds for other projects. This tweet further establishes the certainty that if all Binance users decide to withdraw their assets, Binance has more than enough to pay, with funds left in their corporate reserves.

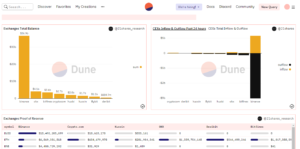

To further support this, 21 Shares Research, one of the world’s biggest ETP providers, shared a breakdown of notable exchanges’ proof of reserves, with Binance ranking first with over $36 billion in assets in reserve. This clearly shows that most of the FUD being circulated on crypto Twitter is unfounded and, therefore, should not be taken seriously. Furthermore, Binance is the largest centralized exchange and has released more than enough proof to show that its customers’ assets are safe.