Amidst growing concerns about national security and infrastructure vulnerabilities, China’s role in the cryptocurrency sphere has become a focal point of discussion. Historically, the U.S. has taken firm actions against perceived threats from Chinese technology companies such as Huawei and TikTok. The stakes are higher with cryptocurrencies, as Bitcoin mining operations could potentially serve as a hardware layer that’s deeply integrated into critical U.S. systems, including energy and telecommunications infrastructures.

Chinese Firms Control ASIC Markets

Bitcoin mining, the process of introducing new coins into circulation and securing the network, relies heavily on sophisticated computing systems. These systems require high-performance semiconductors known as ASICs, predominantly supplied by China. Notably, Chinese firms control approximately 98% of the ASIC market, with major players like Bitmain at the forefront. These chips, although designed in China, are manufactured by Taiwan’s TSMC using advanced technologies. This dominance in the semiconductor sector presents multiple challenges related to U.S. trade policies, competitiveness, and national security, according to Sriram Viswanathan, the founding managing partner of Celesta Capital.

Despite existing tariffs and trade measures, Chinese companies have found ways to circumvent these restrictions, often by relocating operations or engaging in aggressive market strategies to undercut U.S.-based ASIC producers, he said. Such tactics undermine significant legislative efforts like the CHIPS Act, which aims to bolster domestic semiconductor production.

Expansion of Chinese Mining Facilities Raise Concerns

The expansion of Bitcoin mining facilities in the U.S., many of which are Chinese-owned and utilize Chinese-manufactured equipment, raises significant security concerns, Viswanathan argued. These facilities could potentially act as conduits for Chinese intelligence operations, enabling covert data collection or cyber-espionage targeting critical U.S. infrastructure. Furthermore, the inherent technical complexities of cryptocurrency mining equipment might allow for backdoor vulnerabilities. Security experts warn that these Chinese-manufactured devices could be equipped with hidden firmware or software capable of unauthorized data transmission or even sabotage.

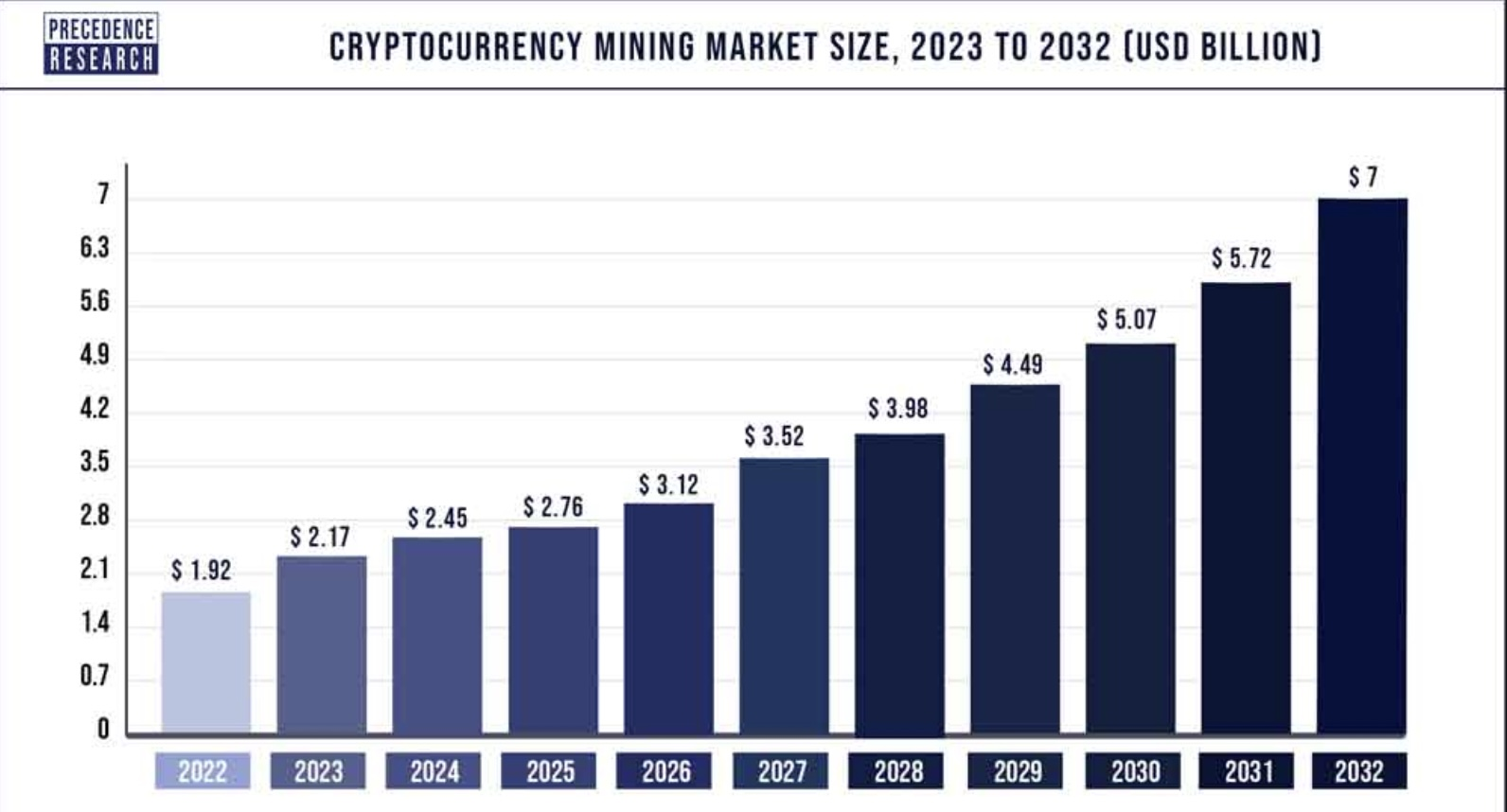

The growing reliance on Bitcoin and related technologies underscores their increasing importance to the U.S. financial system. With an estimated 40% of U.S. adults owning cryptocurrencies and a projected annual growth rate of 9% in the mining sector, the implications of any disruption are significant. Dependence on Chinese suppliers for Bitcoin transaction validation poses a substantial risk, especially in times of geopolitical tension.

Viswanathan said that addressing these concerns requires decisive action from U.S. policymakers. Proposed measures include the implementation of stringent cybersecurity protocols at mining facilities, enhancing supply chain transparency, conducting thorough background checks on investors, and establishing international standards to manage cross-border security issues.

Leveraging Domestic Production

Critical to mitigating these risks is the development of a robust U.S. sector for Bitcoin mining technology. Leveraging initiatives like the CHIPS Act to encourage domestic production of mining semiconductors is crucial. Furthermore, it is imperative to restrict Chinese-manufactured mining hardware and operations on U.S. soil, akin to the measures taken against Huawei in the telecommunications sector.

In the fourth quarter of 2023, crypto miner Core Scientific reported a net revenue of $141.9 million, representing an increase of $20.7 million compared to Q4 2022. Aside from Core Scientific, other major crypto miners have also reported impressive earnings. For one, mining firm Riot Platforms saw its total revenues reach an all-time high of $281 million in 2023.