Introduction

The year 2024 marks a significant milestone in the evolution of digital assets, with the anticipated launch of Crypto Exchange-Traded Funds (ETFs). This development promises to reshape the investment landscape, offering a new gateway for investors into the cryptocurrency market. As we venture deeper into the digital age, Crypto ETFs emerge as a beacon of innovation, offering a blend of traditional investment strategies and the dynamic world of cryptocurrencies. This novel amalgamation is poised to attract a diverse range of investors, from seasoned traders to those new to the world of digital assets, thereby expanding the global financial ecosystem.

The Emergence of Crypto ETFs

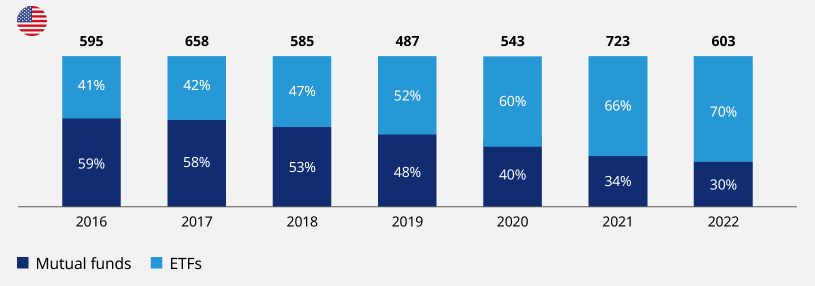

Crypto ETFs, poised for launch in 2024, represent a major leap forward in the accessibility of digital assets. Industry experts predict that U.S. investors will have access to spot Bitcoin and Ether ETFs by Q2 2024, signaling a shift from traditional financial products to more innovative and inclusive investment opportunities. This comes after years of anticipation and regulatory hurdles, highlighting a significant change in the narrative from “if” to “when” these products will be available. The burgeoning interest in Crypto ETFs reflects the growing mainstream acceptance of digital currencies and their potential to offer diversified, lower-risk investment opportunities compared to direct cryptocurrency investments. The anticipation surrounding these ETFs underscores the increasing demand for regulated, easily accessible investment avenues in the digital asset space.

The Ripple Effect on the Market

The introduction of Crypto ETFs is expected to have a profound impact on the broader cryptocurrency market. With industry analysts suggesting the approval of spot crypto ETFs could unlock trillions in new investments, the potential for growth is immense. This expansion is not just limited to the volume of investments but also encompasses the diversity of products, with specialized offerings catering to various risk appetites likely to follow. The emergence of Crypto ETFs could serve as a catalyst for increased institutional participation, further legitimizing the cryptocurrency market and potentially leading to greater stability and reduced volatility. This shift is indicative of a maturing market, one that is evolving to meet the needs of a broader investor base, while offering innovative financial products that align with the digital age.

Investor Education and the Role of Crypto ETFs

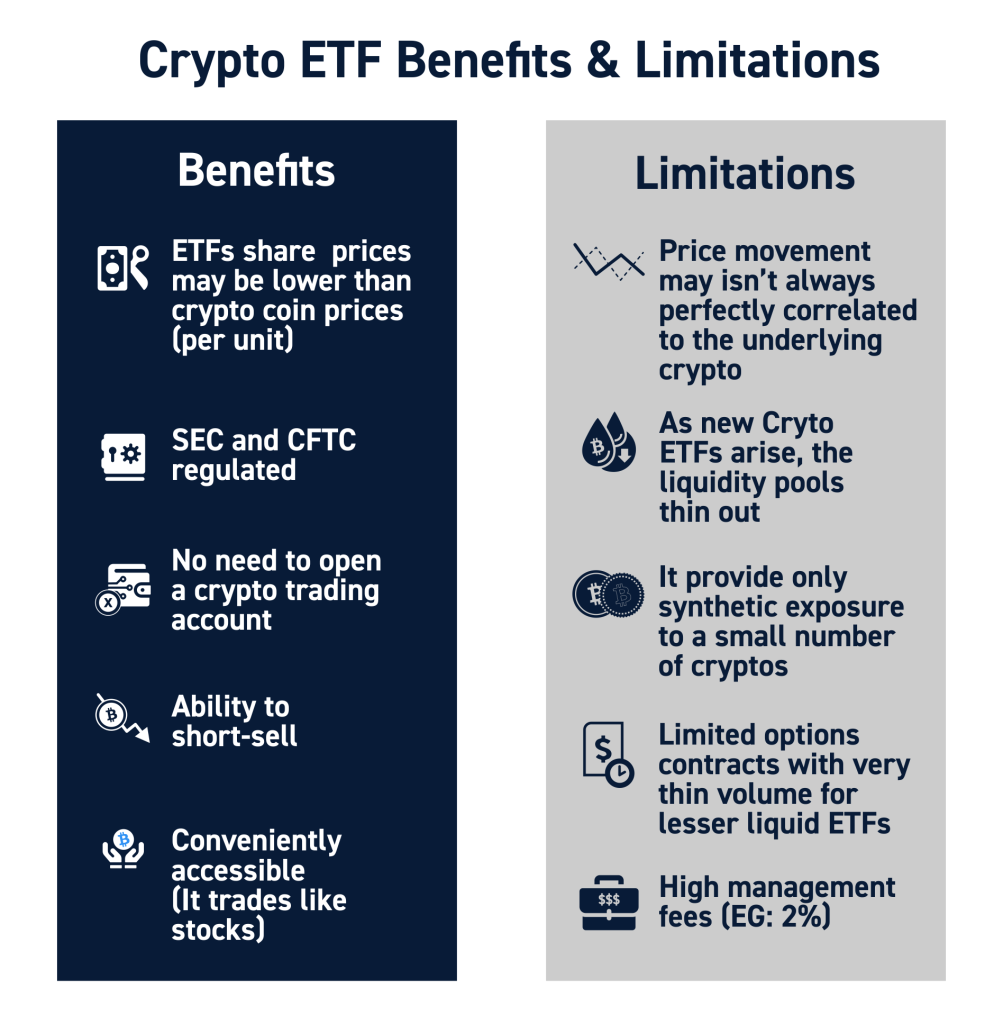

As the Crypto ETF market gains momentum in 2024, a significant focus will be on investor education. The complexity and novelty of crypto-based financial products necessitate a comprehensive understanding for both new and seasoned investors. Educational initiatives and resources will play a critical role in ensuring investors are well-informed about the intricacies of Crypto ETFs, including their structure, underlying assets, and associated risks. This educational push is expected to contribute to a more informed and savvy investor base, which is crucial for the long-term sustainability and growth of the crypto investment sector. By demystifying Crypto ETFs and enhancing investor knowledge, the industry aims to foster a more robust and engaged investment community.

Global Market Impact and Diversification Opportunities

The introduction of Crypto ETFs is not only a milestone for the U.S. market but also has significant implications for global financial markets. As more countries observe the integration of these products into the U.S. financial system, it may encourage similar developments worldwide, leading to increased global adoption of crypto-based investment products. This international expansion presents opportunities for diversification, not just in terms of geographical spread but also in offering exposure to a wider range of digital assets. The potential for cross-border investment products could further integrate the global financial markets, providing investors with a broader spectrum of investment opportunities and fostering a more interconnected financial landscape.

Regulatory Landscape and Market Readiness

The year 2023 set the stage for the emergence of Crypto ETFs, with mounting signals indicating regulatory approval. High-profile application filings, such as those by BlackRock, and over a dozen asset managers with pending spot bitcoin ETF filings with the SEC, have paved the way for a more regulated and structured market. This regulatory clarity is crucial for investor confidence and market stability. The increasing involvement of established financial institutions and the heightened interest from regulators reflect a growing recognition of the importance and potential of digital assets. The evolving regulatory framework is expected to provide a more secure and transparent environment for investors, fostering growth and innovation in the cryptocurrency space.

The 2024 Outlook

Looking ahead to 2024, the Crypto market is at the cusp of a significant transformation. The upcoming Bitcoin halving, which reduces the issuance rate of new Bitcoin, serves as another catalyst likely to boost the market. Despite the turbulence experienced in 2022, firms like Hashdex remain optimistic about crypto’s growth trajectory, believing in its potential to change the world for the better. The year 2024 stands as a pivotal moment in the cryptocurrency saga, with Crypto ETFs potentially driving a new era of growth and accessibility. This period is expected to witness an infusion of fresh capital, innovative financial products, and a broader, more diverse investor base, collectively contributing to the maturation and expansion of the cryptocurrency market.

Conclusion

As we venture into 2024, the launch of Crypto ETFs stands as a testament to the growing maturity and acceptance of digital assets in the mainstream financial world. This development not only expands investment opportunities but also signifies a broader acceptance and integration of blockchain technology in traditional finance. The year 2024 may well be remembered as the year when Crypto ETFs bridged the gap between the innovative world of cryptocurrency and the established realm of traditional investment, marking a new chapter in the financial sector’s evolution. The intersection of traditional finance and digital assets through Crypto ETFs is not just a milestone for the cryptocurrency industry but a harbinger of the future direction of global finance.