Digital Asset Investment Products Witness Remarkable Growth

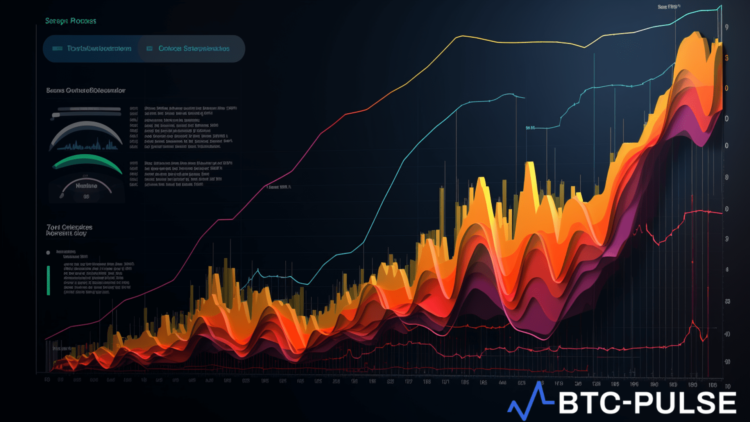

Investor interest in digital asset investment products continues to show strength, as recent data indicates a significant surge in inflows. A report from CoinShares highlights that these investment vehicles have attracted $646 million, propelling the year-to-date (YTD) total inflows to an astonishing $13.8 billion. This figure not only surpasses last year’s total of $10.6 billion but sets a new record in the digital asset investment sphere.

Bitcoin remains at the forefront of investors’ minds, securing $663 million in inflows. Conversely, short-bitcoin investment products experienced their third consecutive week of outflows, totaling $9.5 million, suggesting a waning pessimism among investors betting against Bitcoin’s price.

Shifting Tides in ETF Enthusiasm

Despite the influx of capital into digital asset investment products, there are signs that the fervor among exchange-traded fund (ETF) investors may be cooling off. The report indicates a drop in weekly flow levels compared to the highs experienced in early March. Specifically, the past week’s volume fell to $17.4 billion from the staggering $43 billion recorded in the initial week of March.

Investor sentiment varies greatly across regions. The United States leads with a substantial $648 million in inflows, while Brazil, Hong Kong, and Germany also reported positive inflows. However, Switzerland and Canada faced outflows, highlighting the polarized regional sentiments towards digital asset investments.

Ethereum, despite being a leading cryptocurrency, saw its fourth week of outflows, totaling $22.5 million. In contrast, other altcoins like Litecoin, Solana, and Filecoin continued to attract investor interest with notable inflows.

Industry Leaders Maintain a Positive Outlook

Despite a slowdown in Bitcoin spot ETF flows, prominent figures within the cryptocurrency industry remain bullish about the market’s prospects. Ripple CEO Brad Garlinghouse shared his optimistic forecast, predicting a significant increase in the total market value of cryptocurrencies, spurred by spot ETFs and the anticipated Bitcoin halving.

Matteo Greco, a research analyst, echoed this sentiment, projecting Bitcoin’s price to reach $75,000 by the halving event. Greco emphasized the historical pattern of Bitcoin’s price movements post-halving, suggesting a potential uptrend in the coming months.

Currently, Bitcoin’s price exhibits a robust performance, trading at $72,308, which is a more than 4% increase over the past day. It is now nearing its all-time high, showcasing the continued enthusiasm and confidence among investors in the digital asset market.