The spectacular collapse of FTX and the reported fraud of Sam Bankman-Fried have decimated trading activity across the board, contracting volumes and flushing investors.

Amid this development, data shows that while there is the capital flight to perceived “safe havens” in USD and stablecoins, crypto market participants are flocking back to the original “OGs” of crypto.

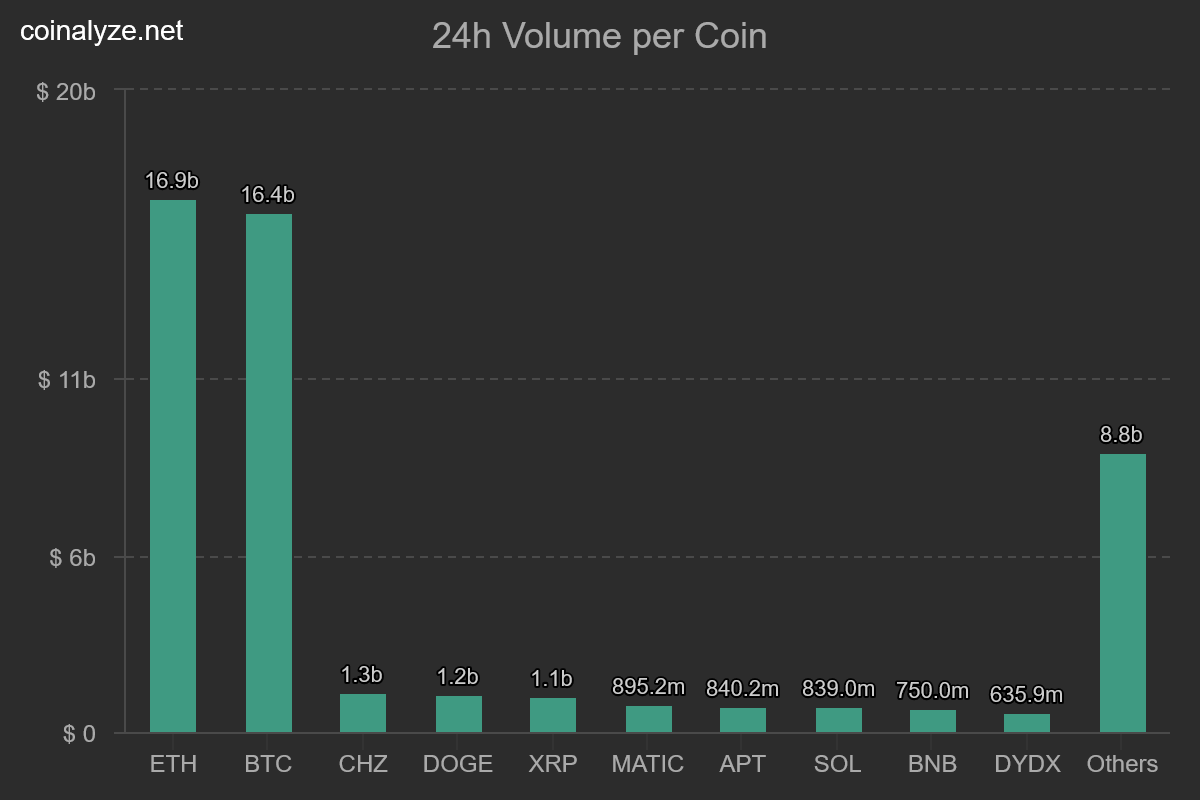

Records show Bitcoin and Ethereum trading dominate, contributing over 95 percent of average trading volumes.

A notable development is that while traders would typically opt for Bitcoin, considering its store of value narrative and longevity, more are instead opting for Ethereum. The gap is tight, but Ethereum’s significance is growing, reading from activity over the past trading day.

Data streams show $16.9 billion of ETH-related volumes were traded in the previous 24 hours. During this time, $16.5 billion of BTC volumes changed hands. Meanwhile, coins like XRP, DOGE, APTOS, CHZ, and MATIC carved out a minor market share. Their activity may be low, but new projects like APTOS command a decent market share, an indicator of interest over the past few weeks.

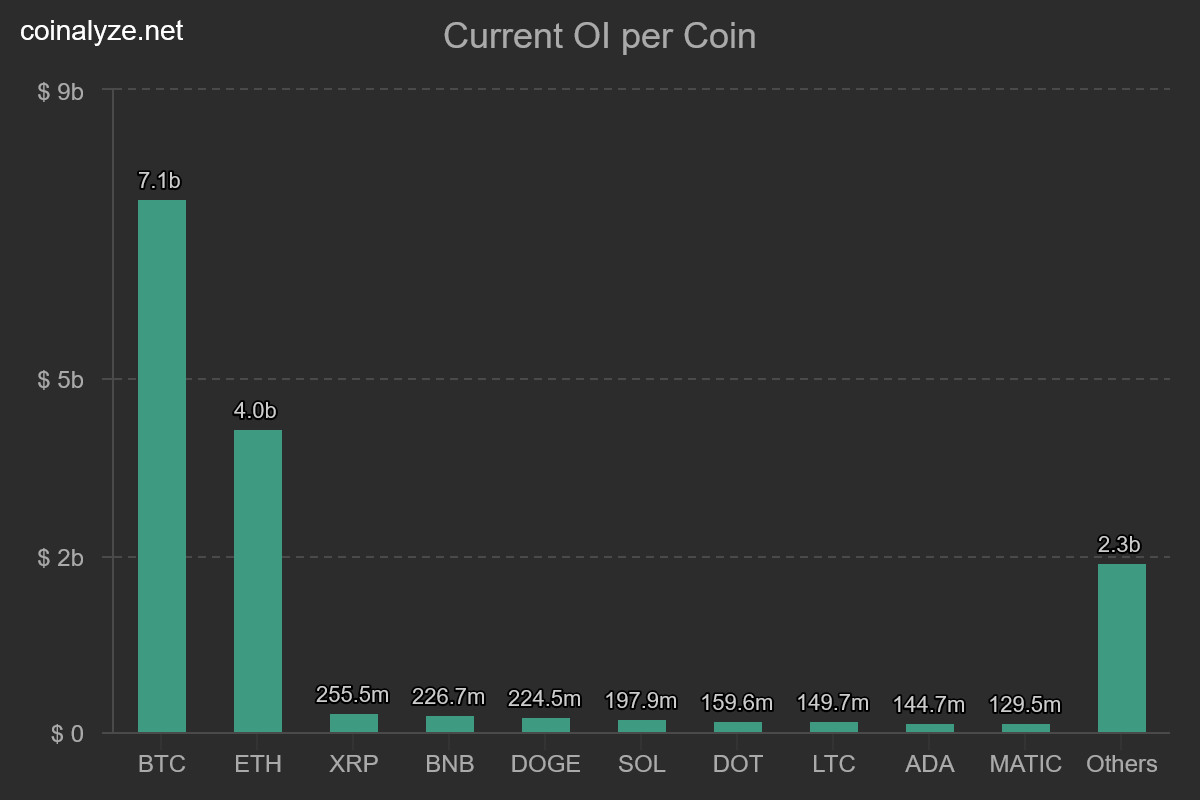

Although Ethereum trading is popular, there are more Bitcoin positions reading from the number of open interest across popular liquid exchanges like Binance and OKX.

Open Interest denotes the number of open positions under leverage, which is directionless. It can rise or drop regardless of market conditions, bullish or bear. However, a market of apprehension or excitement can be interpreted from the number of open interest. As of November 17, there were $7 billion of BTC open position; roughly half the Ethereum open interest, which stood at $4 billion.

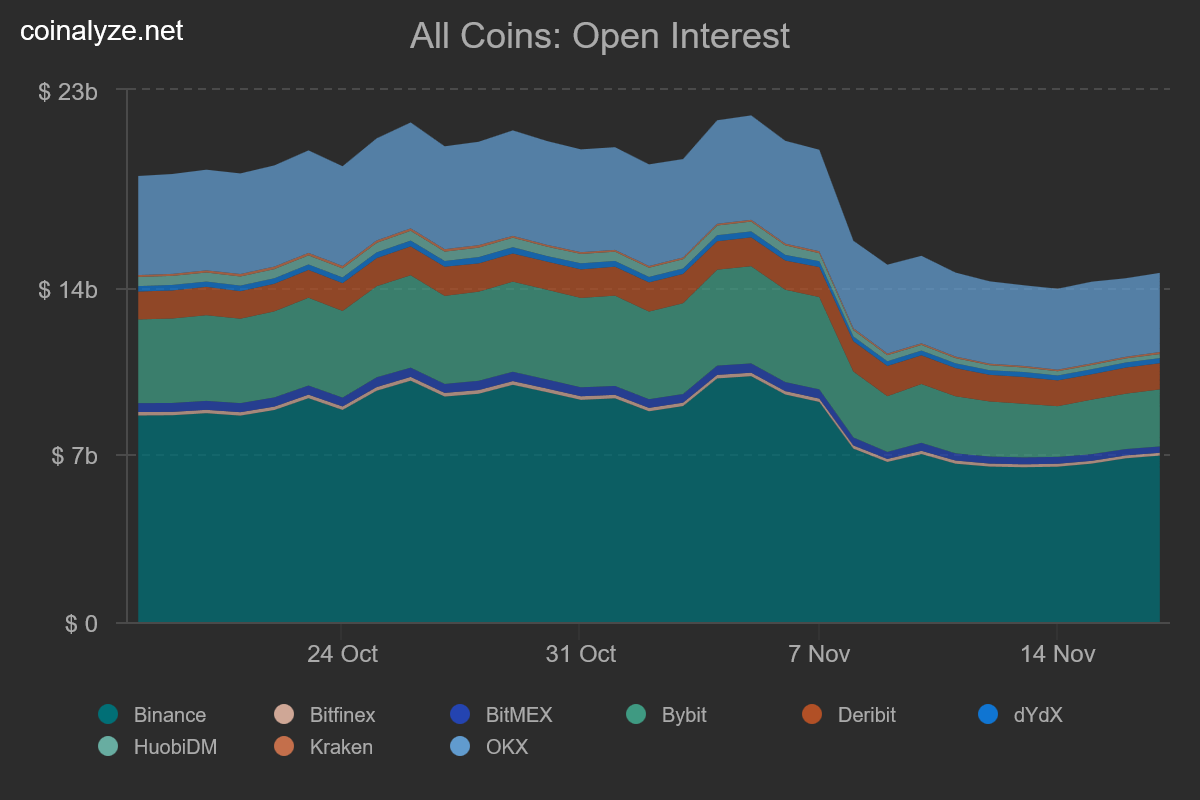

Nonetheless, over the past month, open interest has been declining. This is a major indicator of general weakness and fear across the market. It could also be because of a significant chunk of open positions being wound down in FTX International.

By closing open positions as the exchange went bankrupt dented the number of BTC, ETH, and other altcoins open interest. Specifically, contraction of open interest could be seen from November 5, when FTX’s liquidity problems began to show.

Presently, traders prefer trading on Binance, OKX, Bybit, and Deribit; their respective open interest valuation is over $1 billion. BitMEX has commands a decent chunk but is several folds lower than those registered by Binance.