Cardano vs Ethereum: An Introduction

When it comes to the cryptocurrency market, there’s a lot more than just Bitcoin. Two major players in the blockchain space, Cardano and Ethereum, have been at the forefront of discussions. In the “Cardano vs Ethereum” debate, both have their ardent supporters and critics.

Origins and Founders: From Ethereum to Cardano

One of the fascinating aspects of the “Cardano vs Ethereum” story is their interlinked histories. Ethereum, introduced by Vitalik Buterin, opened the gates to decentralized applications (DApps) and smart contracts. Charles Hoskinson, one of Ethereum’s co-founders, later launched Cardano, envisioning a more research-driven and sustainable blockchain solution.

Technology and Infrastructure

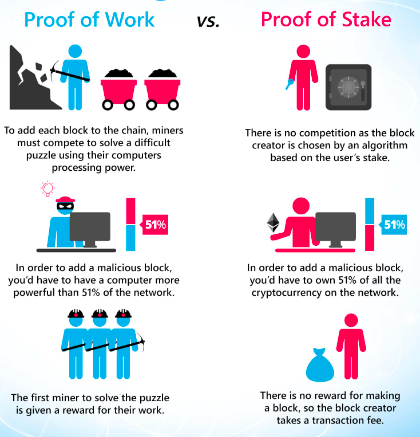

In the Cardano vs Ethereum discussion, technology forms a significant aspect. Ethereum currently employs a Proof of Stake mechanism after transitioning from Proof of Work. Cardano, on the other hand, uses the Ouroboros PoS protocol, reputed for its energy efficiency and scalability.

Smart Contracts and DApps

Both platforms offer smart contracts, but the approach differs. Ethereum’s Solidity has been the staple for developers, while Cardano’s Plutus offers a robust foundation for intricate contracts. When considering Cardano vs Ethereum in terms of DApps, Ethereum has an early mover advantage, hosting a multitude of applications on its network. However, Cardano’s growing ecosystem cannot be underestimated.

Tokenomics and Market Presence

Ethereum’s ETH and Cardano’s ADA tokens are both highly valued in the market. In the Cardano vs Ethereum battle, Ethereum’s longer presence gives it a more substantial market cap. But Cardano, with its strong research backbone, promises a potentially high reward for long-term investors.

Security and Sustainability

Sustainability is becoming a pivotal consideration in the crypto world. While Ethereum’s move to PoS has made it more eco-friendly, Cardano’s inception with PoS gives it an edge in the Cardano vs Ethereum sustainability debate. Security-wise, both platforms have robust mechanisms, but Cardano emphasizes peer-reviewed research to mitigate potential risks.

Community and Development

An active community is essential for a blockchain’s success. Ethereum, being older, boasts a massive developer and user community. However, the Cardano community is rapidly growing, and its emphasis on academic and research partnerships brings a unique angle to the Cardano vs Ethereum comparison.

Adoption and Real-world Use Cases

While Ethereum has been adopted by a slew of companies and projects for its smart contracts, it’s not the only game in town. The “Cardano vs Ethereum” narrative is spiced up by Cardano’s increasing adoption. Various African nations have shown interest in Cardano, seeing it as a potential solution for digital identity and financial infrastructure. Such real-world implementations could significantly boost Cardano’s global positioning in the coming years.

Interoperability and Cross-chain Solutions

Cardano has emphasized its vision of creating an “internet of blockchains” – a world where different blockchains can communicate and operate seamlessly with one another. In the realm of Cardano vs Ethereum, Cardano’s focus on interoperability might give it a significant advantage in a future where multiple blockchains coexist and interact.

Growth and Investment Opportunities

The crypto market is rife with volatility, but both Ethereum and Cardano have shown promise for investors. Ethereum’s well-established platform has provided consistent returns, while Cardano, being a younger entity, offers opportunities for exponential growth. In the Cardano vs Ethereum investment arena, it boils down to one’s risk tolerance and belief in the respective project’s vision.

Governance and Protocol Upgrades

A significant part of the Cardano vs Ethereum discussion revolves around governance. Ethereum has faced challenges with its hard forks in the past, leading to the creation of Ethereum Classic. Cardano, with its Project Catalyst, introduces a community-driven approach to fund projects and guide its future, aiming for a more democratic and decentralized governance system.

Decentralization and Validator Nodes

Decentralization remains at the heart of any blockchain project. Ethereum, in its transition to PoS, has aimed to further its decentralization. Meanwhile, Cardano’s stake pool model ensures a wide distribution of validators, making it hard for any single entity to control the network. This decentralization aspect adds another layer to the Cardano vs Ethereum evaluation.

Educational Outreach and Training

Both Ethereum and Cardano have recognized the importance of educating the masses about blockchain. Ethereum has a multitude of online resources, forums, and developer training programs. Cardano, through the Cardano Foundation, has been actively partnering with universities and institutes for research and curriculum development, further fueling the Cardano vs Ethereum rivalry in creating a knowledgeable community.

Regulatory Compliance and Institutional Interest

Last but not least, the way these blockchains interact with the broader financial world and regulatory bodies can’t be ignored. Ethereum’s DeFi platforms have sometimes raised regulatory eyebrows. Cardano, understanding the importance of regulatory compliance, has been building its platform keeping future regulations in mind. The Cardano vs Ethereum battle, in this context, is about striking the balance between innovation and compliance, as institutional interest in cryptocurrencies grows.

Future Outlook

The future of Cardano vs Ethereum remains uncertain. Ethereum 2.0 promises enhanced scalability and security. Meanwhile, Cardano’s phased development approach, focusing on sustainability and academic partnerships, sets an exciting stage for its future.

Conclusion

The Cardano vs Ethereum debate doesn’t have a definitive winner. Each blockchain offers unique strengths. Ethereum’s pioneering spirit and vast DApp ecosystem make it a formidable contender. Conversely, Cardano’s research-driven approach and emphasis on sustainability position it as a noteworthy competitor. The crypto world will keenly watch the trajectories of these two giants.

With the constant evolution of the crypto space, the dynamics between Cardano and Ethereum are bound to change. While this article provides a snapshot, it’s crucial for investors and enthusiasts to stay updated and conduct thorough research before making decisions.