Early in May, the price of Terra’s UST and LUNA crashed heavily, planting doubt in investors’ minds. Following the crash, several reports have been compiled and spread as to why these tokens’ prices plummeted heavily.

While some sources have claimed that one particular trader who had a clash with Luna’s founder was responsible, on-chain analysis reveals that several wallet addresses were involved in the downfall of the Terra ecosystem.

Nansen recently published a report showing a series of events that led to the crash. From the analysis, several wallets were involved and seven of them stand out. Here are the seven wallet addresses:

- 0x8d47f08ebc5554504742f547eb721a43d4947d0a (EIP 1559 User)

- 0x4b5e60cb1cd6c5e67af5e6cf63229d1614bb781c (Celsius)

- 0x1df8ea15bb725e110118f031e8e71b91abaa2a06 (hs0327.eth)

- 0xeb5425e650b04e49e5e8b62fbf1c3f60df01f232 (Heavy Dex Trader)

- 0x41339d9825963515e5705df8d3b0ea98105ebb1c (Smart LP: 0x413)

- 0x68963dc7c28a36fcacb0b39ac2d807b0329b9c69 (Token Millionaire / Heavy Dex Trader)

- 0x9f705ff1da72ed334f0e80f90aae5644f5cd7784 (Token Millionaire)

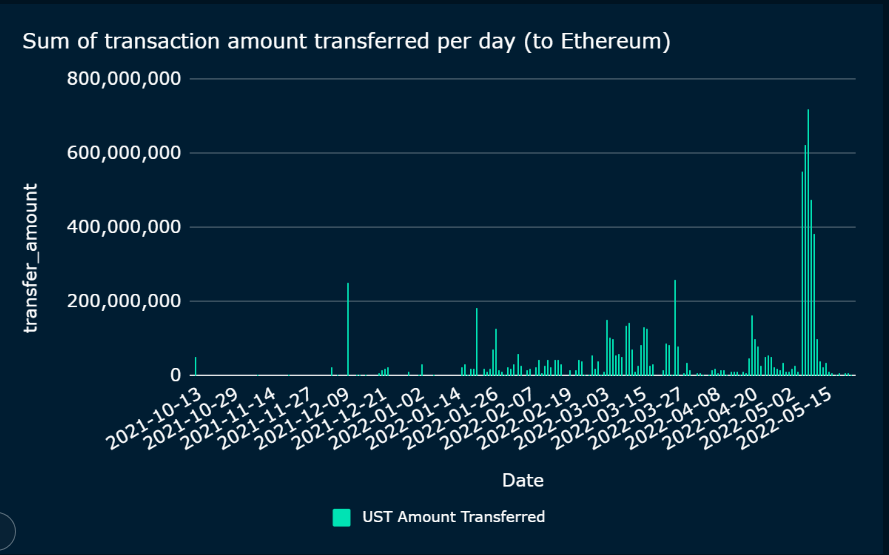

The main events spanned from May 7th to May 12th, although other minor activities still occurred before and after this period. Multiple wallets swapped UST to and fro during the period of the crash, but a bulk of the transaction volume came from just a few wallets.

On the 7th of May, vast volumes of Terra’s UST were withdrawn from the Anchor protocol. Interestingly, the wallet with the most enormous withdrawal volume had withdrawn more than 347 million UST from Anchor.

The funds withdrawn were then bridged from Terra to Ethereum. Next, Curve’s liquidity pools were used to swap large amounts of UST to other stablecoins like USDT and USDC.

Undoubtedly, the large volumes of UST swapped led to an imbalance in the price of UST on Curve Finance, Anchor protocol, and other DEXs and CEXs.

Other crypto community members noticed the instability and called Do Kwon’s attention to it. At that moment, Terra’s founder was still confident of the token regaining its peg. He mocked those who panicked because of the slight fluctuation in UST value. However, that was only the beginning, and things quickly went from bad to worse within a few days. Terra’s LUNA and Bitcoin reserves could not defend UST’s peg, which marked the end of UST.