Institutional Traders Losing Confidence by JPMorgan

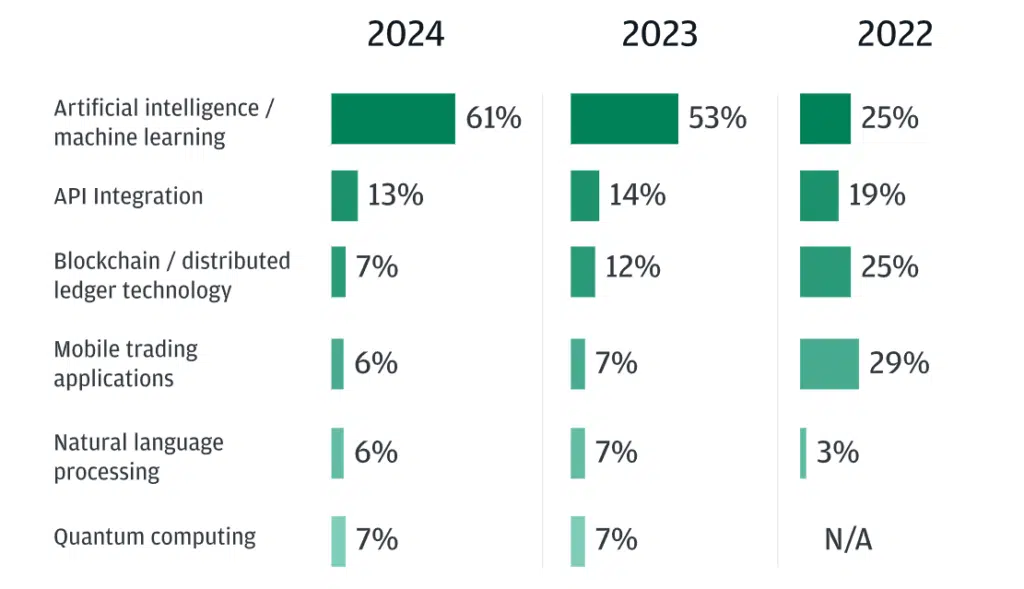

According to a recent survey conducted by JPMorgan among more than 4,000 institutional traders, confidence in blockchain technology has seen a drastic decline. Only 7% of respondents now view blockchain as a promising asset over the next three years, marking a 72% decrease from 2022.

Shift in Prospects

Despite this decline, blockchain technology still ranks third in terms of prospects among institutional traders, following API integration (13%) and artificial intelligence/machine learning (61%). This shift underscores a broader reassessment of technological investments within the industry.

Crypto Trading Intentions

The survey also shed light on institutional traders’ attitudes towards cryptocurrency trading. A staggering 78% of respondents expressed no plans to trade digital assets, while 9% are currently engaged in crypto trading. However, 12% are considering entering the crypto market within the next five years, indicating a cautious but not dismissive stance towards this burgeoning asset class.

Market Trends

Market analysis from Q3 2023, as reported by Galaxy Digital, reveals concerning trends for blockchain and crypto investments. Both the number of completed deals and total capital invested hit their lowest points since Q4 2020. Despite this, there are signs of potential improvement, with venture capital fundraising showing a slight uptick and an increase in new fund launches.

Conclusion

The JPMorgan survey paints a nuanced picture of institutional traders’ sentiments towards blockchain and cryptocurrency. While confidence in blockchain has waned, it remains a contender among emerging technologies. With the crypto market facing headwinds, including regulatory scrutiny and market volatility, institutional traders are cautiously navigating their involvement in this evolving landscape.