Uniswap, Lido Finance, and OpenSea are three decentralized finance (DeFi) protocols that have gained popularity in recent years due to their innovative use of blockchain technology and ability to offer a wide range of financial services. These protocols have also gained attention due to their ability to generate significant fees, which has led to speculation about their potential impact on the Ethereum network.

1. Revenge of the dApps

Three Ethereum-based apps are now generating more monthly fees on a combined basis than the Ethereum L1:

•Uniswap

•Lido

•OpenSeaMeanwhile, Ethereum's flagship dApps are quickly conquering competing chains.

— The DeFi Investor 🔎 (@TheDeFinvestor) December 28, 2022

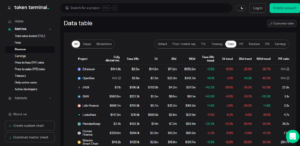

According to Token Terminal, over the past 7 days, Uniswap generated $3.2M, Opensea $7.2M, and Lido Finance $5.7M respectively. While the entire Ethereum network generated just $14.5M in fees.

This news has sparked a debate among the cryptocurrency community about the implications of these protocols generating more fees than Ethereum. Some argue that this trend is a sign of the growing popularity and adoption of DeFi, while others see it as a potential problem for the Ethereum network.

One of the main concerns about these protocols generating large amounts of fees is that it could lead to increased congestion on the Ethereum network. As more users flock to these protocols, the demand for Ethereum’s blockchain services may outstrip the available capacity, leading to higher fees and slower transaction times. This is especially problematic for Ethereum, as it is currently facing scalability issues that have hindered its ability to process large numbers of transactions.

Despite the potential scalability issues that these protocols may cause, they have also contributed to the growth of the Ethereum network, as the fees generated by these protocols have provided a financial incentive for developers to continue building on the platform.

In recent months, there has been a trend towards increased use of Layer 2 solutions on the Ethereum network, examples of which are Arbitrum and Optimism. These solutions, which operate on top of the Ethereum mainnet, offer a way to scale the network and process more transactions without putting additional strain on the main network.

This trend has been driven by the growing popularity of DeFi protocols, which have contributed to increased demand for Ethereum’s blockchain services. As a result, the number of transactions on the Ethereum mainnet has declined, while the number of transactions on Layer 2 solutions has increased.

Overall, the success of Uniswap, Lido Finance, and OpenSea in generating significant fees has sparked a debate about the impact of these protocols on the Ethereum network. While some see it as a sign of the growing adoption of DeFi, others worry that it could lead to increased congestion and scalability issues. Therefore, it can be seen that the adoption of Layer 2 solutions helps solve numerous problems encountered using Ethereum L1.