Circle’s Euro coin is set to be launched on the 30th of June. The new cryptocurrency will serve as a stablecoin pegged to the Euros. Just like USDC, the EUROC will be backed by euro-dominated financial reserves to make it maintain its 1:1 value.

The Euro coin will create a new digital banking and foreign exchange era. EUROC will be available for anyone that has access to the internet, regardless of an individual’s location or native currency.

Four major centralized exchanges (Binance.US, Bitstamp, FTX, and Huobi Global) are already set to list the token when it is launched later this month. The token will also be hitting decentralized platforms, and Compound, Curve, DFX, and Uniswap protocols are the leading DEXs to welcome the Euro coin.

USDT’s Position Now Threatened

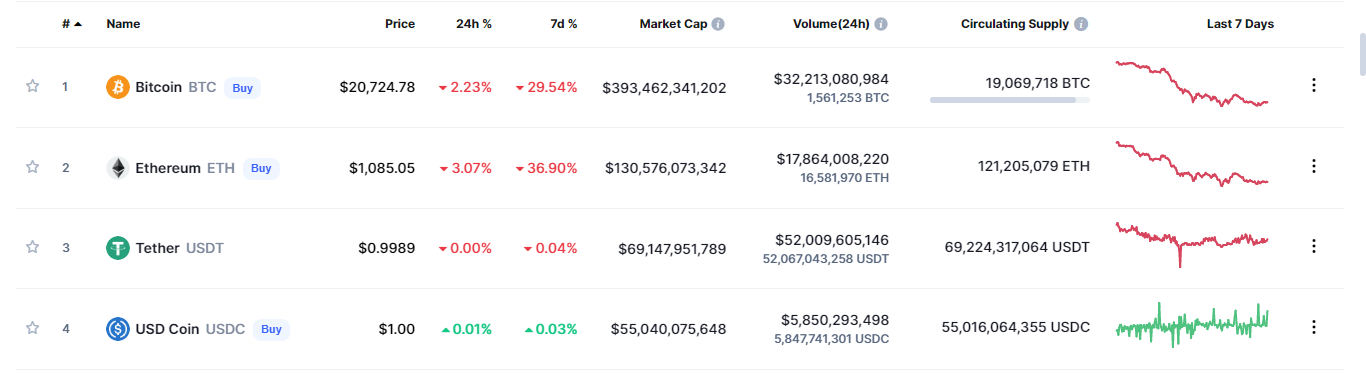

The issuing company for the Euro coin, Circle, already manages a stablecoin (USDC). USDC has a market capitalization of $55 billion and is seen as the fiercest competitor for USDT. In the last month, large volumes of USDT were swapped to USDC, making Tether’s market capitalization drop from $83 billion to $69 billion.

With the introduction of EUROC to the crypto market now, more traders in the UK and other European nations will likely give preference to the Euro coin over Tether’s USDT. The UK alone has over 3.5 million crypto users, and crypto adoption in the United Kingdom is growing by about 5% every year.

Undoubtedly, the uncertainty about the strength of Tether’s dollar reserves will be an added reason for traders to exit their Tether positions. In the past few weeks, Tether has been less stable than Circle’s USDC. USDT is currently valued at $0.998, while USDC has maintained its $1 value. Once EUROC hits the market, we can expect many European traders to convert their stables from Tether’s USDT to Circle’s Euro Coin, causing USDT’s market capitalization to plummet further.

While developers await the official release of the Euro coin, the token can be integrated with smart contracts, and liquidity will be available in the coming days. The token will work broadly with ERC-20 compatible wallets and protocols. The Circle team also has plans to make the token compatible with other blockchain standards later this year.