Overnight, the value of liquid staking tokens increased as investors bet on the expansion of decentralized staking products in response to rumors that their centralized counterparts could be subject to a ban in the United States. The SEC rumors state that the body could soon ban all staking activities for retail customers.

The CEO of Coinbase, Brian Armstrong, tweeted that he had heard the rumors about the United States Securities and Exchange Commission banning retail investors from participating in cryptocurrency staking on Twitter causing the recent spike of activity in the crypto space.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

According to a review from Staked, a non-custodial staking service provider, the value of staked assets was approximately $42 billion in the fourth quarter of 2022, and annualized staking rewards were estimated to be $3 billion during that same time period. This number did not include only individual investors in the retail market.

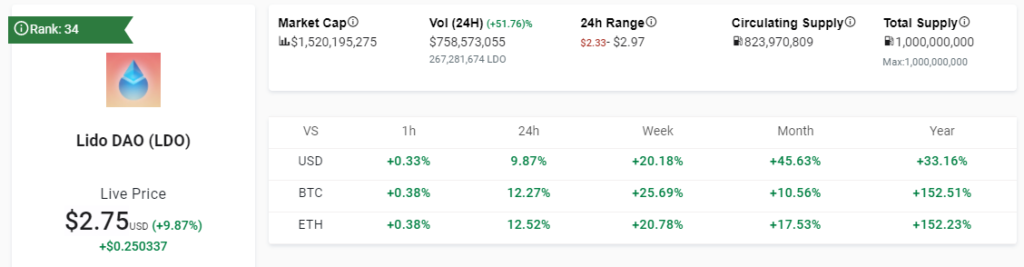

Lido’s chart activity

According to recent data, the liquid staking sector increased by an average of 5.4%, while the overall trading volume also increased by 51.76%. Over the past twenty-four hours, the value of both Rocket Pool’s RPL and Stader’s SD tokens increased by over 9% as of the time of writing.

The term “liquid staking” refers to the process of exchanging staked ether for tokenized versions of ether that are compatible with applications that make use of decentralized finance (DeFi). Earning yield is one of the uses for these tokens, but they can also be used as collateral for loans or margin trading.

Prominent traders on Crypto Twitter postulated that the flow of these funds into DeFi alternatives such as Lido and Stader could possibly explain the immediate price bump for related tokens.

A ban on centralized staking providers in the US would be a boon for Lido. Coinbase sits at 11.5% vs Lido's 25%.

We can assume nearly all cbETH is from US customers. Lido will receive the vast majority of unlocked cbETH. $LDO https://t.co/VmyamW8thL pic.twitter.com/OTWtMlAT1L— housefire (@chipflare) February 8, 2023

As of right now, investors are unable to withdraw or freely trade ether that has been staked on the Ethereum blockchain. However, rumors are circulating that the highly anticipated Shanghai upgrade to Ethereum, which is scheduled to take place next month, will allow investors to withdraw their staked ether.

What does this mean to crypto?

Ethereum staking business is expected to grow bigger in the coming future. However, if the SEC or other regulatory bodies outlawed staking, it may have far-reaching consequences for the cryptocurrency market, including lower demand for staked coins, more volatility, less secure networks, and widespread industrial disruption. As a consequence, blockchain networks that depend on staking for consensus may become less secure, which might have a negative impact on the value of staked cryptocurrencies and the cryptocurrency market as a whole. What extent a ban would have depends on a number of variables, such as the nature of the ban itself, the health of the cryptocurrency market, and the nature of the economy and any applicable regulations.