In the past month, no crypto project has trended more than Terra’s LUNA and UST. Since the violent crash of both tokens, multiple plans have been made to get the project up again. Interestingly, LUNA has risen above its all-time low in the last few days.

LUNA is currently ranked 212 on the list of cryptocurrencies by market capitalization. While this is still a disappointing rank for the token, its market cap has gained millions after falling below rank 1000 some days back.

Here are three reasons why Luna’s market cap is back above the $1 billion mark:

Luna’s Buy Back and Burn Proposal

Billions of LUNA tokens were minted to protect UST. However, all that only caused more havoc to Terra’s native token. At the moment, burning Luna seems to be the best option. The protocol has proposed a burning solution, although this is yet to be approved by the governing members of the protocol. The prospect of burnt excess supply has attracted a few investors to the project again.

Recently, a Twitter user suggested that Luna implement a 10% buy and sell tax for every LUNA transaction. Luna currently has a daily trading volume of $1.6 billion. 10% of that would amount to 160 million Luna tokens burnt daily.

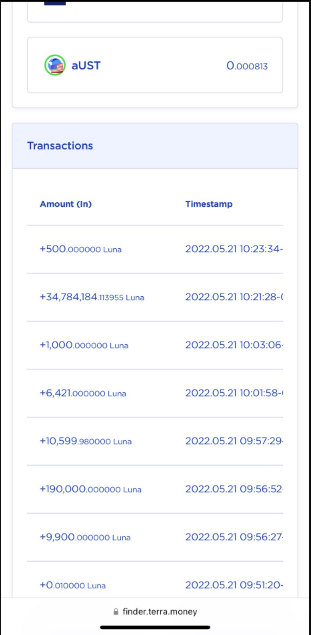

Do Kwon also recently provided a burn address for Luna, and several holders burnt their tokens. Notably, one holder burnt more than 34 million LUNA to play a part in supply clamping.

The Launch of Terra without UST

Following the unpleasant events in the Terra ecosystem, the team is working towards the relaunch of Luna. This time, the token will not be used as a backing for UST to prevent a repeat of the crash. Do Kwon and his crew have also planned to reward Luna investors who held the token before the crash. These plans have captivated the interest of Luna holders, and many are hoping the project gets revived.

Fear of Missing Out

The moves made by Do Kwon to bring back the dead coin have not gone unnoticed. Admittedly, LUNA at $0.0002 looks pretty cheap given its all-time high of $119. With investors seeing this as an opportunity to accumulate millions of Luna tokens, the market cap has bounced above $1 billion. Perhaps, if Do Kwon’s plans to revive the project are successful, LUNA may exceed $10 billion in market capitalization in the coming years.