- Introduction

- Financial Performance and Growth Potential

- Market Dominance and Competitive Advantage

- Technological Innovation and Disruption

- Expansion into New Markets and Revenue Streams

- Consumer Behavior and Market Trends

- Risk Assessment and Mitigation

- Amazon stock price prediction 2024

- Amazon stock price prediction 2025

- Amazon Stock Forecast for the Year 2030

- Conclusion

- FAQ

Introduction

In this comprehensive analysis, we provide an in-depth prediction for Amazons stock price for 2030. By closely examining various factors that influence the company’s performance, including financial indicators, market dynamics, technological advancements, consumer behavior, and competitive landscape, I aim to offer valuable insights into the potential trajectory of Amazon’s stock price over the next decade.

Financial Performance and Growth Potential

Amazon’s impressive financial performance sets a solid foundation for future growth. The company has consistently demonstrated strong revenue growth, driven by its diverse product offerings, expanding customer base, and relentless focus on customer satisfaction. With its well-established e-commerce platform, AWS dominance, and ventures into emerging sectors, Amazon is well-positioned to capitalize on evolving market trends, which indicates significant growth potential for its stock price by 2030.

Market Dominance and Competitive Advantage

Amazon’s market dominance in the e-commerce industry is unparalleled. The company’s relentless pursuit of innovation and vast logistical infrastructure have granted it a significant competitive advantage over its rivals. By continually expanding its product categories, enhancing its fulfillment network, and improving last-mile delivery efficiency, Amazon remains a leader in the rapidly growing e-commerce space. Such market dominance positions the company favorably to capture a larger market share and drive its stock price higher in the coming decade.

Technological Innovation and Disruption

Technological innovation lies at the core of Amazon’s success. The company’s investments in artificial intelligence, machine learning, and automation have resulted in operational efficiencies and improved customer experiences. Amazon’s early adoption of voice assistants, smart home devices, and cloud computing services through AWS has revolutionized multiple industries. As Amazon continues to push the boundaries of technological advancements, it is poised to disrupt existing markets and tap into new growth opportunities, bolstering investor confidence and positively impacting the Amazon stock price in 2030.

Expansion into New Markets and Revenue Streams

Amazon’s expansion beyond e-commerce has been instrumental in diversifying its revenue streams. Amazon Web Services (AWS) ‘s cloud computing division has experienced remarkable growth and is expected to remain a significant revenue driver. Additionally, Amazon’s foray into digital streaming with Prime Video, its investments in healthcare, and its smart home ecosystem powered by Alexa demonstrate the company’s commitment to expanding its reach. This strategic expansion into new markets provides Amazon with additional revenue sources and enhances its overall market position, contributing to a positive outlook for the Amazon stock price prediction for 2030.

Consumer Behavior and Market Trends

Understanding consumer behavior is vital in predicting Amazon’s future performance. The continued shift towards online shopping, the increasing reliance on mobile devices, and the growing preference for convenience and personalized experiences favor Amazon’s business model. By leveraging its vast consumer data, Amazon can deliver targeted advertising, personalized recommendations, and seamless shopping experiences, likely to drive customer loyalty and fuel revenue growth. Anticipating and capitalizing on changing consumer trends will drive Amazon’s stock price upward in the next decade.

Risk Assessment and Mitigation

While Amazon’s growth prospects are promising, it is essential to consider potential risks and uncertainties. Regulatory challenges, geopolitical factors, supply chain disruptions, and increasing competition are among the risks that could impact Amazon’s stock price in the future. A comprehensive risk assessment and effective risk mitigation strategies will be crucial for Amazon’s sustained growth and investor confidence.

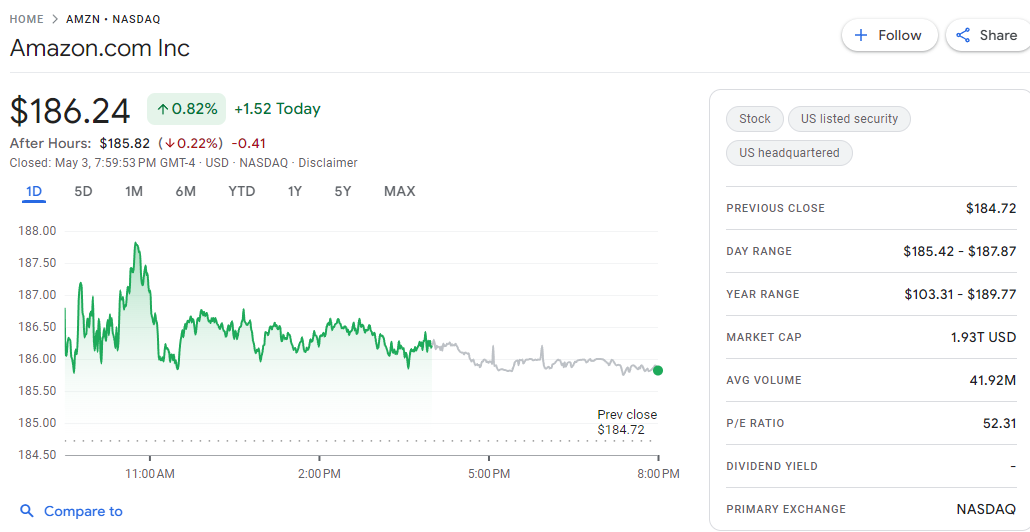

Amazon stock price prediction 2024

We project that the price of an item on Amazon will be $250 in 2024, representing an annual increase of 39%. We also anticipate a gain of 26% from now till the end of the year. We anticipate a price of $212 for 1 Amazon by mid-2024. The Amazon stock price is expected to increase by 75% in 2024, reaching $300 by year’s end from its current $151. This is a +34% increase from the second half of 2025.

Amazon stock price prediction 2025

If Amazon shares continue to rise at the same average annual pace as they have over the last ten years, the current projection for Amazon stock in 2025 is $ 270. This is based on the assumption that Amazon shares will continue to grow in value. If this were to happen, the price of AMZN shares would climb by 60.35 percent.

Amazon Stock Forecast for the Year 2030

If Amazon’s stock continues to rise at its current pace of growth during the last ten years, it will be worth $567.36 per share in the year 2030. If my forecast for Amazon stock in 2030 comes true, the value of AMZN stock will increase by 422.04% relative to where it is now trading.

Conclusion

Based on the comprehensive financial performance analysis, market dominance, technological innovation, expansion into new markets, consumer behavior, and risk assessment, I predict that Amazon’s stock price will experience significant growth by 2030.

FAQ

What factors are considered in the prediction of Amazon’s stock price for 2030?

The prediction considers Amazon’s financial performance, market dominance, technological advancements, consumer behavior, competitive landscape, and potential risks. These elements help provide a well-rounded view of Amazon’s potential growth trajectory.

How has Amazon’s financial performance influenced its future stock price predictions?

Amazon’s strong financial performance, characterized by steady revenue growth and diversified product offerings, sets a solid foundation for future growth. This financial robustness suggests significant potential for stock price appreciation by 2030.

What role does Amazon’s market dominance play in its stock price forecast?

Amazon’s unparalleled market dominance, especially in e-commerce and logistics, positions it favorably for continued growth. This dominance is expected to drive its stock price higher as the company captures more market share over the next decade.

How do technological innovations impact Amazon’s stock price outlook?

Amazon’s commitment to technological innovation, such as AI, machine learning, and automation, has not only improved operational efficiencies but also customer experiences. These advancements are crucial for market disruption and could significantly boost Amazon’s stock price by 2030.

In what ways does Amazon’s expansion into new markets affect its stock price?

By venturing into new sectors like cloud computing, digital streaming, and smart home technologies, Amazon diversifies its revenue streams. This strategic expansion enhances its market position and is a positive indicator for its future stock price.

How does consumer behavior influence Amazon’s stock price projection?

The shift towards online shopping and the demand for personalized experiences align well with Amazon’s business model. Leveraging vast consumer data allows Amazon to enhance customer engagement and loyalty, likely driving up its stock price.

What are the potential risks that could affect Amazon’s future stock price?

Risks include regulatory challenges, geopolitical factors, supply chain disruptions, and increased competition. Effective risk mitigation strategies are essential to maintain growth momentum and investor confidence.

What is the predicted stock price of Amazon for the years 2024, 2025, and 2030?

The predicted stock price for Amazon is $300 by the end of 2024, $270 in 2025, and $567.36 by 2030. These predictions assume that Amazon will continue growing at a similar rate as in the past decade, with significant annual increases.

MORE: