- Analysis of Terra Luna Classic

- Community Attitudes and the Future of LUNC

- Consequences of LUNC’s Carbon Tax

- Is It Time to Buy LUNC?

- LUNC price prediction

- FAQ

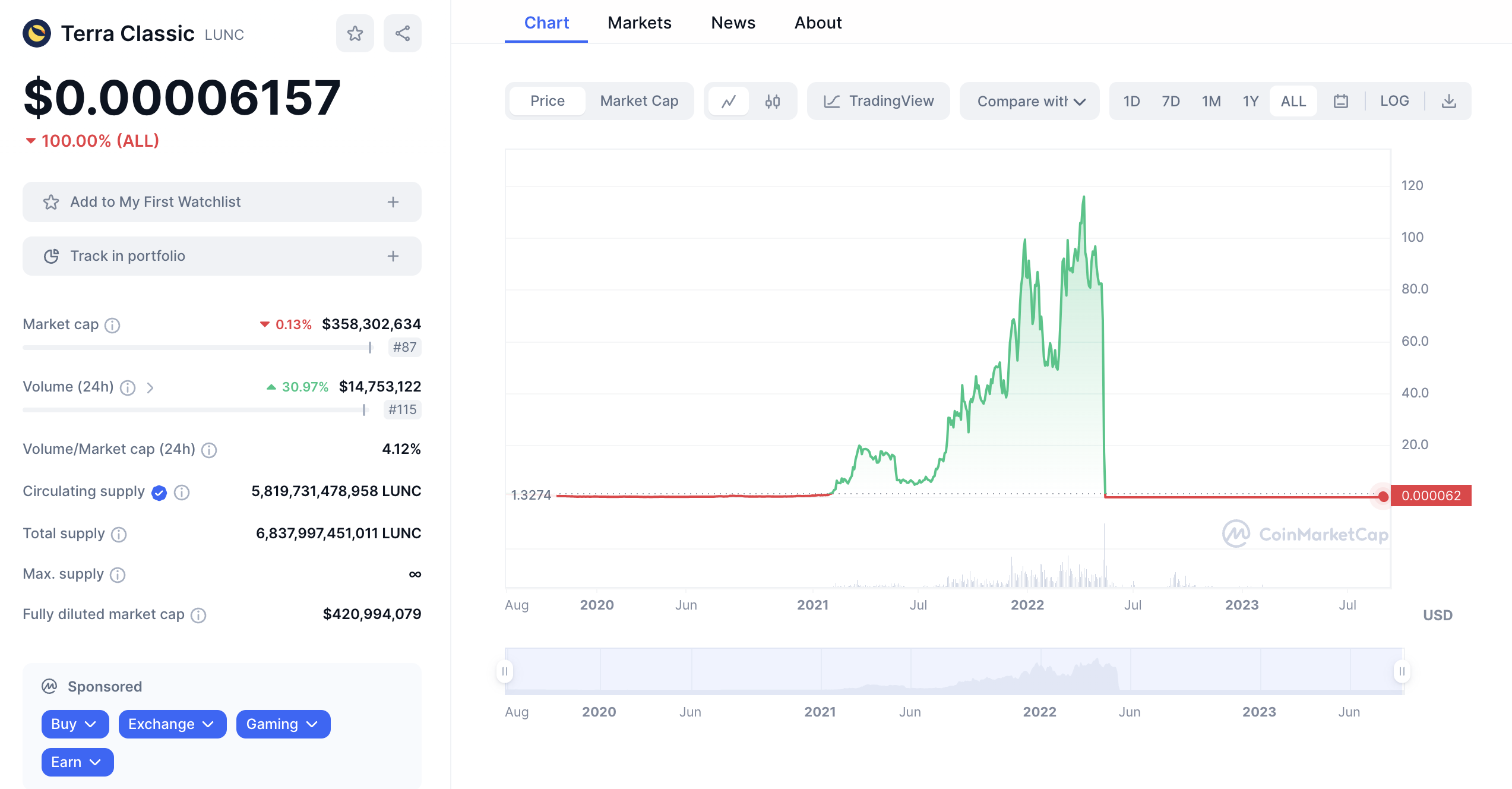

Terra Luna Classic’s (LUNC) future price forecast is based on market data analysis and past price movements. LUNC has dropped significantly, by 4.6%, in the previous 24 hours. This is indicative of a pessimistic outlook in the Bitcoin market. However, the long-term forecast is still bullish, with LUNC perhaps reaching $0.00029 by 2024.

Analysis of Terra Luna Classic

The Terra blockchain protocol is an open-source platform that supports a thriving community of decentralized apps (dApps) and provides developers with industry-leading resources. Terra’s blockchain sets the door for the next generation of decentralized finance (DeFi) using a proof-of-stake consensus method.

In addition, Terra is a payment network built to accommodate a stablecoin whose value is algorithmically pegged to that of a government-issued currency.

In 2018, Terraform Labs created the Terra protocol. This Do Kwon, and Daniel Shin-founded South Korean lab set out to create a cryptocurrency with a steady value by combining the advantages of traditional currencies with Bitcoin (BTC).

The Terra protocol’s native token, LUNC, is used largely for staking, which protects the network’s safety and integrity. In addition, LUNC may be used for governance, giving users a voice in policymaking and enabling them to shape the future of the Terra protocol.

At first, the cryptocurrency was designed to round out the price swings of terraced (UST), Terra’s algorithmic stablecoin. Unfortunately, UST lost its stability after an assault exploiting a blockchain protocol flaw forced it to decouple from the US dollar. The ensuing near-complete loss of value inscribed this event into the history books of major crypto failures.

Do Kwon take the lead in resurrecting the project after these developments, proposing a hard fork that was well-received by the community? Since then, a new blockchain technology with its own native currency named LUNA has been introduced, while the old Terra blockchain continues to function with its token rebranded as ‘Luna Classic (LUNC)’ from ‘LUNA’

Once the seventh biggest cryptocurrency by market cap, LUNA has fallen to over 200th place due to recent occurrences.

As a result of Terra’s disintegration, a new chain had to be established, and the older one was rebranded as “Terra Classic (LUNC).” Terra 2.0 aims to take over the previous network’s protocols and software. There are still open issues about the future functionality and practicality of LUNC.

While the LUNC burn has been ongoing, the Terra community has shown remarkable strength of character and hope. Positive reactions to the reorganization plan have pushed share prices up by nearly 170% in a week toward the month’s conclusion.

Community Attitudes and the Future of LUNC

Despite the current network issues, the LUNC community shows signs of rebirth, as seen by the popular hashtag ‘#LUNCcommunity’ on Twitter. By voting on and implementing important ideas about the token burn, the LUNC community has helped the project recover from the losses sustained in the last collapse.

While Do Kwon and his group work on Terra 2, Luna Classic’s community will oversee day-to-day operations. Increasing optimism in the LUNC community bodes well for the cryptocurrency’s price, which may continue its ascent in the months ahead.

Rising LUNC popularity, especially at the start of this month, propelled the currency to the $0.000517 resistance level before it was met with selling pressure. However, since Bitcoin has been under selling pressure recently, market sentiment has been impacted. It will be interesting to see how investors react to LUNC if its social dominance becomes more apparent.

Consequences of LUNC’s Carbon Tax

All purchases and sales of LUNC have been subject to a new 1.2% “burn tax” imposed by the community. These actions should put LUNC in a strong position to recover from the over-minting-related losses that have been incurred.

1.2% of all LUNC tokens are destroyed every time a transaction is made as part of this burning process. This burn is being conducted to decrease the LUNC stockpile from 6.5 trillion to 10 billion. While this process may eventually lead to higher demand, it does pave the way for a drop in supply.

In general, LUNC is still selling at a big discount to where it was before the fall. However, some of the losses may be recouped via a continuous burn process. Reduce the supply and fix the harm with the help of validators. The community’s upbeat attitude is reflected in the tripling of LunarCrush’s social mentions and interactions.

Positive developments for LUNC have emerged thanks to the exchanges’ backing of the burn mechanism. Additional exchanges may be prompted to help the community recover if they see this message of encouragement.

Ultimately, LUNC’s near-term growth prospects have been solidified by enhanced public awareness and the burn mechanism plan. If major trading platforms keep accepting LUNC, the coin’s upward trend might continue for several months.

A Look at the LUNC Terra Luna Classic Price

Primary resistance and support levels for LUNC were detected at $0.000181 and $0.000172, respectively, during a downward movement in November 2022.

The daily data for LUNC shows a price drop from $0.000259 in October 2022 to $0.000148 in November 2022. Midway through December, though, the price showed signs of life again, rising to $0.000184.

Relative Strength Index (RSI) readings over 50 indicate a buying opportunity as LUNC continues its upward trend. Additionally, bolstering positive market sentiment is rising On-Balance-Volume (OBV).

Above the $0.000184 level in November 2022, the following support levels were found on the 6-hour chart: $0.000237, $0.000226, and $0.000198.

Is It Time to Buy LUNC?

In light of the persistent efforts of the LUNC community to reduce the token supply and preserve its value, the future of LUNC seems bright. When investing in a project with substantial setbacks, it is important to understand the dangers involved. The coin’s price might drop significantly during the next several sessions if it becomes the target of pump-and-dump scams.

LUNC price prediction

Our research shows that a reasonable pricing for Terra Luna Classic in 2023 would be between $8.33 and $12.49, with an average price of LUNC at around $10.41.

Our research shows that a fair price for LUNC (Terra Luna Classic) in 2024 is between $0.00019 and $0.00029, with an average price of $0.00024.

Based on our study, we expect the price of LUNC (Terra Luna Classic) will be between $0.00025 and $0.00037 in 2025, with an average price of about $0.00031.

Our research shows that a fair price for Terra Luna Classic will be between $0.00032 and $0.00049 in 2026, with an average price of LUNC around $0.0004.

Our research shows that a reasonable pricing for Terra Luna Classic in 2027 would be somewhere between $0.00042 and $0.00063, with an average price of LUNC around $0.00053.

Our research shows that a reasonable price for LUNC in 2028 is between $0.00055 and $0.00082, with an average price of about $0.00069. This is our price forecast for Terra Luna Classic.

Our data suggest a price range for LUNC of $0.00071-$0.0001 in 2029, with an average price of LUNC somewhere around $0.00089. This is our pricing estimate for Terra Luna Classic.

Our algorithm predicts a price of $0.00093 for Terra Luna Classic in 2030 and a price range of $0.0014 for LUNC, with an average price of $0.0011.

Our research shows that a fair price for Terra Luna Classic will be between $0.0012 and $0.0018 in 2031, with an average price of LUNC somewhere around $0.0015.

Our research shows that a fair price for Terra Luna Classic will be between $0.0015 and $0.0023 in 2032, with an average price of LUNC somewhere around $0.0019.

Our research shows that a fair price for LUNC in 2033 is between $0.002 and $0.003, with an average value of around $0.0025. This is our price forecast for Terra Luna Classic.

Our research shows that a fair price for LUNC (Terra Luna Classic) in 2034 is between $0.0026 and $0.004, with an average price of about $0.0033.

FAQ

What is Terra Luna Classic (LUNC)?

Terra Luna Classic (LUNC) is the original token of the Terra blockchain protocol, an open-source platform supporting decentralized apps (dApps) and offering a payment network for stablecoins. Originally aimed to stabilize the price of its algorithmic stablecoin, UST, LUNC now functions mainly for staking and governance within the Terra ecosystem.

What led to the creation of Terra Luna Classic?

Following a significant devaluation due to an attack exploiting a blockchain protocol flaw, the Terra community underwent a major restructuring. This included a hard fork proposed by Do Kwon, leading to the creation of a new blockchain (Terra 2.0) with its token LUNA, while the original blockchain was rebranded as Terra Luna Classic (LUNC).

How is the Terra community reacting to LUNC’s current situation?

Despite past setbacks, the LUNC community has shown resilience and optimism, particularly evident on social media platforms like Twitter. Community-driven initiatives, such as token burn proposals, have been instrumental in LUNC’s partial recovery.

How does the LUNC burn process work?

The LUNC burn process involves destroying 1.2% of all tokens involved in every transaction. This mechanism is designed to decrease the total supply of LUNC, thereby addressing the over-supply issues and contributing to its value recovery.

What has been the impact of the LUNC burn tax so far?

The burn tax has contributed to a positive outlook for LUNC, with social mentions and interactions tripling. It has also received support from various exchanges, bolstering its recovery prospects.

MORE: