Since 2022, it has been the winter season for Bitcoin and altcoins. Bitcoin failed to reach the highly anticipated $100k and further plummeted away from that region in January. The flagship currency opened the year around $46,000 but has failed to hit even $50,000 in 2022. At the moment, Bitcoin is valued at $23000, and many investors are already running out of patience. Amidst the storm or winter, the bigger picture reveals that Bitcoin may recover soon. Even if not to the $50K or $100K levels, to a price region well above the current $23K.

Three Reasons Why Bitcoin May Recover Soon

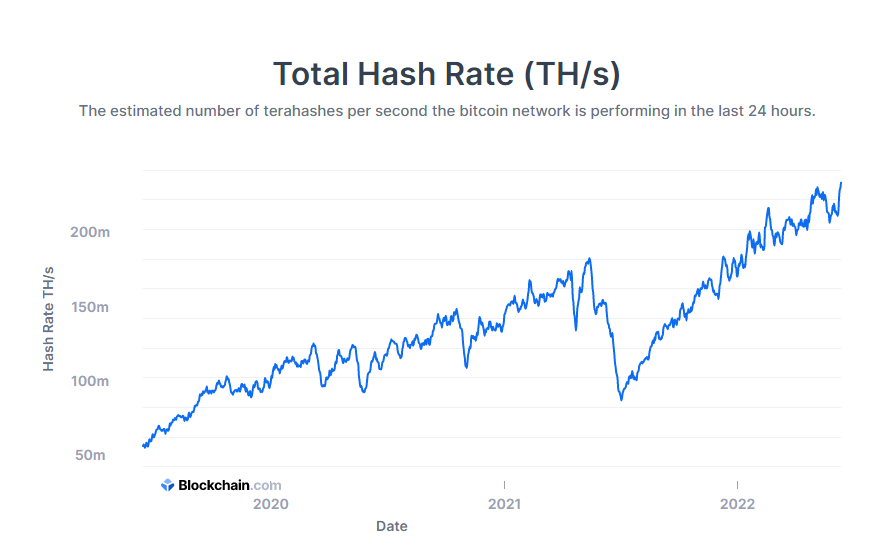

- Bitcoin’s Hashrate is at an all-time high: Bitcoin’s hashrate is currently above 230 million TH/s. This is the highest it has ever reached. The hashrate indicates that more miners are joining the network to validate transactions, making the network more secure.

What is the relationship between hashrate and Bitcoin’s price? A severe decline in Bitcoin’s hashrate causes the asset’s price to go south most times. On the other hand, a sharp increase in hashrate is usually followed by an appreciation in price. The hashrate is a value indicator and reveals how many resources miners are willing to invest in the asset. The more miners are willing to spend, the more psychological value Bitcoin has.

- Bitcoin may have Bottomed Out: Billions of dollars have been wiped off the crypto markets from the start of the year to date. Many “weak hands” have already sold off, and Bitcoin may just have bottomed out. Valuable assets usually have extreme lows, and the RSI indicator for Bitcoin indicates that BTC is already oversold. Strategic investors buy back at over-sold regions, causing the price to spring up again. At the moment, Bitcoin is in its fourth-longest bear run in history, and bear runs don’t last forever for BTC.

- The SEC may approve the Grayscale Bitcoin Application: Grayscale recently applied to turn its Bitcoin trust into a spot ETF. The SEC is yet to approve Grayscale’s application. However, a positive reply from the SEC will be bullish for the market. Grayscale currently owns 3.4% of the world’s supply of Bitcoin.