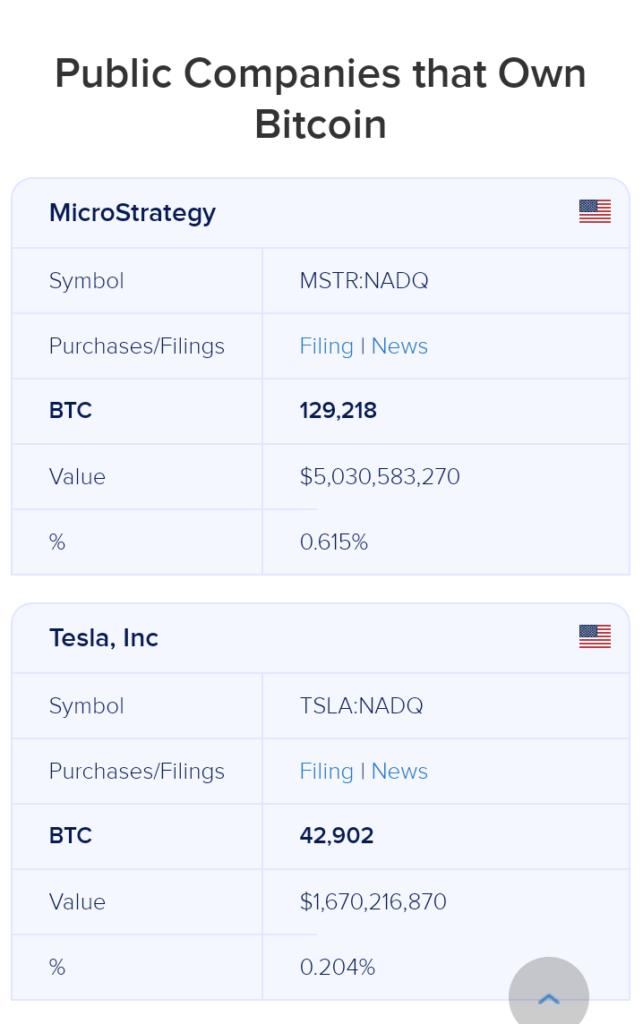

The most enormous Bitcoin whale in the Crypto ecosystem, MicroStrategy, recently revealed that the company might be in big trouble if Bitcoin falls below the $21000 mark. MicroStrategy currently owns more than 129k Bitcoins with a dollar valuation of $5 Billion.

MicroStrategy is currently leading the charts in BTC holdings. Other public companies that come next to the Bitcoin whale are Tesla and Galaxy Digital. Tesla now owns $1.59 billion worth of BTC, while Galaxy Digital owns $609 million worth of Bitcoin.

A significant volume of MicroStrategy’s Bitcoin holdings were acquired in debt. About two months ago, MicroStrategy obtained a $205 million loan from Silvergate bank to buy more BTC. Cumulatively, the company has raised more than $2 billion in debt to acquire the world’s leading crypto asset.

Commenting on the loan, the company’s spokesman said that Bitcoin would need to drop by about 50% from its current value of $39k for the company to get a margin call. While this is extremely risky, the company is aware that a margin call can be avoided by acquiring more Bitcoin to sustain its position if things go South.

While MicroStrategy is primarily a software company, the organization has been acquiring Bitcoin since 2020. About a month ago, a Twitter user accused MicroStrategy of selling some of its BTC secretly.

The CEO of the software company refuted such claims and assured his audience that all purchases and sales of the leading crypto asset by MicroStrategy will always be announced rather than done secretly.

Michael Saylor is a Bitcoin maximalist, and he stated earlier this year that he doesn’t ever plan to sell MicroStrategy’s Bitcoin stash.

Despite the liquidation concerns, the company is still in huge profit. It acquired its total Bitcoin holdings at an average price of $30,700.

MicroStrategy’s stock is currently 37% lower than the previous year and 62% lower than its high in November 2021. The company’s stock price has been highly dependent on the rise and fall of Bitcoin.