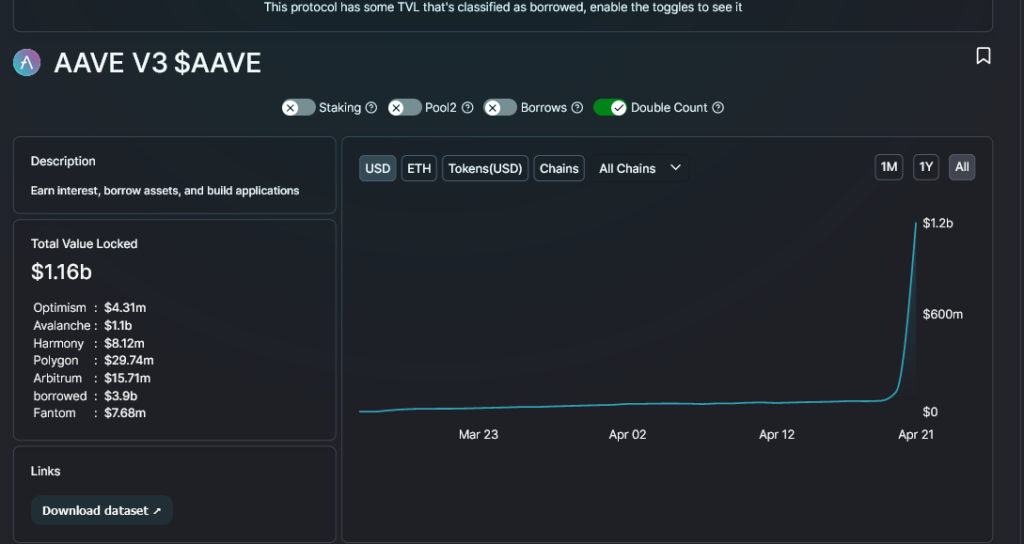

According to observers, the Total Value Locked (TVL) across Aave v3 markets is “blowing up”.

As of April 21, Aave v3 TVL stood at over $1.2 billion, up more than 60X from roughly $8 billion posted on March 16, 2022, when the new version was launched.

The interest in Aave v3 stems from some of its distinguishing features, making it unique from other competing protocols.

Representative of the ever dynamic crypto and DeFi space, the Aave v3 market introduces better capital efficiencies with better security and cross-chain functionalities. While it offers attractive features, Aave isn’t compromising decentralization. Despite its presence in various decentralized mainnets and layer-2 networks, all of its operations remain non-custodial.

Some of the protocol’s groundbreaking features include the introduction of secure portals enabling seamless cross-chain transactions between supported networks. Thus far, Aave v3 supports Polygon, Avalanche, Harmony, Fantom, Arbitrum, and Optimism. The eventual deployment in Ethereum will depend on the community’s approval.

Besides, the update introduces higher efficiency mode giving users the ability to borrow more. At the same time, Aave v3 has an ingenious “Isolation Mode”, which allows for new assets to be listed while protecting the protocol. Moreover, aware of the limiting high Gas fees in Ethereum, Aave v3 has a Gas Optimization feature that slashes all Gas cost functions by 20 and 25 percent.

Aave is one of the leading DeFi protocols allowing users to borrow and lend digital assets. Aave is known for popularizing Flash Loans, a revolutionary feature enabling users to borrow large sums and repay within an Ethereum block, which usually takes around 13 seconds to settle. When writing, AAVE is up 20 percent in the previous trading month.