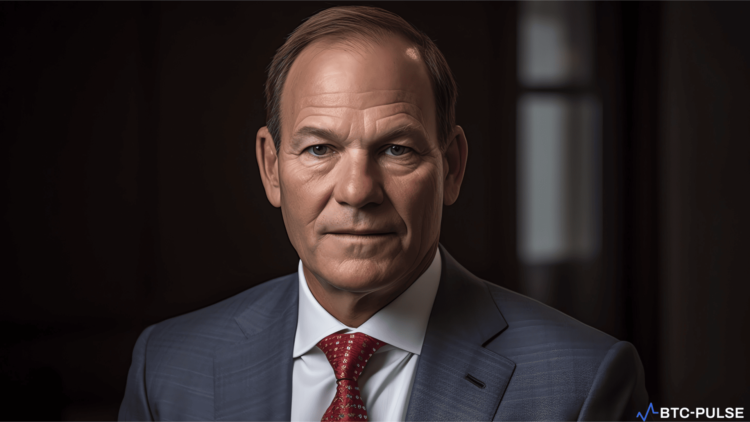

Amid escalating global tensions and an unsettling U.S. economy, Paul Tudor Jones, a hedge fund billionaire, champions Bitcoin and gold as the prime investment choices over traditional stocks.

The Current Economic Quagmire

On Oct. 10, Paul Tudor Jones, the esteemed founder and chief investment officer of Tudor Investment, expressed his concerns about the present investment climate during an interview with CNBC. “It’s a really challenging time to want to be an equity investor and in U.S. stocks right now,” Jones remarked, highlighting the precarious position of the U.S. economy.

Drawing attention to the staggering 122% debt-to-GDP ratio, Jones inferred that the U.S. is navigating its feeblest fiscal waters since World War II.

Bitcoin and Gold: The Safe Havens?

The ongoing Israel-Hamas conflict and its ramifications present an ominous geopolitical landscape, according to Jones. These evolving global crises are prime contributors to the emerging risk-averse market sentiment.

Attributing America’s current financial predicament to surging interest rates and mounting debt, Jones painted a grim picture. With a national debt skyrocketing to an unprecedented $33.5 trillion and interest rates at 5.5%, the economic strain is palpable.

Reflecting on this dire scenario, he stated, “As interest costs go up in the United States, you get in this vicious circle, where higher interest rates cause higher funding costs, cause higher debt issuance, which cause further bond liquidation, which cause higher rates, which put us in an untenable fiscal position.”

Jones, a Bitcoin enthusiast for several years now, disclosed in 2020 that 1-2% of his assets were allocated in BTC, further increasing this to 5% the subsequent year. Even during the bearish wave of May 2023, Jones remained steadfast in his Bitcoin commitment.

BTC Price Outlook

Although Jones’s endorsement is powerful, Bitcoin experienced a 2% decrease, settling at $27,151. Over the weekend, the cryptocurrency failed to surpass the $28,000 resistance, marking its lowest in 10 days. Nonetheless, market analysts reiterate a positive longer-term trend for Bitcoin from its low last November.