On the 30th of January 2023, Bitcoinsensus made a post on Twitter saying that Bitcoin miners are selling off fewer BTC.

Miners selling pressure has gone down significantly with low transactions to exchanges.

Have we been saved from a miners capitulation as they are selling small amount of #Bitcoin as price goes higher? pic.twitter.com/q5jyF01TB6— Bitcoinsensus (@Bitcoinsensus) January 30, 2023

According to Bitcoinsensus, an information platform that keeps the crypto community up-to-date on crypto news and technical analysis, the crypto space might be getting out of a BTC miners’ capitulation.

Bitcoin began 2023 on a positive note as the asset climbed above $21k on the 14th of January 2023, for the first time in two months catapulting up to roughly 28%. This has given market players a new cause for optimism considering the crypto winter that hit the crypto space last year.

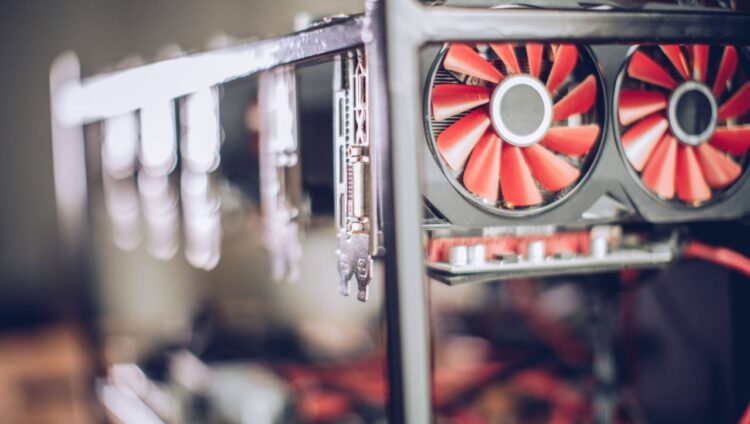

As the crypto market capsized, and liquidity ceased, miners, found themselves cornered into a difficult position, and those unable to settle their debt were forced to sell off their BTC reserves.

Major BTC dumping took off in May 2022, as Bitcoin miners sent a shock wave throughout the community by selling off more than 100 percent of their mining rewards. Public miners sold $6.5k of their BTC holdings in July, compared to around 14.6k the month before when they were forced to trade their BTC on a major scale in order to maintain operation.

Recapturing 2022 at a glance, Jaran Mellerud a Bitcoin mining analyst at Luxor Mining stated that between January and November, public miners offloaded around 51k BTC, while mining around 47k BTC.

The crypto market is observed to be slowly gaining momentum as the pressure built up from the incessant selling of public BTC by miners has eased up and this has significantly helped Bitcoin mining operations placing a number of BTC miners back in profit.

Since January 1, 2023, the hash price has been over 20% and Bitcoin mining profitability grew from $0.06 TH/d to $0.07874 TH/d. According to the stats at btc.com, BTC is observed to have recoupled in the days leading up to January 2023. Trade sizes climbed from an average of $700 on January 8 to $1,100 on January 16th.

Analysts suspect that a number of factors could be behind Bitcoin’s new year glory, including a heightened probability of lowered interest rates as well as bulk purchases by whales.

With conditions improving and some miners still operating on thin margins, many in the crypto community wonder if miners would continue to accumulate assets or continue the trend of selling.