Bitcoin Miners Break Records

Bitcoin miners have been dispatching unprecedented amounts of BTC to centralized cryptocurrency exchanges. According to an announcement by on-chain analytics firm Glassnode, Bitcoin miners forwarded a record-high $128 million to exchanges over the past week, corresponding to 315% of their daily income.

Previous Peaks Surpassed

Notably, previous spikes in miner revenue transferred to exchanges have occurred during the 2021 bull run and a capitulation inflow in late 2022 as markets reached their cycle bottom. However, the latest surge is significantly larger, outpacing previous peaks.

Cashing Out or Taking Profits?

Typically, when miners send their BTC earnings to exchanges, it indicates a desire to cash out to cover costs or garner profits. Considering BTC hit its peak price for the year at $31,185 on June 24, the past week could be viewed as an opportune moment for such actions.

CryptoQuant’s co-founder and CEO Ki Young Ju concurred, suggesting that the current price-to-earnings ratio presented an “attractive price for miners to sell.”

BTC Prices Hold Steady

Interestingly, despite this massive shift of Bitcoin from miners to exchanges, BTC prices remain unaffected. At the time of reporting, the digital asset hovers slightly above the $30,000 mark. However, the current price level of around $31,000 poses significant resistance, as past attempts to break through in mid-April and late June have failed. A potential downturn could be on the horizon if miners begin liquidating and bulls fail to secure new highs.

Miners Grapple with Profitability Issues

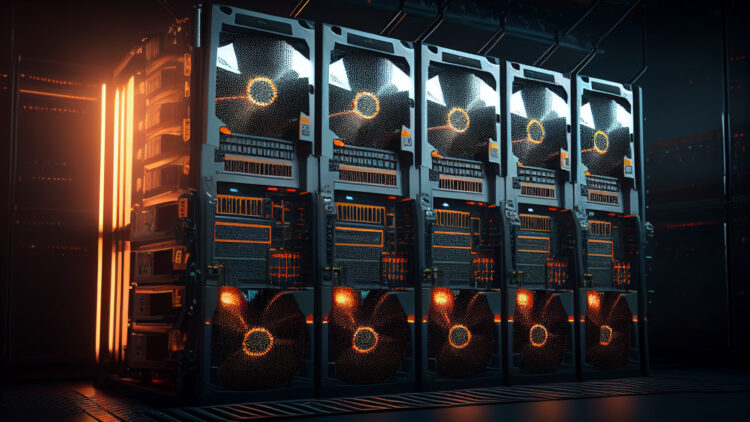

Bitcoin mining profitability or hash price, has seen a minor upswing over the last week due to the rise in BTC prices, sitting at $0.076 TH/s per day as per HashrateIndex. But miners continue to face substantial obstacles.

Despite Bitcoin’s price swelling by more than 88% year-to-date, mining profitability has plummeted by over 30% since July of the previous year and is down over 80% from the apex of the 2021 bull market. Coupled with almost record hash rates of 377 EH/s and peak difficulty levels, Bitcoin miners are still navigating a tough road.

Increasing hash rates and difficulty, in conjunction with soaring energy prices, are contributing to decreased mining profitability. Consequently, miners may find themselves obliged to sell their hard-earned Bitcoin to meet expenses, an action they would rather avoid.