Bitcoin prices are bearish, but the selling momentum is lower at spot rates.

Technically, prices have steadied after the over 20 percent slump from November 2022 highs on November 8 and 9.

However, the coin is still down 18 percent in the previous week of trading but down 11 percent in the last 30 days. Trackers reveal that the fear of mid-last week is tapering, looking at price volatility (it is now low) and participation levels (relatively lower, meaning folks are not scrambling for the exits, impacting liquidity).

Let’s dig deeper for better context:

BTC has been swinging above November 2022 lows at around $15.5k but is also limited to the upside. The immediate resistance level is at $17.5k. This liquidation wall (as it seems) also flashes with June 2022 lows. While the path of least resistance is southwards, there are hints of strength (a relief rally?), looking at the performance in the daily chart.

Although there is a bounce, traders are still apprehensive and mainly unwilling to commit.

A glimpse on the BTCUSDT daily chart shows that prices are within the November 9 bear candlestick with reducing volatility. The result has been the confinement of prices inside a bear flag.

There could be more room for gains if prices increase above $17.5k and $18.5k in a recovery. On a more cautious outlook, there are also risks of further losses if BTC slumps below $15.5k. In that case, BTC may drop to $12k—or lower, back to June 2019 trade range.

Looking at statistics,

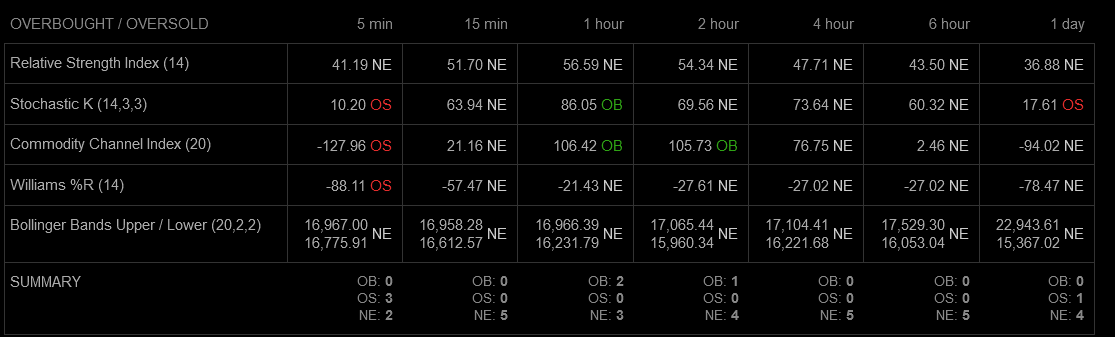

Technical indicators are mixed with no defined signals in the short term; prices are within a bear flag.

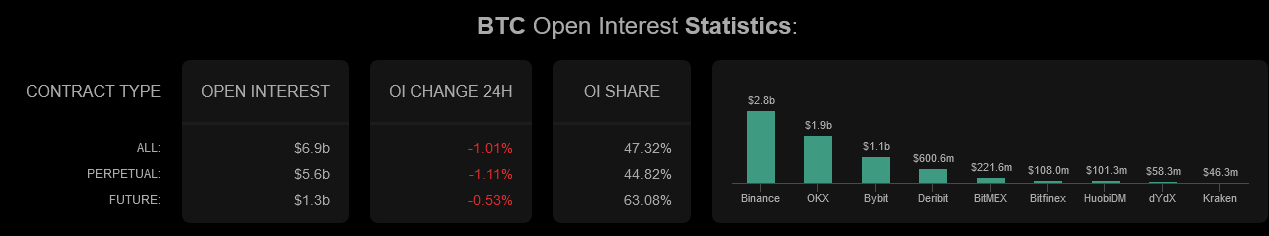

At the same time, there are fewer open positions, as open interest trackers show. At $9.6 billion, it is down roughly one percent in the past 24 hours.

So far, more positions are open on Binance and OKX than in other derivatives crypto exchanges.

Meanwhile,

Raoul Paul opines that market participants are “panicky”, comparing the current state of events to past market cycles. Paul is confident crypto and the financial markets will find their bearing and edge higher:

Liquidity will soon turn…you don't need a super cycle of liquidity like 2020, just a positive cycle for crypto to perform as the network keeps growing… pic.twitter.com/guL9EnZBPE

— Raoul Pal (@RaoulGMI) November 14, 2022

Michael Saylor is also chiming in on the FTX drama, saying it is an expensive “advertisement” for Bitcoin. The exchange’s collapse represents the failure of the corrupt crypto-bank fueled by an inflationary fiat cryptocurrency.

The failure of FTX & FTT represents the collapse of a corrupt crypto-bank fueled by an inflationary fiat crypto-currency. #Bitcoin is an incorruptible, deflationary asset and ethical network offering property rights & freedom to billions of people.

pic.twitter.com/TRTOYadL4Y— Michael Saylor⚡️ (@saylor) November 14, 2022