On December 13, 2022, Coinbase CEO and Co-founder, Brian Armstrong, tweeted to reassure customers of the reliability of the exchange following the recent crypto market turbulence.

Lots of fear out there in the markets. It's important people remember how different Coinbase is in moments like this: 🧵

— Brian Armstrong (@brian_armstrong) December 13, 2022

In the wake of FTX’s insolvency and the arrest of its founder and CEO, Samuel Bankman Fried, known popularly as SBF, the cryptocurrency world is being rocked from within and scrutinized from without. Exchanges, in particular, are under heavy scrutiny as users are forced to examine the validity of their trust in centralized platforms. The FUD surrounding Binance has been a matter of serious concern the past week, with net outflow reaching record highs and prompting the release of proof of reserves to repair customer trust.

Brian Armstrong, CEO and co-founder of Coinbase, a U.S. publicly traded cryptocurrency exchange platform, felt the need to set Coinbase apart in the discourse as the exchange has not been spared from the wave of mass withdrawals and lack of trust.

Armstrong highlighted three reasons users should trust Coinbase. Coinbase is “based in the U.S.,” Armstrong says. This is an attempt to distance themselves from FTX, which is incorporated in Antigua and Barbuda with headquarters in the Bahamas, and even Binance, with the main company initially based in China and registered in the Cayman Islands. Despite the jab, stating that they are subject to the full oversight of U.S. regulatory authorities implies that Coinbase cannot rug pull or be as fraudulent as FTX turned out to be.

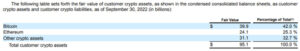

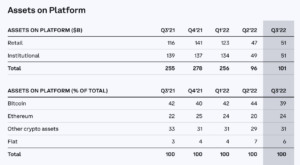

Armstrong also stated that customer assets are backed 1:1 and pointed to the company’s public financials to prove it. This proof of reserve is also something Binance has also been forced to make clear in recent days, after allegations that the company lacked the reserve to back up customer funds. The Coinbase CEO is making it clear that the exchange isn’t playing smart with user funds.

Finally, Armstrong points to a capitalization of $5 billion on the company’s last 10-Q balance sheet.

Despite dwindling profits, a problem that every exchange is facing at the moment, Brian Armstrong maintains that the company’s capital is rock solid.

Coinbase is not without its problems, with Apple’s 30% tax rule no longer allowing NFTs to be sent on Coinbase wallets and revenue expected to fall over 50% this year. In addition, Twitter user Chris Hart has complained that Coinbase is making Plaid, a data transfer fintech, a requirement for linking bank accounts, even though Plaid was recently required to pay a $58 million settlement for selling consumer data in July. Furthermore, the exchange has yet to distribute the Songbird airdrops, which has led to some users’ mistrust of the exchange.

When it comes to funds traded on the exchange, however, users can take whatever consolation or reassurance they can from the Coinbase CEO’s remarks and decide whether it is time to close their eyes to the FUD and put their trust in Coinbase.