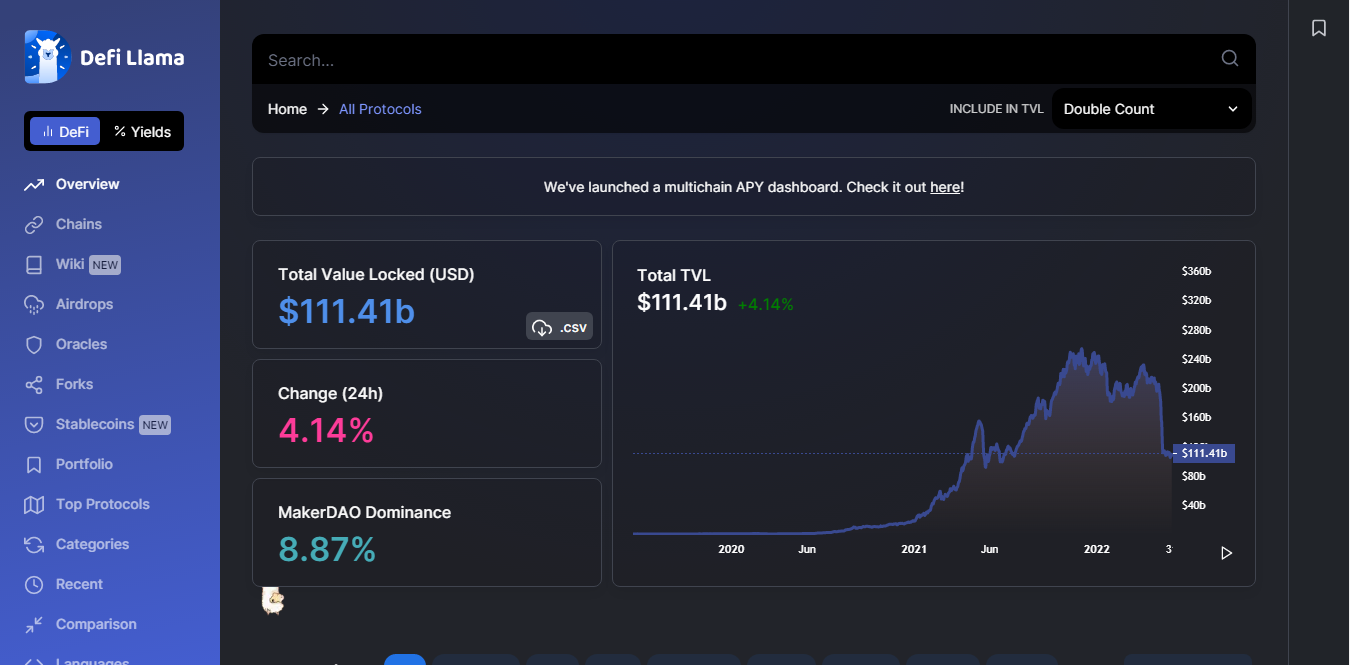

On the 31st of May, the TVL across all DeFi protocols saw a significant increase, adding roughly $5 billion to its initial value. Ethereum, Solana, and the Binance coin are among the leading tokens in the DeFi ecosystem. The cumulative value of tokens locked across DeFi protocols now amounts to $111 billion.

TVL across DeFi Pools Keep Fluctuation

The total value locked across DeFi pools has never been a constant figure. This is because of the fluctuation in the value of cryptocurrencies. Over $200 billion worth of tokens were locked in DeFi liquidity pools earlier this month. However, that value quickly plummeted following the crash in the price of Bitcoin and Altcoins.

Since the start of the week, though, the prices of many crypto tokens have recovered. In the past 24 hours, Ether has gained about 2.5% of its value, while the Binance coin has gained over 1.5%. Overall, the cumulative TVL appreciated by approximately 4% in the last 24 hours.

The recent increase in value of DeFi tokens may arrest the interest of more investors once again. The total value locked across DeFi protocols reached its peak late in 2021 after the crypto market boomed. The TVL went as high as $250 billion in the final days of November and early in December before crashing early in 2022.

The months of January and February were unfavorable, and many investors pulled out of the market. Although the $200 billion mark was reached again in March, it did not take too long for things to fall apart. At the start of May, the value of DeFi tokens and other crypto assets dropped drastically, sending the value of staked and locked tokens to around $100 billion from over $200 billion.

Interestingly, despite the bull run in late 2020 and early 2021, many crypto tokens are back to their roots. Investors who failed to take profits would be disturbed by the current value of cryptocurrencies. Members of the crypto community would be hoping for a turnaround from here, as a further plummet in prices of cryptocurrencies could lead to extreme fear for investors.