Gemini, a regulated cryptocurrency exchange led by the Winklevoss twins, has denied rumors of its possible involvement in the LUNA sell-off.

In a tweet from Gemini via its official Twitter handle, the New York-based crypto exchange and custodian, denied allegations that suggested it was involved in crashing Terra’s native currency, LUNA, by offering a loan of 100,000 BTC to the investment company giants BlackRock and Citadel and saying it did not issue any such loan.

On Thursday, an unsourced rumor circulated that BlackRock and Citadel dumped the borrowed crypto, causing LUNA and UST prices to plummet. UST is currently valued at $0.52, which is well below the intended price of $1.00 but above the $0.32 mark reached yesterday.

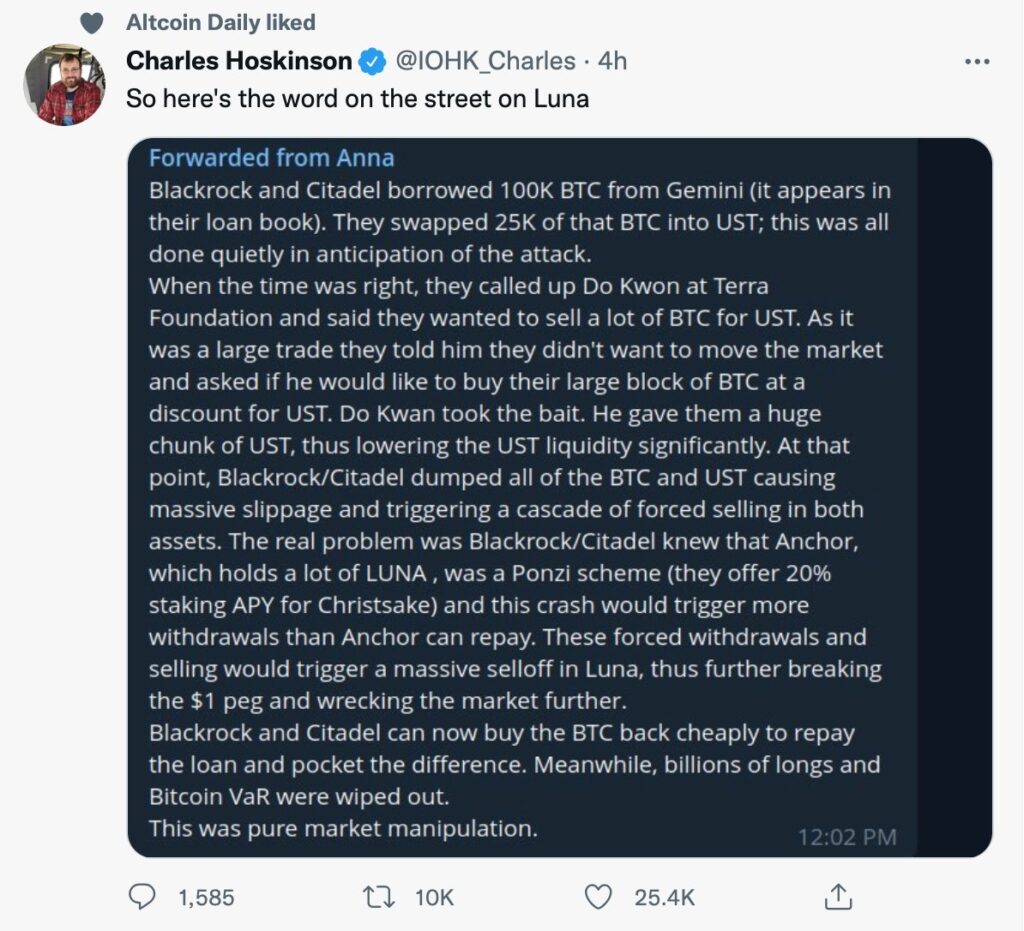

The rumor, which sounds more like a conspiracy theory, was amplified by Cardano founder Charles Hoskinson, accused the two investment firms of borrowing 100,000 Bitcoins and swapping 25% of the coins for UST.

The conversation picture, tweeted by Charles Hoskinson, went on to explain that both companies reached out to Do Kwon of the Terra Foundation and told him about their plans to sell a lot of Bitcoin for UST.

Due to the fact that the two didn’t want to shake the market, they suggested that he buy the BTC at a discounted rate, which he accepted and gave them a large amount of UST, significantly lowering UST liquidity.

At this point, Blackrock and Citadel dumped all UST and BTC, resulting in a massive slippage that started a cascade of forced sales on both assets.

Knowing that Anchor, a Ponzi scheme, holds a lot of LUNA, they were certain that the crash would trigger more withdrawals than it could repay.

The resulting forced sale and withdrawal then sparked a massive sell off of LUNA that broke the $1 peg, further ruining the market. With that, Blackrock and Citadel can buy cheaply, repay the loan, and bag the difference.

However, the CEO has deleted the tweet, and the parties involved did not acknowledge any of these allegations, with BlackRock even going so far as to make a press release saying it was not involved in the UST and LUNA crash.

In addition, Terra USTs’ stable coin value continues to decline rapidly; It’s now worth $0.47 when this piece was completed, with LUNA down 99.98%.