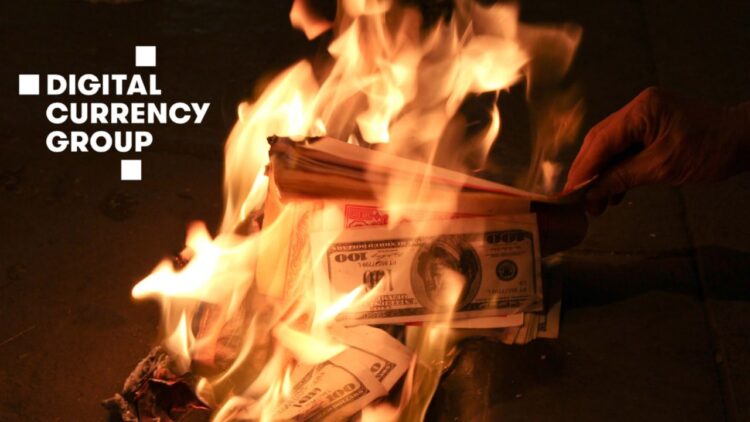

On November 21, 2022, a member of the crypto community on Twitter criticized Barry Silbert, CEO of Digital Currency Group, for promoting low-quality assets over high-quality assets.

Barry has shilled a lot of low quality crap over the years, aggressively promoted ETC over ETH, likely drove Coindesk to negatively cover Ethereum for years, many of the Grayscale Trusts are in hot garbage assets he bagholds, and GBTC arb trade killed many funds

there, i said it

— DCinvestor (@iamDCinvestor) November 21, 2022

The user DCinvestor commented on his Twitter page in the late hours of the day, using ETH and ETC as reference points.

Digital Currency Group was the founder of Grayscale, Coindesk, Luno, Genesis, and Foundry. The user pointed out the fact that Barry used Coindesk, the famous cryptocurrency news platform, to propagate his wrong views.

Another user who shares the same sentiments as DCinvestor commented on the CEO hindering BTC block size growth with Blockstream.

Another user believes that DCinvestor’s use of words regarding Barry’s aggressive promotion of low-quality assets is an understatement; he feels the word “trick” better fits the expression.

The user went further to say the CEO tries to manipulate people into buying ETC by representing it as ETH. Another user by the name of omslice commented that Silbert’s promotion of ETC was questionable.

Grayscale is a platform designed to manage digital assets and is also one of the subsidiaries of Digital Currency Group. It also manages GBTC (Grayscale Bitcoin Investment Trust ), a security asset mainly invested in the price of BTC.

DCinvestor also commented about the harm caused by GBTC arbitrage trading, a type of trading that involves trading security assets at a premium to the value of BTC.

While it’s favorable, like all arbitrage trading, it comes with risk. In addition, there is a high potential for GBTC to drop from premium, making it very risky.

Another commented on the risk of GBTC arbitrage trading, saying it has reduced the supply of bitcoin drastically due to lockup, and if those BTC were in circulation, the prices may not have dropped so low.

However, the major cause of the recent price drop is the bearish plummet that started in May 2022. It crippled a lot of digital assets, and many strayed from their all-time high.

Bitcoin lost over 70% of its all-time high of 2021 and is currently trading below $16,000. According to some analysts, the market had begun to show signs of recovery, not enough to chase the bear but enough to lead it into a steady climb.

However, the crash of one of the largest exchanges in the industry sent prices crashing down. Nevertheless, this bearish plummet, like all that preceded it, will eventually give way to a massive bull run, and all assets will surge back to life.

Join the BTC-Pulse community on Telegram.