One of the crypto world’s most well-known liquid staking protocols on Ethereum, Lido Finance, has remained at the top spot in various rankings of liquid staking protocols and seems to be holding up well.

Lido Finance is a platform for liquid staking on Ethereum, Solana, Polygon, and other crypto networks. It offers a competitive 3.8% yield on ETH deposits without the need for large-scale infrastructure.

Over the years, many liquid staking protocols have been created to allow crypto-asset owners to stake their tokens and earn rewards.

Staking is especially important as most blockchains are trying to move from the proof-of-work system, which is not energy-efficient and expensive, to proof-of-stake (PoS), where validators validate transactions based on the amount of coins that they staked. Ethereum switched to the PoS system today.

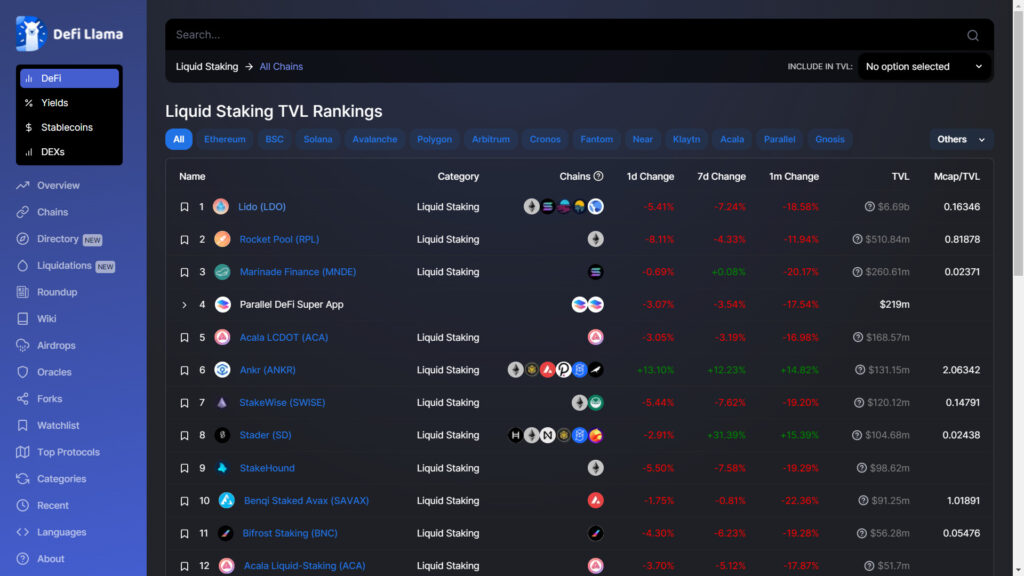

Of all the liquid staking protocols, Lido Finance appears to be the largest as it holds over 4 million ETH (4%) out of the little more than 14 million ETH staked, representing 12% of the total ETH supply versus protocols like Rock Pool that holds just over 230,000 ETH.

One competitive advantage of Lido Finance over other protocols is its higher market cap of 6.69 billion staked ETH (stETH) over other protocols like Rocket Pool and StakeWise, which have market caps of 510 million and 260,000 ETH, respectively.

Its dominance over other top liquid staking protocols may also be related to its variety of PoS assets that it allow its users to stake; Other assets include Solana and Terra Classic, among others, as well as the fact that users can deploy stETH in various DeFi applications such as Sushi, Curve, Yearn, etc.

Furthermore, the decentralized autonomous organization (Lido holders) runs the nodes at Lido Finance, and stakers are well rewarded. Of the $309 million in staking revenue generated, 10% of the revenue goes to node operators, and 90% goes to stakers compared to other staking protocols like Rocket Pool, which favors big stakers over small stakers.