Introduction: Cryptocurrency and Taxes – The New Paradigm

In the past decade, the world has witnessed an extraordinary financial revolution, with cryptocurrencies such as Bitcoin becoming an integral part of our economic landscapes. This digital revolution, which has transcended borders and traditional financial institutions, is enabling a new form of commerce that is decentralized and globally accessible.

However, as with all financial instruments, cryptocurrencies come with certain obligations, notably taxation. As this new asset class grows and matures, both users and governments are grappling with how to deal with the complex issue of cryptocurrency taxation. Here, understanding your Coinbase tax documents becomes essential.

Coinbase, a frontrunner among cryptocurrency exchange platforms, has demonstrated commitment not only in providing a secure and user-friendly platform for buying, selling, and managing digital assets, but also in helping users to navigate the murky waters of cryptocurrency taxation.

Coinbase provides its users with comprehensive tax documents that detail all transactions within a tax year. These tax documents are designed to help users accurately report their cryptocurrency transactions, as is required by tax law in many jurisdictions, including the U.S.

Whether you’re a seasoned trader, a long-term investor, or a newcomer intrigued by cryptocurrencies, understanding how to access, read, and use these documents for your tax reporting can make a significant difference. Knowing your tax obligations regarding cryptocurrencies will help you avoid legal complications, and might even save you money by ensuring you accurately calculate and report any gains or losses.

The journey of navigating through cryptocurrency taxation might seem overwhelming, but armed with your Coinbase tax documents and some essential knowledge, you’ll be well prepared to tackle this new paradigm head-on.

Coinbase, known for its user-friendly interface and diverse range of supported cryptocurrencies, makes managing digital assets easy for both new and experienced users. Recognizing the tax implications of cryptocurrency trading, the platform provides comprehensive tax reports, helping its users maintain transparency and compliance with tax laws.

Navigating Through Coinbase Tax Documents

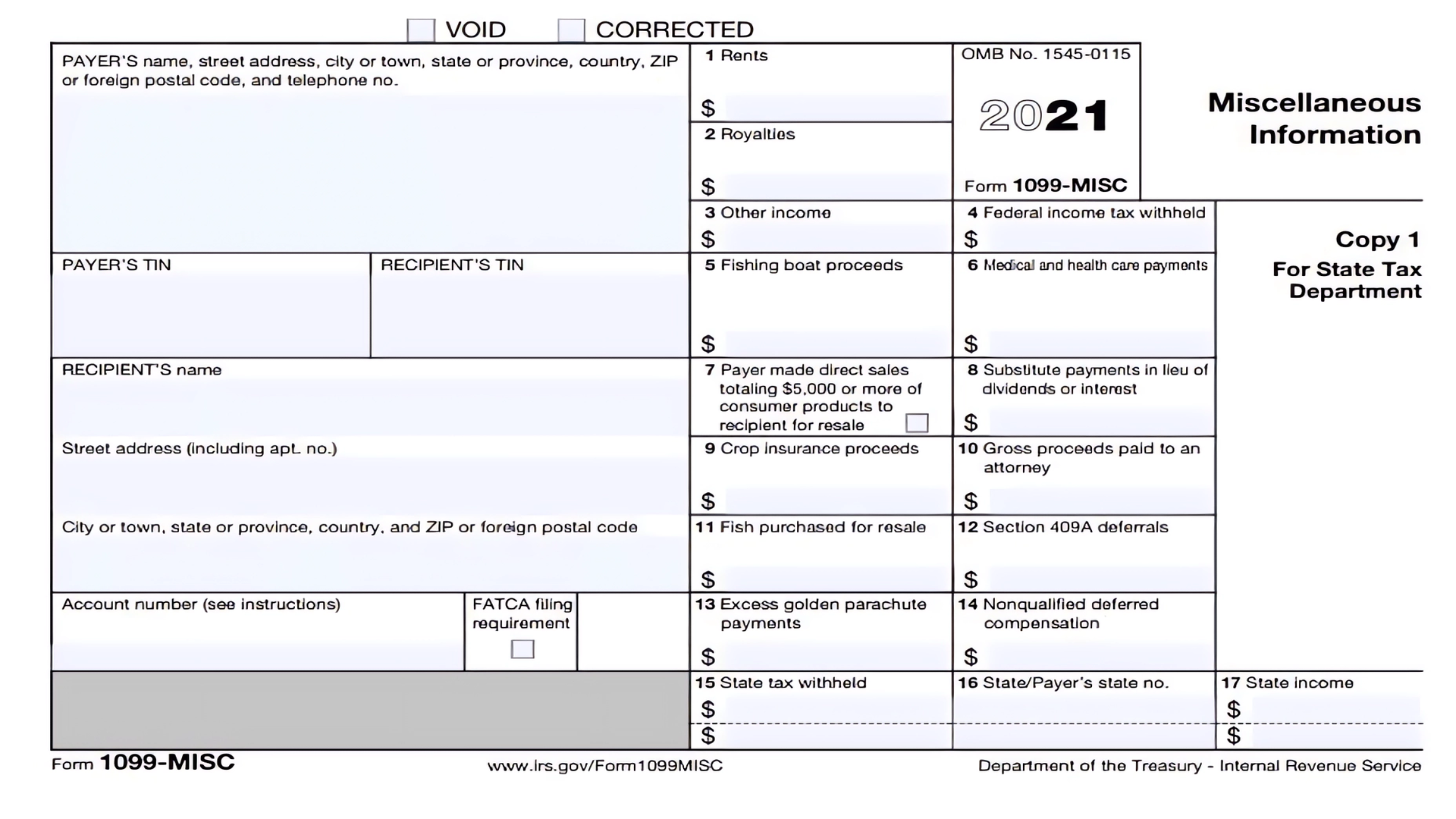

Coinbase provides Form 1099-MISC, Form 1099-B, or Form 1099-K to users, based on qualifying criteria such as transaction value, frequency, and location. Form 1099-MISC reports miscellaneous income, Form 1099-B reports broker and barter exchange transactions, and Form 1099-K reports payment card and third-party network transactions.

After logging into your Coinbase account, you can find these forms under ‘Tools’, followed by ‘Tax Center’. Once there, download your tax forms and review them thoroughly. This is the first, crucial step in ensuring your crypto tax compliance.

Deciphering Coinbase Tax Documents

Each of the Coinbase tax forms contains specific information pertinent to your transactions. Form 1099-K includes gross income from your transactions, Form 1099-B includes cost basis for your transactions (if available), and Form 1099-MISC includes rewards or mining income.

It’s imperative to understand that the IRS treats cryptocurrency as property, not currency. This distinction means that every transaction — no matter how small or seemingly insignificant, from buying a cup of coffee to swapping Bitcoin for Ethereum — can potentially trigger a taxable event. The documents provided by Coinbase will help you keep track of these occurrences.

1099-MISC criteria:

- You’re a Coinbase customer AND

- You’re a US person for tax purposes AND

- You’ve earned $600 or more in miscellaneous income such as rewards or fees from Learning rewards, USDC Rewards, and/or staking

Understanding the Implications: Capital Gains and Losses

If you’ve sold, exchanged, or disposed of your cryptocurrency during the year, you might have incurred capital gains or losses. These need to be reported on your tax return, and Coinbase tax documents can help you determine these amounts. Coinbase’s Form 1099-B provides you with the cost basis of your transactions (if available), which can be used to calculate your gains or losses.

Calculating capital gains or losses for crypto assets involves understanding your cost basis (how much you paid for the asset) and your proceeds (how much you received when you sold the asset). Subtracting your cost basis from your proceeds gives you your gain or loss.

The Role of Professional Tax Software

While navigating tax forms and calculating gains and losses may seem daunting, tax software that integrates with Coinbase can simplify this complex process. These tax software solutions automatically import your transactions from Coinbase and calculate your gains and losses, streamlining your crypto tax reporting and ensuring accuracy. Moreover, they stay updated with the changing tax regulations, keeping you compliant with the current laws.

Preparing for the Future: Cryptocurrency and IRS

Cryptocurrencies are attracting more mainstream attention than ever before, and the IRS is paying increased attention to the reporting of these digital assets. They’re refining their guidelines and expanding efforts to ensure compliance. Coinbase tax documents play a significant role in this landscape, maintaining transparency with your transactions and ensuring compliance with tax laws.

Conclusion: Accuracy, Compliance and Forward Planning are Key

Understanding how to navigate and use Coinbase tax documents is essential for every investor, trader, or general user involved in the realm of cryptocurrencies. In a rapidly evolving landscape where digital currencies are becoming more mainstream, having comprehensive knowledge of your financial responsibilities is vital.

Accurate record-keeping is not merely a good practice; it’s a requirement that ensures compliance with tax laws. Proper management of your tax documents enables you to have a clear overview of your transactions, gains, losses, and overall financial position in the cryptocurrency market. It also empowers you to make more informed decisions about future transactions and investments.

As the cryptocurrency market continues to evolve, tax laws and regulations are expected to develop correspondingly. The IRS is investing more resources into understanding this space and is dedicated to refining guidelines to ensure effective and fair compliance. Staying updated on these changes and using available tools and resources, like Coinbase’s tax reporting features and integrated tax software solutions, is increasingly crucial.

Furthermore, these tax documents provided by Coinbase not only serve a practical purpose in terms of tax filing but also provide users with a wealth of information about their investing habits. By taking a closer look at this data, users can identify trends, understand their investment strategies better, and plan for the future more effectively.

In essence, the world of cryptocurrencies is exciting and full of potential, but it comes with the important responsibility of understanding and adhering to taxation laws. With platforms like Coinbase providing comprehensive tools for tax compliance, users are better equipped to handle these responsibilities confidently.

This readiness not only mitigates risks and potential complications with the IRS but also contributes to the overall stability and legitimacy of the cryptocurrency market. After all, as digital currencies become an increasingly significant part of global economies, adherence to laws and regulations will ensure that this exciting new frontier of finance continues to grow in a sustainable and controlled manner.