Introduction to the Next Crypto Bull Run

In the world of cryptocurrency, volatility is the only constant. Marked by dramatic swings in value, these markets alternate between periods of ‘bull’ and ‘bear’, indicating rises and falls, respectively. As we inch closer to what several market pundits are forecasting to be the next crypto bull run, understanding the key trends and strategies becomes imperative. It’s this knowledge that separates those who make significant profits from those who incur substantial losses.

Understanding Market Trends: The Next Crypto Bull Run

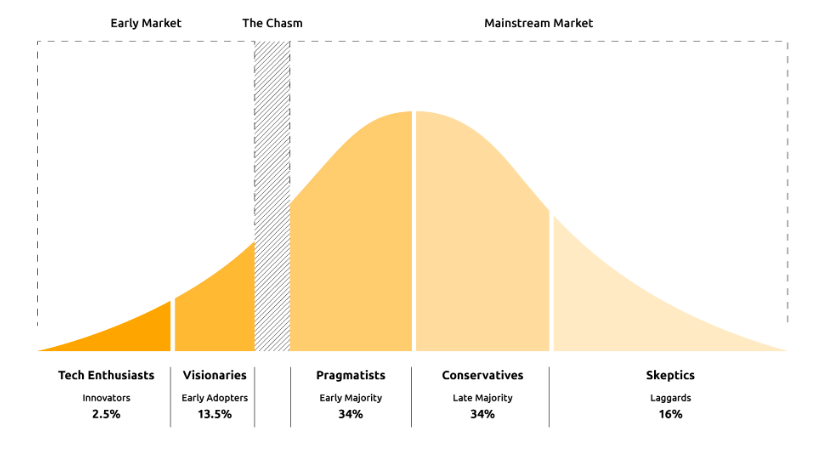

Trend #1: Mainstream Adoption

A significant indicator of the next crypto bull run is mainstream adoption. Cryptocurrencies, which started as a tech-savvy niche, have infiltrated our everyday dialogues and financial planning. This trend stems from the increased acceptance of digital currencies by entrenched financial institutions and governments alike.

We are now seeing a fusion of cryptocurrencies into standard banking systems, with Bitcoin and its counterparts being embraced as payment methods by multinational corporations. At the same time, the exploration of Central Bank Digital Currencies (CBDCs) is gaining momentum across several nations. This widespread acceptance suggests a volatile, yet sustained upward trend for cryptocurrencies, paving the way for the next crypto bull run.

Trend #2: Technological Innovation

Cryptocurrency thrives on innovation. The advent of new blockchain technologies, smart contracts, and decentralized applications (DApps) generate market enthusiasm and are often the harbingers of a bull run. A noteworthy example is Ethereum’s transition to Ethereum 2.0, a development expected to complete in the coming years. This significant upgrade will enhance the scalability, security, and sustainability of the Ethereum blockchain. It might serve as a catalyst for a substantial increase in value, contributing to the momentum of the next crypto bull run.

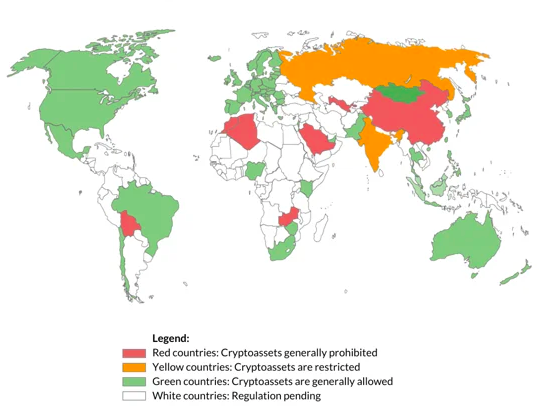

Trend #3: Regulatory Environment

The regulatory climate holds the potential to substantially influence the timing and intensity of the next crypto bull run. Regulatory news that casts a positive light on the crypto landscape can stimulate a bull run, while unfavorable news can lead to a bear market. Consequently, staying up-to-date with the latest regulatory developments around cryptocurrencies is crucial for traders and investors alike.

Trend #4: Institutional Investment

Increasing institutional interest in and investment in cryptocurrencies can also signify an upcoming bull run. Institutions such as pension funds, endowments, and even corporations are beginning to view Bitcoin and other digital assets as a valid investment class, which can contribute to increased market stability and signal the onset of a bull run.

Investing Strategies for the Next Crypto Bull Run

Having dissected the key trends shaping the next crypto bull run, let’s focus on the investment strategies that can help you capitalize on these market surges.

Strategy #1: Diversification

The high volatility of cryptocurrency markets makes diversification a prudent strategy. Investing all your resources in a single cryptocurrency can lead to dramatic losses if the market takes a downturn. Diversification – spreading your investments across a range of cryptocurrencies – can help mitigate risk while increasing the potential for returns. It’s akin to not putting all your eggs in one basket.

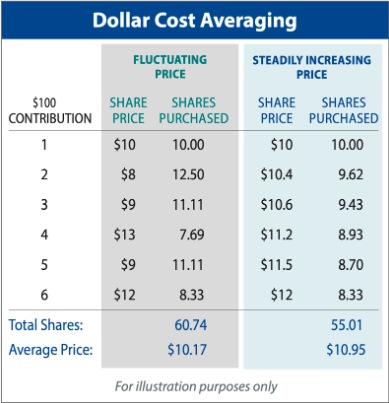

Strategy #2: Dollar-Cost Averaging (DCA)

Dollar-cost averaging is an investment approach where a fixed amount of money is allocated to buy a specific cryptocurrency at regular intervals, irrespective of its price. By employing DCA, investors avoid pouring large investments into high price levels and reduce the impact of short-term volatility on their portfolio. This tactic can be especially beneficial during the anticipated highs and lows of the next crypto bull run.

Strategy #3: Long-Term Holding (HODLing)

“HODLing,” a term born out of a misspelled internet meme, has become a widespread strategy in crypto investment circles. In simple terms, it means retaining your cryptocurrencies over an extended period, regardless of market volatility. This strategy can be beneficial if you have confidence in the long-term potential of the cryptocurrencies in your portfolio and can withstand short-term losses.

Strategy #4: Technical Analysis

Understanding technical analysis can be invaluable during a bull run. Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. By analyzing trends and patterns in price charts, traders can make informed decisions about when to buy or sell.

Embracing Risk Management

An often-overlooked strategy, yet highly critical for any form of investment, including crypto, is risk management. It is especially important when preparing for the next crypto bull run. Risk management involves setting a clear plan regarding how much one is prepared to risk per trade and how much loss one can tolerate without seriously damaging their portfolio.

This can include strategies like setting stop losses or limit orders, which automatically close a trade if the price hits a certain level, protecting investors from significant losses. Another strategy is position sizing, where investors only risk a small percentage of their portfolio on a single trade. These practices can not only safeguard your assets during periods of extreme volatility but also ensure that you have a solid foundation to continue investing even when the market takes an unexpected turn. Proper risk management can act as a cushion, absorbing the shocks of market volatility during the next crypto bull run.

Conclusion: Navigating the Next Crypto Bull Run

While predicting the precise timing of the next crypto bull run can be challenging, being informed about market trends and implementing robust investment strategies can position you to leverage it effectively when it does occur. Successful cryptocurrency investing is a blend of thorough research, patience, and sometimes, the courage to go against the crowd.

Whether you’re an experienced trader or a novice in the world of crypto, understanding these trends and strategies can help you navigate the tumultuous yet potentially rewarding world of cryptocurrencies during the next crypto bull run. Your path to crypto success is shaped by your understanding of these dynamics, and this guide aims to provide the insights you need.