- Rivian Automotive: An Introduction

- Well-Known Supporters

- Difference Between Rivian and Tesla Vehicles

- Scaringe’s Ambitions for the Vehicle Industry

- Rivian Stock Price Prediction: Price History

- Rivian Stock Price Prediction: Price Analysis

- Rivian Stock Price Prediction

- Rivian Stock Price Prediction 2024

- Rivian Stock Price Prediction 2025

- Rivian Stock Price Prediction 2030

- Conclusion

- FAQ

Rivian Automotive: An Introduction

Rivian Automotive was established by R.J. Scaringe. It is considered to be a great competitor to the prominent carmaker platform Tesla Inc. (TSLA). The platform is mostly anonymous and external to the automotive circles. The firm secretly applied for its initial public offering back in 2021 on the 27th of August.

In that IPO, the value of the electric vehicle (EV) making company’s value was nearly $80B, as per the reports. At that time, Rivian anticipated an initial public offering at the mid of November, according to the reports published by Bloomberg. Nonetheless, Rivian IPO went live on NASDAQ on the 9th of November under RIVN as its ticker symbol.

Well-Known Supporters

Rivian has collected huge funding from well-known players within the corporate sector of America. In this respect, the platform generated a minimum of up to $10.5B since the year 2019. The prominent investors of Rivian take into account Ford Motor Co. (F), Amazon.com Inc. (AMZN), as well as the fund management firm T. Rowe Price Group, Inc. (TROW).

Before the IPO, the aforementioned platforms held a voting power of up to 13.0%, 20.2%, and 16.9% respectively in Rivian. In addition to this, Scaringe had a voting power of nearly 11.0%. Jeff Bezos, the chief executive officer of Amazon, visited Plymouth of Rivian in Michigan back in 2018. He was quite fascinated when he encountered Scaringe who established the platform back in 2009 following getting a Ph.D. degree from MIT, the reports from The New York Times pointed out.

On the 19th September of 2019, Amazon declared that the company would purchase a hundred thousand Rivian vehicles for a fleet for cargo delivery as included in the Climate Pledge of the company. Pickups and SUVs are categorized among the highly profitable units of the customer vehicle market. The vehicles manufactured by Rivian are promising a jump in the case of durability as well as range in the case of battery charge.

The stakeboard platform of Rivian possesses an exclusive electric motor for every vehicle. Access to this, stakeboard was a chief motivation for the stake of Ford. For many years, some ambitious plans were followed by Ford to elevate capital spending on the electric vehicles’ development. As per the plans of Rivian, it intended to offer up to 135M shares. The respective shares’ value ranged from $57 to $62 per share.

Difference Between Rivian and Tesla Vehicles

This would generate up to 9.6B. The filing of Rivian signifies that essential investors such as T. Rowe Price and Amazon already have expressed their interest in purchasing an aggregate sum of nearly $5 billion. The SUV model of Rivian, also known as R1S, is analogous to the Range Rover that is developed by Land Rover. It competes with the Model X of Tesla. The electric pickup truck of Rivian is named R1T and possesses a flatbed in comparison with the Ford 150 which is the top marketing pickup truck of Ford, as noted by Times.

The R1S SUV of Rivian may be the largest threat posed to Tesla. Based on the battery pack’s choice, the R1S has the potential to deliver large mileage ranging between 240 and 410 miles after being charged. This is much better in comparison with Tesla Model X as it can offer a mileage range between just 237 and 295 miles.

Both of these vehicles provide 3 seating rows. However, R1S is reported to be slightly spacious given that the roofline of the vehicle does not slope as the Model X does. R1T and R1S are anticipated to have selling values beginning at $70,000 while reaching $90,000s in the case of completely-loaded models.

Scaringe’s Ambitions for the Vehicle Industry

Scaringe, while getting the degree of a doctorate at the famous institute MIT, operated with well-known engineers belonging to prominent automakers at the respected Sloan Automotive Laboratory. Following transforming vintage Porsches, Scaringe started dreaming of creating his separate car platform. He reportedly said that he intended to put an impact on the case of apprehensions related to air pollution and climate change.

Scaringe is devoted to smashing traditional views regarding electric vehicles. In his words, his platform has several untruths such as a truck cannot run on electrical energy and that an electric car cannot move off-road. As per him, it is also thought that the truck purchasers do not intend to have something friendly to the environment. According to Scaringe, the respective views are essentially wrong. He added that technology and electrification can develop a truck with incredible capabilities.

During 2018 and 2019, Rivian enhanced its staff to 750. This figure was nearly double of the former workforce. Several people were appointed from Tesla, McLaren Automotive Ltd, and Ford. In addition to this, fifty people were hired from Faraday Future (a struggling rival based in California) to fill the chief positions. Apple Inc.’s longtime VP named Mike Bell – who was a chief figure in iPhone’s launch – became the initial chief technology officer (CTO) at Rivian. Keeping in view these professional people in the platform’s team, Scaringe believed to revolutionize the vehicle industry.

Rivian Stock Price Prediction: Price History

The debut of Rivian in the stock market might have taken place at the likely worst time in recent years. It was listed on Nasdaq back in 2021’s November through IPO (Initial Public Offering). Just within a week, the stock opened above the IPO price thereof at $100.71. After that, it rose to approximately $170 just within seven days. At that time, equity markets were witnessing a maintained bull run.

While Rivian saw a decline after its debut, the project witnessed a closing price of nearly $103.69 in 2021’s end. Nonetheless, a huge shock hit the Nasdaq at the beginning of the next year. In 2022, Rivian lost up to 50% of its value in 2022’s January. The stock value of Rivian closed that month at almost $57.12. During that month, Amazon bought vans additionally from Stellantis. Due to this, Rivian experienced another blow in terms of value.

Nonetheless, later on, Amazon confirmed supporting Rivian continuously. This played a significant role in increasing investor confidence in Rivian’s tech stocks and growth. On the other hand, the mounting inflationary pressures on the share price as well as the demand declines and material costs compelled many investors to stay away from Rivian and other such platforms.

Additional slumps were witnessed in the next months as, in March, the platform announced the delay in SUVs’ deliveries. By the 29th of that month, Rivian’s share price plunged to $53.99. Following that, the stock price further slumped to $24.86 at May’s end. A few months later, in October, Rivian went through a reversal in terms of value. During that month, its price jumped to $36.16. Nevertheless, on the 11th of October, another slump hit the share price with a decline of above seven percent. This paved the way for an exclusive 3-month low.

Apart from that, the enormously harsh market conditions of the previous year compelled Rivian to decrease the production outlook by 50% to 25,000 in March 2022. The respective development resulted in a 10% decline witnessed in the shares. While commenting on this, the platform pointed toward the increasing inflationary stress as well as the minimized price elevations.

Rivian Stock Price Prediction: Price Analysis

Financial analysis of stocks greatly depends on market trends, investor sentiment, as well as previous stock performance. The industry forecast takes into account keeping an eye on the economic outlook. In this respect, analyst ratings, volatility, financial ratios, and volatility also play a significant role. The stock market analysis deals with the fundamental analysis and the technical analysis of the stocks.

In the case of Rivian stocks, the highly volatile nature of the platform’s stocks has been impacting the investors in both positive and negative ways. At the start, the investors benefited from the price volatility of these stocks. Nonetheless, the previous year has been very hard in terms of negative price fluctuations. The overall bear market in the market influenced the automotive industry.

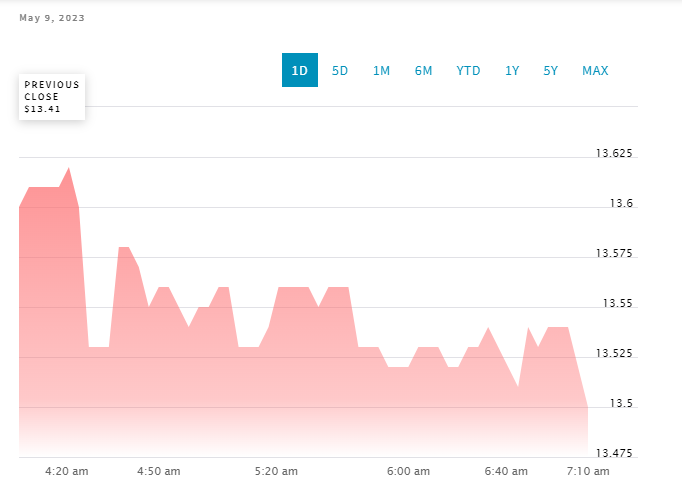

During the latter part of the year 2022, each earnings report issued by Rivian presented a pessimistic sentiment. At present, Rivian’s stock price stands at $13.87. The previous close price was nearly $13.41. The current 24-hour range of the stock price starts from $13.23 and ends at $14.02. Rivian’s current trading volume is approximately $23,002,530. The stocks’ present market capitalization is almost $13,029,000,000.

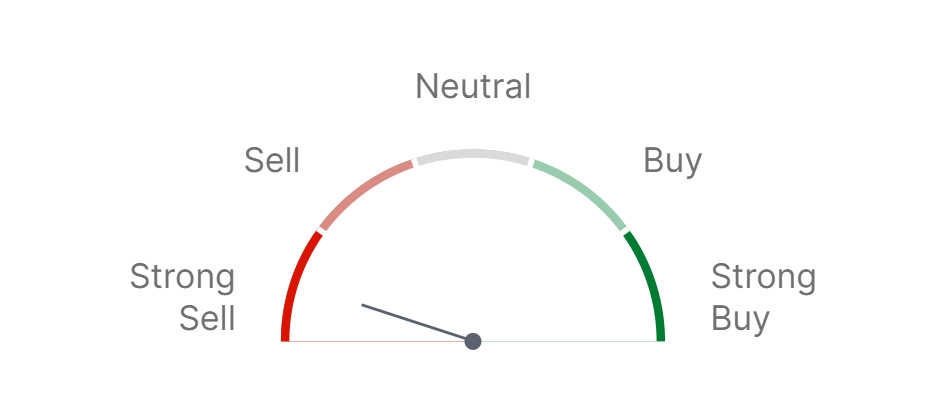

In terms of technical analysis, the Moving Averages Convergence Divergence (MACD) indicator of Rivian Automotive (RIVN) is currently placed at -0.44. This indicator suggests a bearish sentiment. The 20-day moving average of the RIVN stocks stands at $13.14 in comparison with the share price of $13.87. This indicates a bullish sentiment. Nonetheless, the 50-Day moving average of Rivian is again bearish at 14.54.

Rivian Stock Price Prediction

The historical price performance and the price analysis help in getting an understanding of the likely future performance. The stock market has recently been witnessing headwinds. However, historical data and statistics reveal that this industry has gained significant traction during the previous years.

Particularly, in the case of the automotive industry, big giants like Tesla Motors have also experienced declines in recent months. However, it is anticipated that innovation in the sector of electric vehicle (EV) production could elevate the valuation of this industry to a great extent. In this way, the growth prospects are anticipated to be high. Such developments can boost investor confidence and the supply chain.

Rivian Stock Price Prediction 2024

The current year has witnessed a slight recovery in the price of the Rivian Stocks (RIVN) at the start. However, the overall position has not been quite beneficial. In line with the price analysis as well as the macroeconomic conditions specify that the price of the Rivian stocks can reach $19.05. If the market sentiment becomes more favorable, the maximum share price of the stocks can even reach $19.85.

Rivian Stock Price Prediction 2025

In the upcoming years, the exclusive developments as well as the potential ease in the macroeconomic factors will pave the way for more price growth in the stock market. In this way, several new customers are expected to enter this market. As a result of this, the stock production capacity is likely to spike immensely.

The market share of Rivian Automotive is also predicted to grow with an increase in the user base driven by new and innovative developments. Along with this, the competitive environment around the platform will also get tightened. According to the price forecast, the price of Rivian stock will be nearly $27.50 by the year 2025. The maximum price can even reach the point of $29.60.

Rivian Stock Price Prediction 2030

As per the expectations, Rivian Automotive’s strategic partnerships can be crucial to raising its customer demand, growth, and valuation. The adequate developments can enable it to outperform its rivals in a very competitive landscape during the next years. The potential ease in government regulations can also add to it.

The optimistic valuation metrics of Rivian stocks point out that their price could have a substantial increase over time. This also signifies a huge revenue projection in the coming years. By the year 2030, Rivian stocks are predicted to have a price of $95. Additionally, the maximum price of the stocks can even touch the $105 level by that year.

Conclusion

In line with the historical statistics and comprehensive analysis, the price forecasts for Rivian stocks are positive for the upcoming years. Investors interested in long-term investment can choose Rivian. Nevertheless, they should keep in mind that this kind of investment is risky. Hence, keeping an eye on the risk analysis can be helpful. They should also be aware of the news updates. Making an appropriate investment strategy is vital in this respect. However, people having no taste for risk should avoid such investments.

FAQ

What is Rivian Automotive and who founded it?

Rivian Automotive, founded by R.J. Scaringe, is an electric vehicle (EV) manufacturer considered a strong competitor to Tesla Inc. Established in 2009, the company went public in November 2021 with significant backing from major investors.

When did Rivian go public and what was its market value at the time?

Rivian went public on November 9, 2021, under the NASDAQ ticker symbol RIVN. At the time of its IPO, Rivian was valued at nearly $80 billion.

Who are Rivian’s notable investors?

Rivian’s prominent investors include Ford Motor Co., Amazon.com Inc., and T. Rowe Price Group, Inc. These investors held significant voting power before the IPO, contributing to Rivian’s strong financial backing.

How does Rivian’s electric vehicle technology differ from competitors?

Rivian’s vehicles, such as the R1S SUV and the R1T pickup truck, feature a unique skateboard platform that includes an exclusive electric motor for each wheel. This design enhances the vehicles’ durability and range on a single battery charge.

What was the purpose of Amazon’s purchase of Rivian vehicles?

In 2019, Amazon announced it would purchase 100,000 Rivian vehicles as part of its Climate Pledge. This fleet purchase aimed to enhance Amazon’s cargo delivery capabilities with environmentally friendly vehicles.

What are Rivian’s price predictions for the years 2024, 2025, and 2030?

For 2024, Rivian’s stock price is predicted to potentially reach up to $19.85. By 2025, the price could grow to approximately $29.60. Looking ahead to 2030, optimistic predictions suggest the stock could soar to around $105.

What recent challenges has Rivian faced regarding its stock price?

Rivian experienced significant fluctuations in its stock price, with sharp declines seen in early 2022. Challenges included market volatility, production delays, and increased competition, impacting investor sentiment.

What should potential investors consider before investing in Rivian stocks?

Potential investors should consider the volatile nature of Rivian’s stock and the broader EV market. It’s crucial to stay informed about market trends, investor sentiment, and Rivian’s financial health. Investors should also be aware of the risks associated with such investments and consider their own risk tolerance.

MORE: