- Introduction

- Rivian’s Foundation

- The Rise of Electric Mobility

- Prediction & Analysis for Rivian’s (RIVN) Stock Price

- Rivian stock price prediction 2024

- Rivian stock price prediction 2025

- Rivian stock price prediction 2030

- Factors Driving Rivian’s Success

- Potential Challenges and Risks

- Conclusion

- FAQ

Introduction

As the world moves towards sustainable transportation and renewable energy, Rivian, the electric vehicle (EV) manufacturer, has emerged as a promising player in the automotive industry. With its innovative designs, cutting-edge technology, and commitment to environmental consciousness, Rivian has captured the attention of investors and EV enthusiasts alike. In this prediction piece, we dare to gaze into the future and offer a bold prediction for Rivian stock price in 2030.

Rivian’s Foundation

Founded in 2009 by Robert “RJ” Scaringe, Rivian has rapidly evolved from a startup to a global leader in the EV market. The company’s first models, the R1T electric pickup truck and the R1S electric SUV, have received acclaim for their impressive performance, long-range capabilities, and luxurious features. Rivian’s strategic partnerships with major companies like Amazon and Ford have also solidified its position in the industry.

The Rise of Electric Mobility

The 2020s witnessed a transformative shift towards electric mobility, with governments, consumers, and businesses embracing the benefits of EVs. In response to the growing demand for sustainable transportation, major economies introduced aggressive targets to phase out internal combustion engines. This transition, combined with advancements in battery technology, has created a fertile ground for companies like Rivian to thrive.

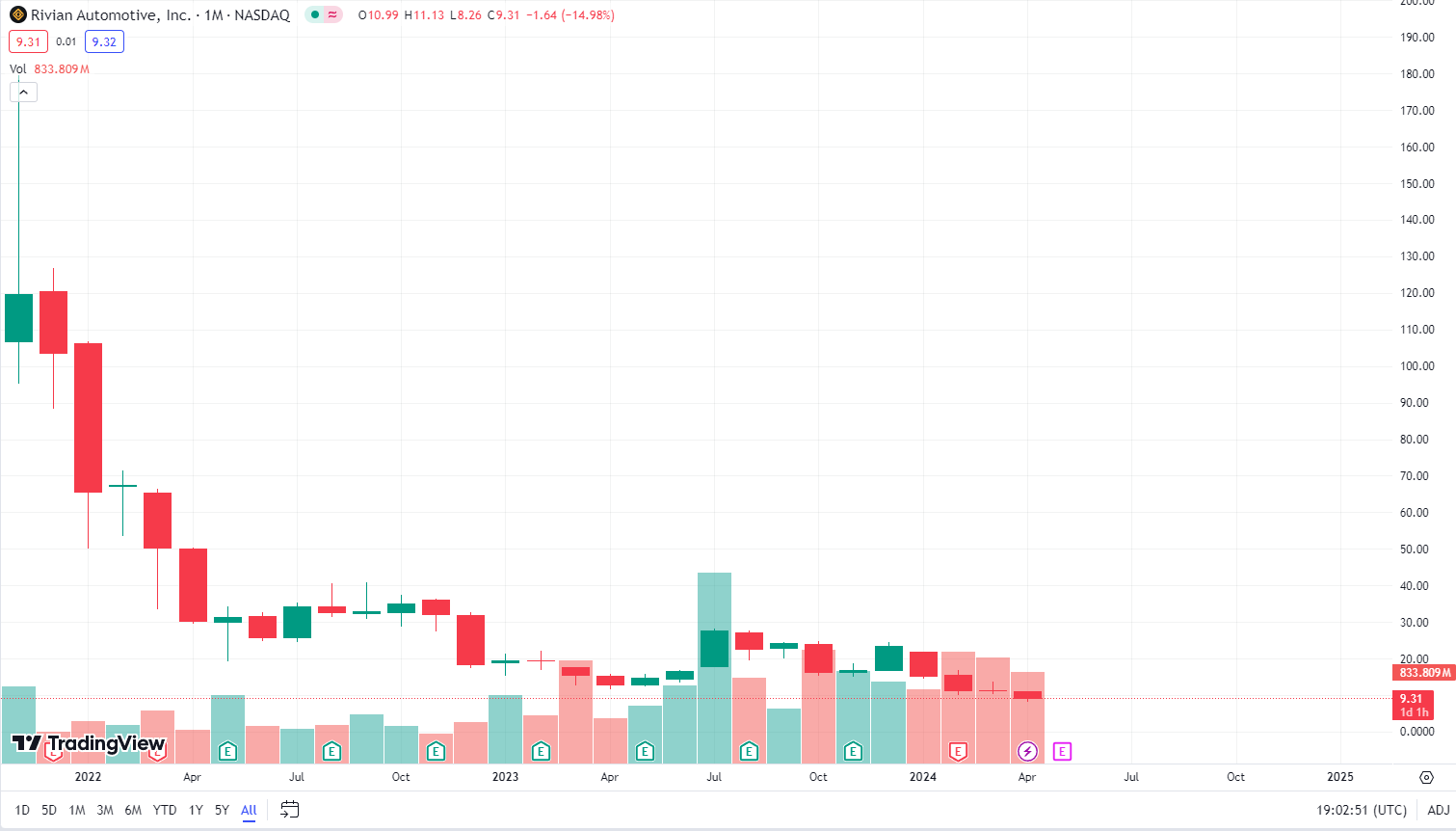

Prediction & Analysis for Rivian’s (RIVN) Stock Price

A Long-Term Market The maturation and expansion of the electric car and clean energy markets bode well for Rivian stock in the long run.

Rivian is well-positioned to ride the tide of increased demand and concentrate on sustainability, providing a stable presence in the expanding EV market, despite the fact that competition for its goods is anticipated to increase as the EV industry develops.

As per our Rivian stock price prediction 2030, Rivian (RIVN) share value is predicted to reach up to $750 by 2030 by a steady and progressive growth with estimates for each year before then; $70 for 2024, $150 expected for 2025, $210 for 2026 and beyond.

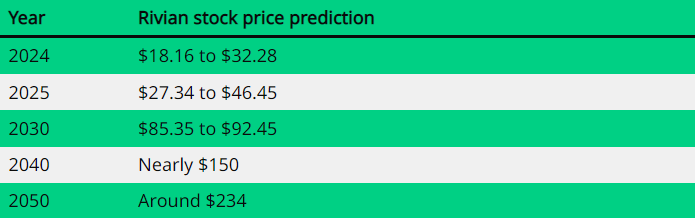

Rivian stock price prediction 2024

In 2024, analysts predict that Rivian stock will be worth $115.16 a share, with further gains possible all the way to $154.28. To the extent that the value moves, it is expected to do so within this range.

However, one group of analysts has set the Rivian stock price forecast for 2025 at $85. Nasdaq forecasts that by 2025, shares of rivian will cost $37.28 a share.

Rivian stock price prediction 2025

In 2025, analysts expect the price of a share of Rivian to be anywhere from $185.34 to $236.45. Future demand for electric cars and the interest of investors inform this broad spectrum. The stock’s lack of assertiveness has led some experts to predict a lower price, but it’s vital to remember that real stock prices are determined by the market.

Rivian stock price prediction 2030

The Rivian stock price forecast for 2030 is $845 per share. Stock in Rivian is projected to rise in value as time goes on, thanks to rising interest in electric cars and technical advancements. Buyers should be aware that the value of the shares, like with any stock transaction, might fluctuate and alter suddenly depending on market circumstances.

Investment experts predict a 50% yearly gain in Rivian share prices. This optimistic attitude, voiced by industry professionals, is anticipated to continue as a promising development in the future year.

Factors Driving Rivian’s Success

Market Dominance: Rivian’s strong brand reputation and market presence will drive consumer demand, enabling the company to capture a significant share of the EV market. The growing recognition of Rivian’s quality, performance, and sustainability will result in a substantial increase in sales and market valuation.

Technological Advancements: Rivian’s continuous focus on research and development will yield breakthroughs in battery efficiency, charging infrastructure, and autonomous driving capabilities. These technological advancements will not only enhance the customer experience but also attract strategic partnerships and investments, further boosting Rivian’s stock price.

Global Expansion: By 2030, Rivian is expected to have expanded its operations globally, penetrating key markets across Europe, Asia, and beyond. This international presence will diversify the company’s revenue streams and provide access to a broader customer base, solidifying its long-term growth prospects.

Potential Challenges and Risks

While Rivian’s future seems promising, it is essential to acknowledge potential challenges and risks that could impact its stock price. These include increased competition from established automakers and new market entrants, regulatory uncertainties, and potential economic downturns. Investors should carefully monitor these factors to make informed decisions.

Conclusion

As we look ahead to 2030, Rivian’s journey is poised for success. With its visionary leadership, cutting-edge technology, and a world hungry for sustainable transportation solutions, Rivian is primed to become a key player in the EV industry. While stock prices are subject to various factors and uncertainties, our prediction reflects the potential growth and positive trajectory of Rivian. As always, investors should conduct their due diligence and consult with financial experts before making any investment decisions.

FAQ

What factors are driving the success of Rivian?

Rivian’s success is driven by its strong brand reputation, technological advancements, and strategic market expansion. Innovations in battery efficiency and autonomous driving capabilities, along with a growing global presence, help attract customers and strategic partners.

What is Rivian’s stock price prediction for 2030?

Rivian’s stock is predicted to reach up to $845 per share by 2030. This optimistic forecast is supported by increasing interest in electric vehicles and ongoing technical advancements.

How has Rivian established itself in the electric vehicle market?

Since its founding in 2009, Rivian has evolved from a startup to a significant player in the EV market by launching acclaimed models like the R1T and R1S, and forming strategic partnerships with major companies like Amazon and Ford.

What are some potential challenges and risks that could affect Rivian’s future stock price?

Potential challenges include increased competition from both established automakers and new entrants, regulatory uncertainties, and possible economic downturns that could affect overall market dynamics.

What growth rate do investment experts predict for Rivian’s stock?

Investment experts forecast a 50% annual growth rate in Rivian’s stock price, reflecting a highly optimistic view of the company’s future market performance.

What is the predicted stock price range for Rivian in 2024 and 2025?

For 2024, Rivian’s stock price is expected to range between $115.16 and $154.28 per share. By 2025, it is anticipated to be between $185.34 and $236.45 per share.

Why might Rivian’s stock price fluctuate?

The value of Rivian’s stock may fluctuate due to market volatility, varying investor sentiments, and shifts in technology and consumer demand within the electric vehicle market.

What long-term strategies is Rivian employing to support its stock price?

Rivian is focusing on continuous technological innovation, expanding into new global markets, and strengthening its brand and product offerings in the electric vehicle industry to support and potentially increase its stock price in the long term.

MORE PREDICTIONS:

Ethereum Price Prediction $100,000

Amazon Stock Price Prediction 2030

Shiba Inu Price Prediction 2040