Are you curious about the Shiba Inu burn rate and what it means for your investments? Look no further than our comprehensive guide. We’ll cover everything from what the burn rate is to factors that affect it, how it works, and even tips on keeping track of it. As a professional in this industry, we want to showcase our expertise and attention to detail in helping you understand this important aspect of investing in Shiba Inu.

What is the Shiba Inu Burn Rate?

Shiba Inu Burn Rate refers to the rate at which SHIB tokens are removed from circulation. This mechanism is an important component of Shiba Inu’s tokenomics and is intended to increase the value of each token by reducing its overall supply. The burn rate is determined by a variety of factors, including market demand, transaction volume, and community initiatives.

In practice, Shiba Inu’s burn rate means that a portion of every transaction completed using SHIB tokens is permanently destroyed. As more transactions occur on the network, this can lead to a significant reduction in the overall supply of SHIB tokens over time. Additionally, certain events or initiatives may be designed specifically to increase the burn rate and accelerate this process even further.

Definition of Burn Rate

Burn rate is a crucial metric in the world of cryptocurrency that measures the rate at which tokens are permanently removed from circulation. In simple terms, burn rate refers to the amount of tokens that are destroyed or ‘burned’ over time. This plays a significant role in determining the value and scarcity of a token.

There are two types of burn rates:

- Automatic Burn Rate: fixed percentage of each transaction is burned automatically

- Manual Burn Rate: tokens can be manually burned by developers or through community voting

Several factors affect Shiba Inu’s burn rate, such as:

- Transaction volume on SHIB exchange

- Popularity and demand for SHIB token

- Community-driven initiatives promoting manual burns

By understanding these factors and monitoring Shiba Inu’s burn rate closely, investors can make informed decisions about their investments and ensure they stay ahead in this ever-evolving market.

The Role of Burn Rate in Shiba Inu’s Tokenomics

The burn mechanism in Shiba Inu’s tokenomics works by removing a portion of the tokens from circulation with each transaction. This results in a decrease in supply over time, which can potentially lead to an increase in demand and price per token. Compared to other cryptocurrencies, Shiba Inu has a higher burn rate due to its focus on reducing the total supply of tokens.

Shiba Inu’s high burn rate strategy creates scarcity and could drive up the value of remaining tokens, making it a unique investment opportunity.

The impact of the burn rate on supply and demand dynamics cannot be understated. As more tokens are burned, there will be fewer available for trading and holding. This scarcity could drive up the value of remaining tokens making them more desirable for investors interested in long-term investment opportunities that benefit from appreciation over time.

In comparison to other cryptocurrencies with lower or no burn rates at all, it is clear that Shiba Inu’s approach places emphasis on creating scarcity as part of its overall tokenomics strategy. The high level of interest generated around SHIB demonstrates that this approach resonates with many traders globally who are seeking unique investment opportunities within crypto markets today.

Factors Affecting Shiba Inu Burn Rate

The tokenomics of Shiba Inu plays a crucial role in determining its burn rate. The total supply and the percentage allocated for burning directly influences the amount of Shiba Inu that is taken out of circulation, leading to an increase in its value over time.

Another factor affecting the burn rate of Shiba Inu is its circulating supply. As more coins are burned or removed from circulation, it becomes increasingly scarce, driving up demand and ultimately increasing its price on exchanges. Therefore, decreasing circulating supply can lead to an increase in burn rate as well as demand for this cryptocurrency.

Tokenomics of Shiba Inu

The total supply of SHIB coins is one quadrillion, with half of it burned to a dead wallet. The remaining 50% was placed into Uniswap and locked away to provide liquidity for trading.

SHIB has a unique distribution model where there was no initial allocation for the team or founders. Instead, all tokens were distributed through marketing efforts and community building initiatives such as giveaways and airdrops.

Emission rate for SHIB is not fixed, as new tokens can be added to the circulating supply through various mechanisms like liquidity mining rewards or community incentives programs. However, Shiba Inu has implemented measures such as burn rates that reduce the overall token supply over time to increase scarcity and value proposition for investors.

Demand for Shiba Inu

The demand for Shiba Inu has been steadily increasing over the past few months, with trading volume on exchanges seeing a surge in activity. The social media sentiment analysis also indicates a positive outlook among investors towards this cryptocurrency. Furthermore, businesses are beginning to adopt Shiba Inu as a form of payment, which is contributing to its rising demand.

As more people become aware of the potential of Shiba Inu and its burn rate mechanism, there is an increased interest in investing in this digital asset. This heightened demand has led to an increase in trading volume on exchanges, indicating that investors are buying and selling at higher rates. Additionally, social media sentiment analysis shows that people have been talking positively about Shiba Inu lately.

Moreover, businesses are adopting Shiba Inu as a means of payment due to its low transaction fees and fast processing time compared to traditional methods like credit cards or wire transfers. This adoption by businesses contributes further to the growing demand for Shiba Inu and might lead other companies down the same path soon enough.

Circulating Supply of Shiba Inu

The circulating supply of Shiba Inu is a crucial factor in determining its value and market performance. As of today, the amount held in wallets is significantly higher than the amount locked up in contracts, indicating that most holders are not actively involved in staking or providing liquidity. Additionally, the circulation ratio of Shiba Inu compared to other cryptocurrencies is relatively high due to its large total supply.

However, potential impact from large holders selling or buying cannot be overlooked as it can have significant consequences on the circulating supply and price movement. It’s important for investors to monitor these factors closely and stay up-to-date with any developments regarding changes in wallet holdings or contract lockups affecting the burn rate of Shiba Inu tokens.

Market Cap of Shiba Inu

Inflationary pressure from minting new coins is a significant factor affecting the market cap of Shiba Inu. As more coins are being minted, their value decreases, leading to lower prices and a smaller overall market cap. However, pricing and market trends analysis across different time frames and markets can provide valuable insights into potential fluctuations in Shiba Inu’s market cap.

Impact on overall cryptocurrency market capitalization is another crucial aspect to consider when analyzing the market cap of Shiba Inu. As one of the most popular meme-based cryptocurrencies, any significant changes in its value could have ripple effects throughout the entire crypto industry.

- Minting new coins leads to decreased value

- Pricing and trend analysis can predict fluctuations

- Ripple effects on entire crypto industry

How Does the Shiba Inu Burn Rate Work?

The Shiba Inu Burn Rate refers to the process of removing a portion of each transaction’s supply from circulation. This is achieved by burning SHIB tokens, which effectively reduces the overall supply and increases the value of each remaining token. The burn rate is set at 1% per transaction, making it an effective way to maintain scarcity and increase demand for Shiba Inu.

By reducing the overall supply with every transaction, the Shiba Inu Burn Rate helps prevent inflation and ensures that existing holders see their investments grow in value. Additionally, this mechanism incentivizes holding onto SHIB tokens rather than selling them off quickly, as doing so would reduce their rarity and thus decrease their long-term potential for growth. Overall, understanding how the burn rate works can help investors make informed decisions about whether or not to invest in Shiba Inu.

Mechanics of Shiba Inu Burn Rate

The concept of burn rate in cryptocurrency refers to the process of destroying tokens or coins. This is done intentionally in order to reduce the total supply and increase scarcity, which can potentially lead to an increase in value for the remaining tokens. The Shiba Inu burn rate is a key factor that affects its overall value.

Calculating the burn rate for Shiba Inu involves tracking how many tokens are being burned through various means such as transaction fees and community events. These burned tokens are permanently removed from circulation, reducing the total supply of Shiba Inu available on the market. As a result, this increased scarcity could drive up demand for Shiba Inu among investors.

- Burn rate involves destroying select amount of cryptocurrency

- Reduces token/coin supply

- Increases scarcitiy but potentialy increases value

- Calculating burn rates tracks when/how many times they occur

- Burned tokens are removed from circulation

How the Burn Rate Impacts the Value of Shiba Inu

A high burn rate increases demand for SHIBA tokens by decreasing supply. As the number of tokens in circulation decreases, scarcity increases and so does demand from buyers seeking to purchase a limited quantity of SHIBA coins. Additionally, burning tokens is seen as a way to increase investor confidence in the project’s long-term viability and commitment to reducing token inflation.

Factors that can affect SHIBA’s value when considering burn rate include market sentiment towards cryptocurrency, changes in regulatory policies concerning digital assets, and overall adoption rates of the Shiba Inu ecosystem. While a high burn rate may have positive effects on value in the short term, it does not guarantee lasting success or protection against unforeseen market conditions.

Relying solely on burn rate as an indicator of SHIBA’s value poses risks since other variables like trading volume and liquidity must also be considered for accurate valuation. Furthermore, while token burning can improve investor perception around supply constraints within an ecosystem, over-reliance on this metric could lead to potential issues with liquidity that may further impact price performance negatively.

Understanding the Benefits of Shiba Inu Burn Rate

Shiba Inu burn rate is a key feature of the cryptocurrency that benefits its holders in several ways. First and foremost, it reduces inflation by removing tokens from circulation, thus increasing their scarcity value. This helps to maintain the purchasing power of Shiba Inu coins over time and prevents their devaluation due to excessive supply.

Moreover, the burn rate serves as a trust-building mechanism for investors who are looking for reliable and credible cryptocurrencies. By demonstrating a commitment to reducing supply and enhancing long-term value, Shiba Inu can attract more stakeholders who are willing to hold onto their coins for extended periods. Ultimately, this leads to greater sustainability for the platform as well as an increase in overall market demand.

Reducing Inflation and Increasing Scarcity

Limited supply, increased demand, and reduction of circulating supply are three key factors that can help reduce inflation and increase scarcity in the Shiba Inu ecosystem. By limiting the total number of tokens available through initiatives such as token burns or by reducing the rewards given to miners, a decrease in circulating supply is achieved. This leads to an increase in value for each individual token and overall scarcity within the market.

As demand increases for Shiba Inu tokens due to their limited availability and growing popularity among investors, so does their value. Implementing measures such as buybacks or holding incentives can further drive up demand while decreasing circulation. These efforts not only benefit current holders but also attract new investors looking for a reliable store of value.

Ultimately, reducing inflation and increasing scarcity requires careful consideration of various economic factors at play within the Shiba Inu ecosystem. By implementing targeted strategies aimed at controlling supply and meeting growing demands, stakeholders can ensure long-term success for this exciting digital asset.

Building Trust and Credibility

To build trust and credibility with our Shiba Inu community, we have implemented a transparent financial model that allows for complete openness in our financial operations. This includes making all financial information publicly available, as well as providing regular updates on the burn rate of SHIB tokens.

Alongside this, we’ve established a community-driven governance system that ensures transparency and accountability at every level. Our community is involved in important decision-making processes to ensure their voices are heard and taken into account.

In addition, we provide regular updates on our burn rate to keep our investors informed about how their investments are being used. We believe these measures will strengthen the trust between us and the Shiba Inu community while ensuring the long-term viability of our project.

Enhancing Long-term Value and Sustainability

Price stability with decreased volatility, increased confidence in the token’s future value, and safeguarding against potential market crashes are all essential aspects of enhancing long-term value and sustainability for the Shiba Inu token. To achieve these goals, the following measures can be taken:

- Implement a gradual burn rate that reduces inflation and increases scarcity over time.

- Develop clear communication strategies to build trust and credibility among stakeholders.

- Establish partnerships with reputable institutions to improve liquidity and reduce volatility.

By implementing these measures, we can ensure that Shiba Inu remains a valuable asset with sustained growth potential for years to come. As an investor or user of the token, it is important to understand how these efforts contribute to its long-term viability.

How to Keep Track of Shiba Inu Burn Rate

To keep track of the Shiba Inu burn rate, it is important to utilize available resources such as Etherscan and Shibascan. These websites provide real-time information on token transactions, including the number of tokens burned. Keeping a close eye on these numbers can help investors make informed decisions.

When analyzing burn rate data, it is best practice to look at trends over time rather than individual data points. This can give a more accurate picture of how many tokens are being burned and if there are any significant changes in burn rate. Additionally, considering external factors such as market conditions and community activity can also provide valuable insights into the overall health of the Shiba Inu ecosystem.

Available Resources for Monitoring Burn Rate

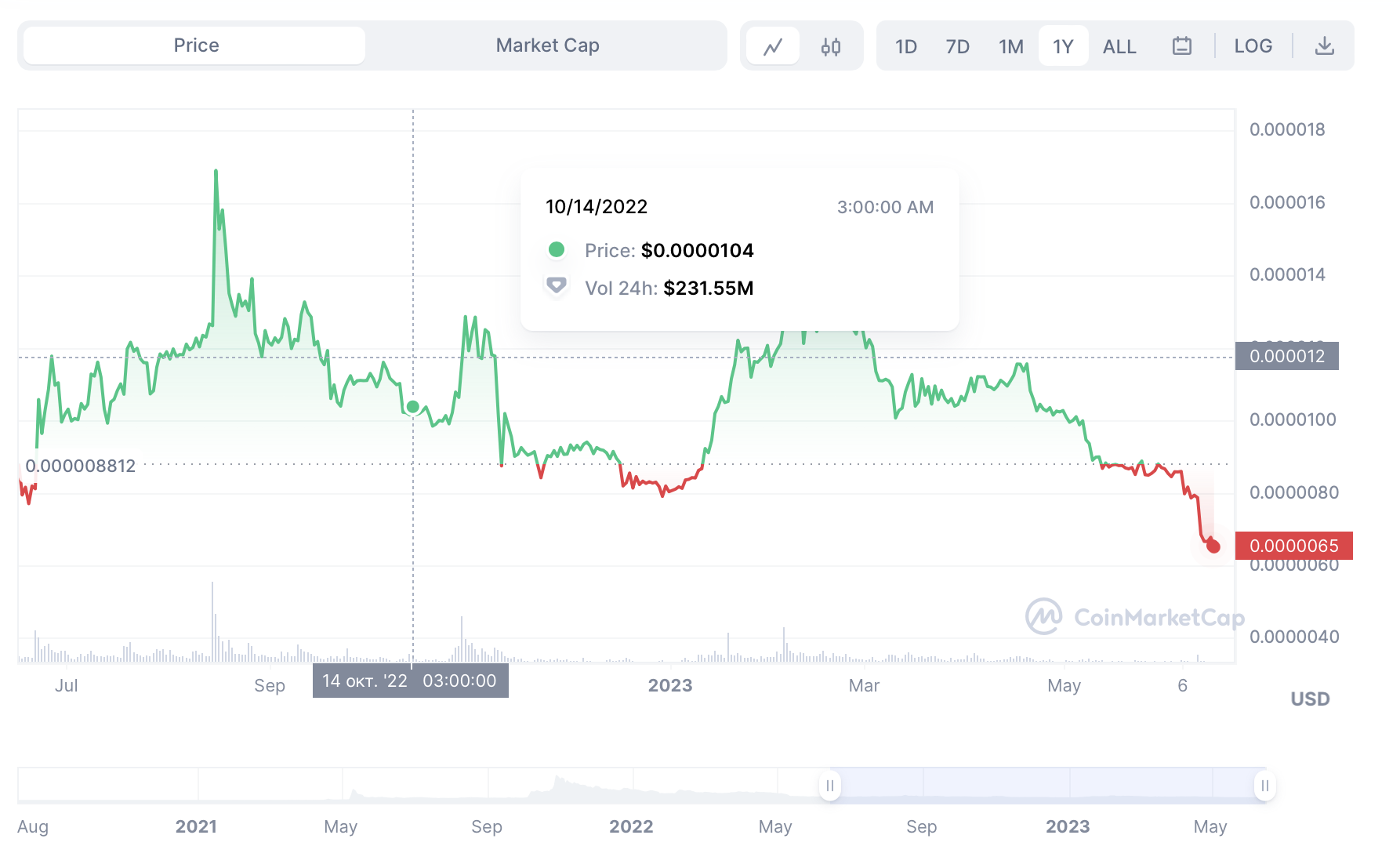

To effectively monitor the burn rate of Shiba Inu, there are several resources available. Websites such as CoinMarketCap and CoinGecko can be used to track the price and market value of Shiba Inu. Social media platforms like Twitter, Reddit, and Telegram groups also provide valuable insights into discussions about Shiba Inu.

Additionally, exploring the blockchain can provide detailed transaction data and wallet addresses holding SHIB. Etherscan is a useful website for this purpose. Keeping a close eye on these resources can help investors understand how much SHIB is being burned over time and make informed decisions based on that data.

Best Practices for Analyzing Burn Rate Data

To ensure effective analysis of burn rate data for Shiba Inu, it is crucial to determine how often you should check the data based on your investment strategy. This will vary depending on individual investment goals and risk tolerance levels. For instance, if you are a long-term investor, checking the burn rate less frequently may be appropriate as changes in supply reduction may not have an immediate impact on your portfolio.

Another essential best practice for analyzing burn rates is to compare them with those of other similar cryptocurrencies. By doing this, you can gain insights into how Shiba Inu’s burn rate performs relative to its competitors within the market. Additionally, closely monitoring trends in the burn rate over time can provide valuable information that will help predict future supply reductions and inform investment decisions accordingly.

Overall, adopting these best practices for analyzing burn rates of cryptocurrencies such as Shiba Inu is fundamental to making informed investment decisions that align with individual financial goals and objectives.

Final Thoughts

In conclusion, understanding the Shiba Inu burn rate can provide crucial insights for investors and traders alike. The burn rate mechanism is a unique feature that sets this cryptocurrency apart from others in the market. As such, it’s important to take note of potential factors that could impact its long-term sustainability.

Overall, while the Shiba Inu burn rate may seem complex at first glance, conducting thorough research and analysis can lead to informed investment decisions. By staying up-to-date on industry trends and monitoring key metrics closely, investors can position themselves for success amidst an ever-evolving digital landscape.