Introduction

When diving into the world of cryptocurrency, one can’t help but come across discussions about stablecoins. Among these, USDC vs USDT is a comparison that regularly captures the attention of both novices and experts. Both tokens represent significant market shares, and their use cases are continually expanding.

What are Stablecoins?

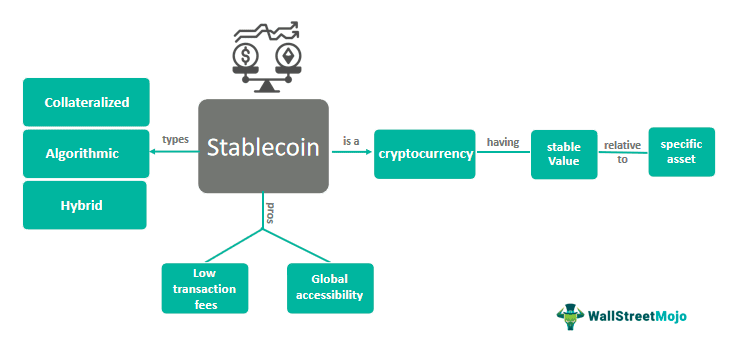

Before we delve deep into the USDC vs USDT debate, it’s essential to understand what stablecoins are. Stablecoins are types of cryptocurrencies designed to minimize the volatility of their price. They are often pegged to stable assets like gold or fiat currencies, such as the US dollar.

USDC: A Brief Overview

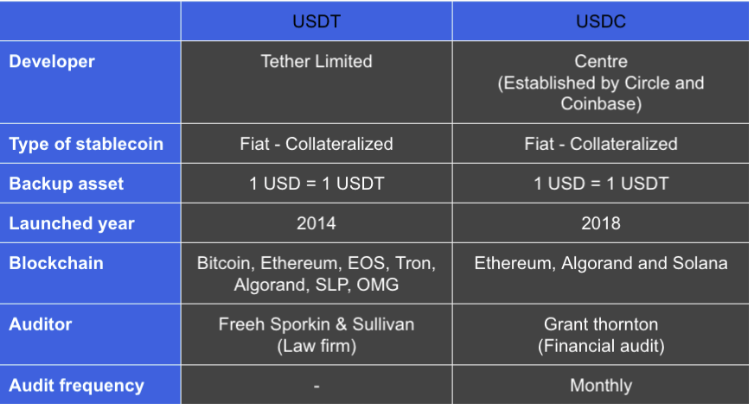

Origin and Issuers: USDC, or USD Coin, is a collaborative effort between Circle and Coinbase. Launched in 2018, its goal was to create a fully backed US dollar stablecoin, which is both transparent and governed by US regulations.

Technical Aspects: Unlike USDT, USDC operates primarily on the Ethereum blockchain as an ERC-20 token. However, it has expanded to other blockchains like Algorand and Stellar.

Regulatory Oversight: One major advantage that supporters of USDC often highlight is its strong commitment to regulatory compliance. Monthly audits ensure that every USDC is backed by one US dollar held in a bank.

USDT: A Brief Overview

Origin and Issuers: USDT, commonly known as Tether, predates USDC, having been introduced in 2014. Initially presented as “Realcoin,” it was later rebranded as Tether by Tether Limited.

Technical Aspects: USDT was initially launched on the Bitcoin blockchain via the Omni Layer. However, to cater to growing demands and challenges, it’s now available on several blockchains, including Ethereum, TRON, and EOS.

Controversies and Concerns: Tether has been a subject of multiple controversies, primarily revolving around the actual backing of the token. Some critics have raised concerns about the lack of transparency in the issuance of USDT and whether it is genuinely backed 1:1 with the US dollar.

USDC vs USDT: Point-by-Point Comparison

- Transparency: USDC tends to have an upper hand in terms of transparency. The rigorous monthly audits and the reputation of its backers, Circle and Coinbase, give it an edge.

- Adoption and Liquidity: USDT, being older, has broader adoption in the crypto space. It is often the preferred stablecoin for traders and is listed on most major exchanges.

- Blockchain Diversity: While both USDC and USDT are available on multiple blockchains, USDT takes the lead with a more diverse range of blockchain integrations.

- Regulatory Stance: USDC’s commitment to comply with US regulations makes it a safer bet for those concerned about the legal implications.

- Stability and Trust: While both coins aim to maintain a 1:1 peg with the US dollar, past controversies around Tether have made some investors wary. USDC, on the other hand, has managed to maintain a relatively clean slate.

Decentralized Finance (DeFi) and Stablecoins

One can’t discuss USDC and USDT without highlighting their pivotal roles in the DeFi ecosystem. DeFi platforms leverage blockchain technology to offer financial services without traditional intermediaries like banks. And at the heart of many DeFi protocols, especially those involving lending and borrowing, are stablecoins.

Both USDC and USDT have been widely accepted as collateral in various DeFi platforms. Their stability, when compared to more volatile assets like Ethereum or Bitcoin, makes them ideal for such purposes. For many DeFi enthusiasts, the USDC vs USDT debate is less about brand preference and more about liquidity, integration, and platform support.

Centralization Concerns

A key critique of both USDC and USDT centers around centralization. While they operate on decentralized blockchains, the issuance and redemption processes for both are governed by centralized entities. This centralization, critics argue, runs counter to the very ethos of cryptocurrencies.

Tether Limited’s control over USDT issuance and the combined influence of Circle and Coinbase on USDC have raised eyebrows. While both tokens provide the stability that the crypto market desires, it’s crucial for users to recognize the trade-offs involved when using centralized stablecoins over decentralized alternatives.

The Rise of Other Stablecoins

While USDC and USDT dominate the conversation, it’s essential to note the emergence of other stablecoins. Coins like DAI, a decentralized stablecoin pegged to the US dollar, and Terra’s UST are gaining traction. These alternatives offer different models and features that may appeal to various users.

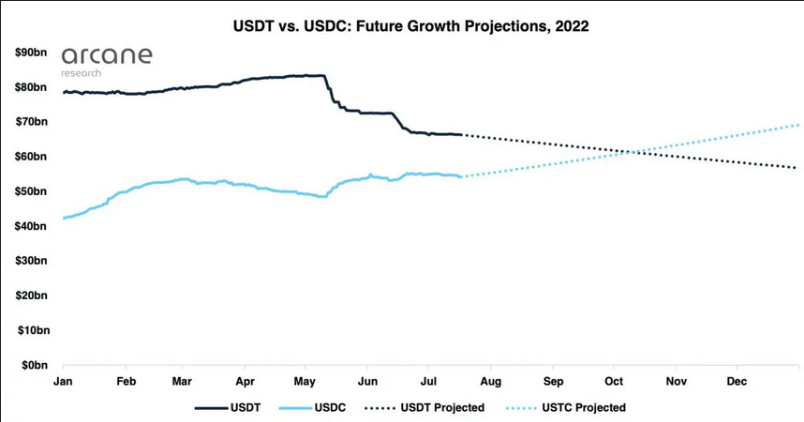

This rise in competition will undoubtedly impact the dynamics of the USDC vs USDT debate, pushing both to innovate, adapt, and offer better features to their users.

Potential Regulation Impacts

The crypto industry is no stranger to regulatory challenges, and stablecoins are no exception. There are growing concerns among regulators about the potential use of stablecoins for money laundering or to circumvent financial regulations.

USDC’s strong regulatory compliance might give it an edge in a world where stablecoins face stricter rules. On the other hand, USDT, with its past controversies, might find itself under more significant scrutiny. This potential regulatory landscape will play a massive role in shaping the future of both tokens.

The Global Perspective

While much of the USDC vs USDT discussion is US-centric, it’s vital to understand their global impact. Both stablecoins are used worldwide, not just as trading pairs but also as a means of remittance or even as an alternative to unstable local currencies in some regions.

Their global adoption speaks volumes about their utility, and as the crypto ecosystem grows, the reach of both USDC and USDT will continue to expand, influencing economies and individuals alike.

Future of USDC and USDT

The debate around USDC vs USDT is not just about which coin is better. It’s about how the concept of stablecoins will evolve in the future. With the rise of central bank digital currencies (CBDCs) and increased regulatory scrutiny, the future for both USDC and USDT will be challenging yet exciting.

Conclusion

USDC vs USDT is a compelling debate that reflects the broader discussions around stablecoins and their place in the crypto ecosystem. While each has its strengths and weaknesses, the choice between them ultimately boils down to individual preferences, risk tolerance, and specific use cases.

Remember, no matter which stablecoin you lean towards, always ensure you conduct thorough research and stay updated with the latest developments. The crypto world is ever-evolving, and being informed is the key to successful navigation.