On the 11th of December 2022, Scott Lewis, the co-founder of Mkt.market, DeFi pulse, and Slingshot.finance came on Twitter to announce that Ethereum’s governance was considering an update that would give Uniswap a huge gas discount.

Ethereum governance is considering a rule change to give the next version of one of its biggest (and most socially connected) protocols a huge gas discount, but with no good disclosures, we dont know how big the uniswap v4 discount will be or how big a head start is being gifted.

— scottlewis.canto (@scott_lew_is) December 11, 2022

The update is EIP-1153 which is called Transient storage opcodes. It was proposed a while ago to make significant changes to how gas works on Ethereum. Since it was being passed over, Uniswaop believes it’s the reason, since the proposal would give Uniswap significant gas advantages and a head start.

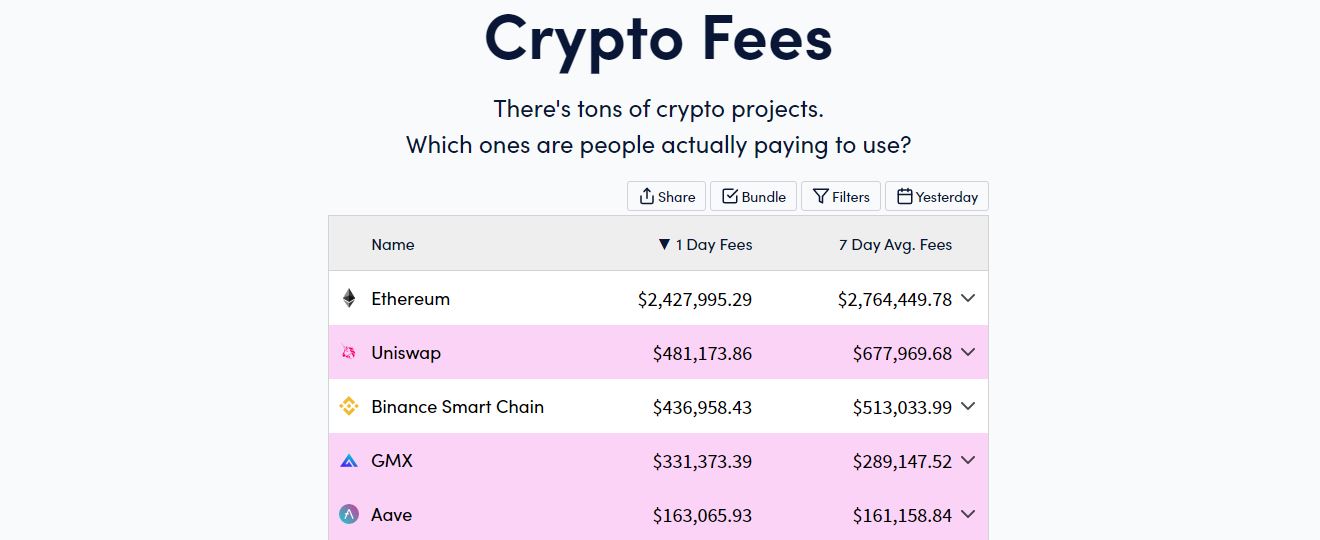

The price situation on Ethereum isn’t good, with gas prices rising seriously due to demand. Uniswap is also one of the major sources of demand leading to price rise, with a weekly average of $678k in fees.

Plenty of other crypto players have the same mindset as Uniswap and Scott Lewis, but that may not be the reason. EIP-1153 solves a major problem whiles creating another one. Similar to short-term memory on a device, 1153 proposed a temporary data storage that can be called in specific instances and discarded after a transaction.

Though that is a powerful tool with real-world applications, it also aims to refund all the gas fees from the discarded data since it has no data repercussions on the network. But this mindset is flawed.

For starters, gas fees are paid for resources and infrastructures provided by the network. Carrying out a transaction on a network doesn’t just cost storage space. There are bandwidth, recording, and even availability costs. For each added load on the system, there is a need for gas costs to cover usage. Thus a full gas refund is impractical.

Another problem generated by EIP-1153 is hack attacks. Suppose transactions have low costs, which are reverted and refunded when the transaction is cleared. In that case, it makes for an affordable attack vector for bad players in the crypto space. It also provides a cheap venue to clog the Network’s system.

The proposal opens Uniswap to both intentional and non-intentional attacks that would allow Uniswap users to create spam transactions which could cause a ripple effect, leading to other users paying even higher fees during peak periods.

Finally, if these transaction data are discarded from the system, how would that affect analysis, research, and numerous other “post-transaction” activities? At the end of the day, the EIP-1153 Ethereum upgrade is set to solve one problem by bringing back a host of other problems.