- What defines Amazon stock?

- What might be the price of AMZN in 5 Years and 10 years?

- Which future Amazon (AMZN) news could impact the price?

- Methodology for price prediction

- Conclusion

- FAQ

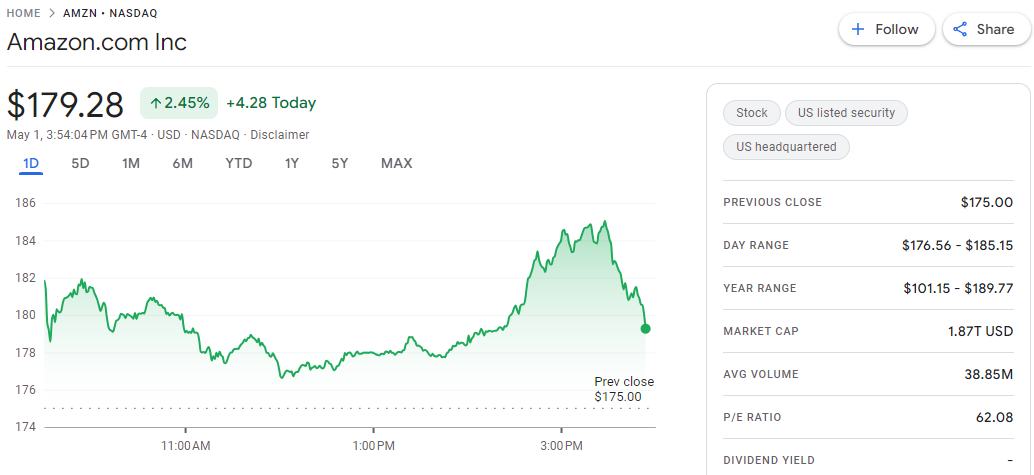

The stock market is a realm of vast possibilities, and the task of forecasting stock prices remains a intricate yet captivating facet of trading. Amazon (AMZN), a titan in the domains of e-commerce and technology, stands as one such stock that consistently captures attention. Within this context, the topic of “Amazon stock price prediction 2025” holds paramount importance for numerous investors.

The experts at TU have provided projections for Amazon stock prices, augmenting them with a NVIDIA forecast. Employing a unique amalgamation of expertise, in-depth analysis, and strategic foresight, these forecasts offer a detailed perspective on the potential future of this influential stock.

What defines Amazon stock?

TU’s successful experts shed light on the relevance of Amazon as a major participant within the global technology sector and explain why they think this is the case. Jeff Bezos launched Amazon in 1994 as a simple online shop. Since then, the company has grown into a technical giant that dominates a sizeable piece of the e-commerce sector in the United States and exercises control over more than forty percent of that market.

Amazon’s reach isn’t limited to the realm of online shopping; the business has also made significant headway in the realm of cloud computing, and its Amazon Web Services division provides services using the infrastructure as a service (IaaS) and platform as a service (PaaS) delivery models. It is worthy of note that Amazon’s stock maintains a prominent place inside the NASDAQ Index; this effectively reflects the company’s significant influence over the technology sector.

What might be the price of AMZN in 5 Years and 10 years?

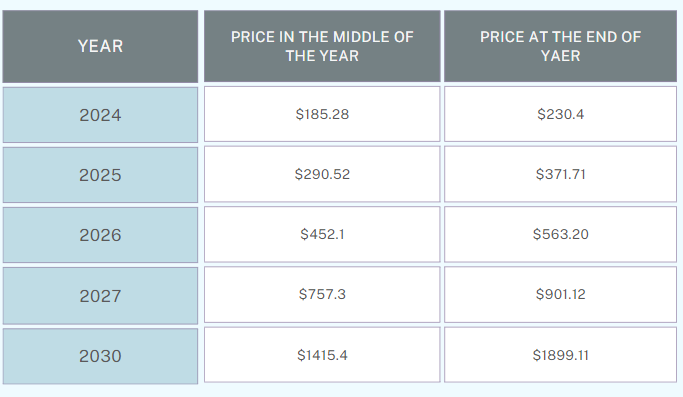

As per the TU forecasts, the long-term price projection for Amazon (AMZN) presents an enthralling panorama. By 2025, Amazon stock price prediction 2025 might see a surge to a peak of $371.71, followed by a substantial ascent to $1899.11 by 2030, and an impressive $3266.56 by 2034. The yearly predictions demonstrate a steady progression, with 2024 commencing at $177.84 and potentially reaching $197.12. The subsequent years exhibit a consistent pattern of growth, with the price climbing to $563.20 by 2026 and $901.12 by 2027, and continuing this upward trajectory until 2034.

Which future Amazon (AMZN) news could impact the price?

Analysts at Traders Union emphasize several pivotal factors that hold the potential to influence Amazon’s stock prices in the future. The overall state of the global economy plays a significant role, with any substantial decline in GDP, industrial output, or other fundamental indicators likely leading to a decline in the stock price. Additionally, U.S. macroeconomic indicators, such as statistics related to the e-commerce segment and the discount rate established by the Federal Reserve, also exert their influence.

Other influential factors encompass Amazon’s long-term development strategies, such as market expansion, foraying into new segments, or acquiring smaller companies. Financial statements, such as increases in revenues and net income, prove critical, alongside the successes achieved by competitors and internal policy issues such as litigations and corporate scandals.

Methodology for price prediction

According to the TU forecasts, the prediction of Amazon’s stock price incorporates a combination of technical and statistical tools. These encompass fundamental instruments of technical analysis, with an emphasis on medium and long-term time frames to attain more precise outcomes. Statistical tools evaluate the probability of events that may impact stock prices. Furthermore, the methodology takes into account distinctive characteristics of the company and its competitiveness.

Conclusion

The prediction of Amazon’s stock price is an intricate endeavor that demands expert analysis and a profound comprehension of the multitude of factors that can influence the market. TU’s comprehensive forecasts and expert analyses provide investors with a clear perspective on potential trends and shifts. We encourage readers to visit Traders Union’s official website to delve into comprehensive details regarding Amazon’s stock price and the NVIDIA forecast.

FAQ

What factors define Amazon as a prominent player in the stock market?

Amazon is recognized for its significant share of the e-commerce market in the U.S. and its impactful role in cloud computing through Amazon Web Services. These sectors have positioned Amazon as a key entity within the technology and NASDAQ index, making it a crucial stock for investors to watch.

What are the projected stock prices for Amazon in 2025, 2030, and 2034?

According to forecasts by TU, Amazon’s stock price might peak at $371.71 in 2025, rise to $1899.11 by 2030, and reach $3266.56 by 2034. These predictions reflect a steady upward trajectory in Amazon’s stock value over the next decade.

Which external factors might significantly impact Amazon’s stock price?

Key external influences include the overall health of the global economy, changes in U.S. macroeconomic indicators like e-commerce statistics and Federal Reserve policies. These factors, along with Amazon’s strategic moves in the market, could notably affect its stock prices.

How do future news and developments potentially alter Amazon’s stock price?

Future stock prices could be impacted by Amazon’s long-term development strategies, market expansion, and financial performance. Other significant factors include competitive achievements, internal policy matters like litigation, and corporate scandals.

What methodology is used to predict Amazon’s stock prices?

TU employs a methodology that integrates technical analysis tools focusing on medium to long-term trends and statistical instruments that assess event probabilities. This approach provides a nuanced understanding of factors influencing Amazon’s stock price.

How reliable are these stock price predictions?

Stock price predictions, while based on expert analysis and advanced forecasting tools, are inherently speculative. Investors should consider these predictions as part of a broader investment strategy and keep in mind the volatile nature of the stock market.

Can changes in the tech sector impact Amazon’s stock value?

Yes, as a major tech company, Amazon’s stock is sensitive to shifts within the tech sector, including innovations, regulatory changes, and the competitive landscape. These can either positively or negatively impact Amazon’s market position and stock value.

What should investors do with this prediction information?

Investors should use these predictions as a guide while also conducting their own research and considering their investment horizon and risk tolerance. Consulting with financial advisors to build a diversified investment portfolio that includes Amazon based on its forecasted growth could also be beneficial.

MORE:

Rivian Stock Price Prediction 2030